Congresswoman Lois Frankel has been heavily trading (buying and selling) stocks lately. As per barchart.com, Frankel has had the highest number of trades (25) in the past 60 days, though her trade amounts are not massive. The democratic party member recently sold Diamondback Energy (NASDAQ:FANG), CarGurus (NASDAQ:CARG), and Danaher (NYSE:DHR), to name a few.

On the other hand, Frankel bought Comcast Group (NASDAQ:CMCSA), Halliburton (NYSE:HAL), and Target Corporation (NYSE:TGT), among others. Let us look individually at the three buys of the politician.

Comcast Group (NASDAQ:CMCSA)

Comcast Group is a media and technology conglomerate. Yesterday, Comcast reported Q3FY22 results that beat both earnings and revenue expectations. CMCSA stock has lost 35.3% so far this year.

Notably, as per Capitoltrades, Frankel bought Comcast stock way before its earnings results on October 12, probably in anticipation of solid quarterly performance. Since the day of trade, CMCSA stock has gained 11.4%.

Is Comcast a Buy or Sell?

On TipRanks, Comcast stock has a Moderate Buy consensus rating. This is based on ten Buys, six Holds, and three Sell ratings. The average Comcast price target of $41.22 implies 28.9% upside potential to current levels.

Halliburton Company (NYSE:HAL)

Halliburton provides services and products to the energy industry related to the exploration, development, and production of oil and natural gas. Recently, HAL reported Q3FY22 results that beat the consensus on both the revenue and earnings fronts.

As per Capitoltrades, Frankel bought Halliburton stock on October 7 and HAL stock has gained 19.3% since. Energy stocks registered huge gains post-October 6 when OPEC+ decided to cut oil output by 2 million barrels per day from November.

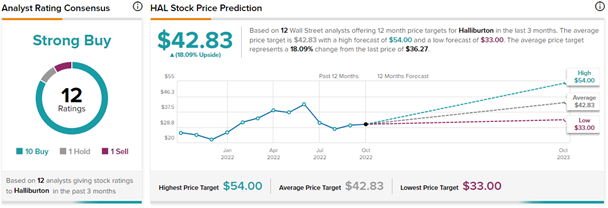

Is Halliburton a Good Stock to Buy Now?

Halliburton stock commands a Strong Buy consensus rating on TipRanks. This is based on ten Buys, one Hold, and one Sell rating. The average Halliburton price forecast of $42.83 implies 18.1% upside potential to current levels.

Target Corporation (NYSE:TGT)

American big-box department store chain Target Corp. has been struggling with inflationary pressures that are squeezing customers’ pockets. The global retail industry is in a downturn owing to weak consumer sentiment. Amid the chaos, TGT stock has lost 27% so far this year.

Target is slated to release its Q3FY22 results on November 16. Unfortunately, the retailer has missed analysts’ expectations in the last two quarters. As per Capitoltrades, Frankel bought Target stock on September 28, and TGT stock has gained 7.1% so far.

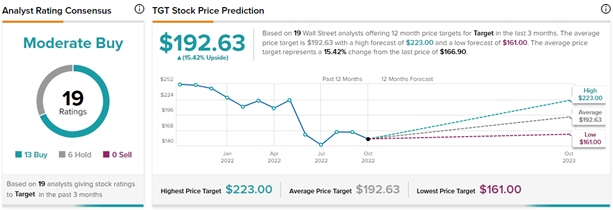

Is Target a Good Stock to Invest in?

On TipRanks, Target stock has a Moderate Buy consensus rating. This is based on 13 Buys versus six Holds. The average Target stock prediction of $192.63 implies 15.4% upside potential to current levels.

Ending Thoughts

Frankel seems to be making interesting bets based on the market conditions and the latest events. Most of her buy trades are already in the green. An investor may choose to follow Frankel’s trades to make informed decisions.