Shares of Intel (NASDAQ: INTC) have bucked the downtrend amid the overall market sell-off and are up 6.6% in the past month, driven by the possibility that Intel could stand to benefit from the passage of the CHIPS act. The CHIPS act is focused on getting semiconductor players to fabricate more of their chips in the United States.

While the passage of this act could benefit Intel, Susquehanna analyst Christopher Rolland remains concerned about the stock and is sidelined with a Hold rating.

Signs of Intel’s PC Market Weakening

Rolland’s research suggests a weakening demand for PCs. The PC market is a part of Intel’s Client Computing Group (CCG). The CCG group made up around 50% of Intel’s total revenues of $18.4 billion in Q1.

Intel estimates generating total revenues of $18 billion in Q2 while earnings are expected to come in at $0.5 per share.

Intel’s management had stated on its Q1 earnings call that while it continued to see strong commercial demand, consumer demand continued to soften and the “impact of no longer shipping to customers in Russia and Belarus” was also being felt.

Intel CFO, Dave Zinsner, added, “Further, component supply constraints continue to be a challenge, with the most recent COVID lockdowns in Shanghai further increasing supply chain risk and contributing to inflationary pressures that are having a negative impact on PC TAM [total addressable market] for the year.”

Even Rolland’s “ODM [original design manufacturing] notebook tracker points to significantly weaker Taiwanese PC ODM builds in 2Q.”

When it comes to its PC business, Intel Taiwan plays a key role.

The analyst also cited data from Gartner and IDC, pointing to “softer 2Q22 PC shipment data.” Rolland also noted that “Intel’s addition of a 14th week in 1Q may present 2Q as seasonally worse.” As a result, the analyst estimates that PC shipments could decline 11% year-over-year to approximately 310 million in 2022.

Are Intel’s Gross Margin & Capex Guidance Likely to Be Lowered?

Intel has projected an adjusted gross margin of 51% for Q2 and 52% for FY22. However, Rolland expects that given the weakness in the CCG group, competitive pricing for Intel’s Alder Lake range of processors, increasing costs for multi-chip modules, and rising competition, Intel could revise its FY22 gross margin guidance “negatively.”

The analyst added, “Given the uncertainty around the CHIPS Act and falling utilizations, we wonder if Intel will not pare back their 2022 capex guidance by ~$2 billion from $27 billion to $25 billion.”

Rolland also pointed out the rising competition from AMD’s processors and Apple’s (AAPL) continuing to marginalize Intel from its range of PCs as Apple PCs are now fitted with their own processors.

Wall Street’s Take on INTC

Considering these headwinds, analyst Rolland lowered the price target on the stock from $42 to $40. The stock is currently priced at current levels.

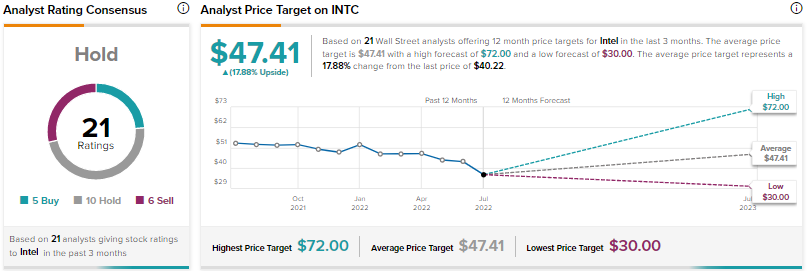

Other Wall Street analysts also side with Rolland and remain sidelined on the stock with a Hold consensus rating based on five Buys, 10 Holds, and six Sells. The average Intel price target of $47.41 implies an upside potential of 17.8% at current levels.

Bottom Line

Even as Intel contemplates a hike in the price of its chips, the company’s expansion plans remain in limbo with the delay in the passage of the CHIPS act. It remains to be seen how Q2 ends up looking for Intel in this challenging macro environment.

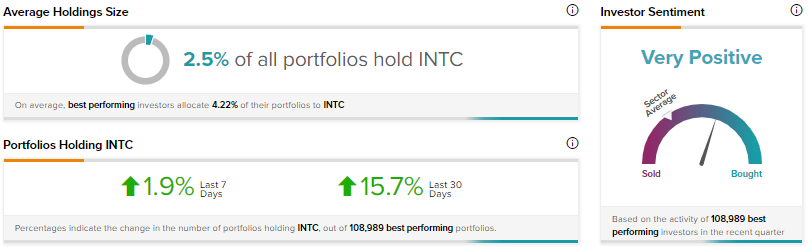

However, investors on TipRanks are very positive about the stock, as indicated by the Crowd Wisdom tool on TipRanks. This tool indicates that 15.7% of the top-performing portfolios on TipRanks have increased their holdings of the stock in the past 30 days.