Headquartered in Delaware, Coinbase Global (COIN) operates a popular cryptocurrency trading platform. I am neutral on the stock.

Let’s not mince words: The Coinbase trading/ investing platform has had lasting ripple effects throughout the modern financial markets. Coinbase helped popularize cryptocurrency while also making it easily accessible to the public.

The Coinbase app isn’t fancy and might not impress crypto experts, but it’s simple and convenient for regular folks who are curious about popular digital tokens like Bitcoin and Ethereum. Moreover, the platform has expanded its cryptocurrency offerings to include some lesser-known altcoins, and this could help entice more crypto enthusiasts into using Coinbase.

On the other hand, COIN stock has been highly volatile lately and its price trajectory in 2022 has been to the downside. A number of factors could account for this, including this year’s technology stock rout as well as the declining price of leading cryptocurrencies, including Bitcoin.

So, should you put a coin in the slot and take a chance on COIN stock? There’s some scary buzz going around, and it’s important to separate the established facts from the chatter. Additionally, informed investors might consider the sizable stake of a famous fund manager. With all of that in mind, in the end, highly risk-tolerant traders might manage to build a bullish argument in favor of Coinbase.

Deep Value Territory?

Cathie Wood is known as a financial market celebrity, but also as the CEO and CIO of the Ark Invest family of funds. The most well-known of these funds is the flagship ARK Innovation ETF (ARKK), which soared in 2021 but came crashing down this year.

As Bitcoin collapsed from over $65,000 to around $30,000, COIN stock fell even harder, crashing from $368.90 to $70. Yet, apparently Wood isn’t deterred. Reportedly, the ARK Innovation ETF recently purchased a whopping 187,462 Coinbase shares, while the lesser-known ARK Next Generation Internet ETF (ARKW) acquired 33,636 COIN shares.

We can’t read Wood’s mind and determine with certainly why her funds made those purchases. However, we do know that Wood recently declared in a tweet that “Genomic sequencing, adaptive robotics, energy storage, AI, and blockchain technology are realities, their stocks seemingly in deep value territory.”

Perhaps Wood had COIN stock in mind when she issued that audacious declaration. Now, it’s up to you to decide whether the stock is truly a “deep value,” since it’s not recommended to buy an asset just because a famous fund manager did.

It is true that COIN stock is trading at a drastically reduced price point. Is this the same thing as a “deep value,” though? Not necessarily, as Coinbase’s financial figures aren’t overwhelmingly positive – and notably, there’s a bankruptcy scare (possibly with merit, or possibly not) which prospective investors should be aware of.

A Worst-Case Scenario

Moving beyond Wood’s stake in COIN stock, let’s evaluate Coinbase as a business, based on the company’s financial results. As it turns out, Coinbase’s first-quarter 2022 business and fiscal data points are less than ideal.

No matter how you slice it, Coinbase didn’t produce great numbers in Q1 2022. The company’s monthly transacting users declined to 9.2 million, compared to 11.4 million in the previous quarter. Furthermore, Coinbase’s trading volume shrank from $547 billion in Q4 2021 to 309 billion in 2022’s first quarter.

It only gets worse from there, unfortunately. In terms of net revenue, Coinbase slid from $2.49 billion in 2021’s fourth quarter to just $1.17 billion in Q1 2022. Also, the company swung from earning $840 million in net income during Q4 2021 to sustaining a $430 million net loss during the fourth quarter of 2022.

Coinbase had some explaining to do, and was quick to blame crypto-market moves. As the company put it, “You can expect volatility in our financials, given the price cycles of the cryptocurrency industry.”

Fair enough – and so, COIN stockholders will have to monitor the price movements of Bitcoin, Ethereum, and other leading digital tokens. At the same time, they’ll need to be aware of a rather unsettling statement found deep within Coinbase’s recently issued Form 10-Q.

The statement reads, “because custodially held crypto assets may be considered to be the property of a bankruptcy estate, in the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors.” Without saying it directly, Coinbase may be suggesting that if the company goes bankrupt, the customers could lose access to their crypto balances.

Reportedly, some folks have taken to social media to vent their consternation about this. There’s already been talk of Coinbase potentially confiscating its users’ cryptocurrency holdings.

Whether this is likely to actually happen, is a matter of debate. Coinbase actually going bankrupt and commandeering the customers’ cryptocurrency accounts is a worst-case scenario. It doesn’t seem very likely to happen in the near future, though anything is possible nowadays.

Wall Street’s Take

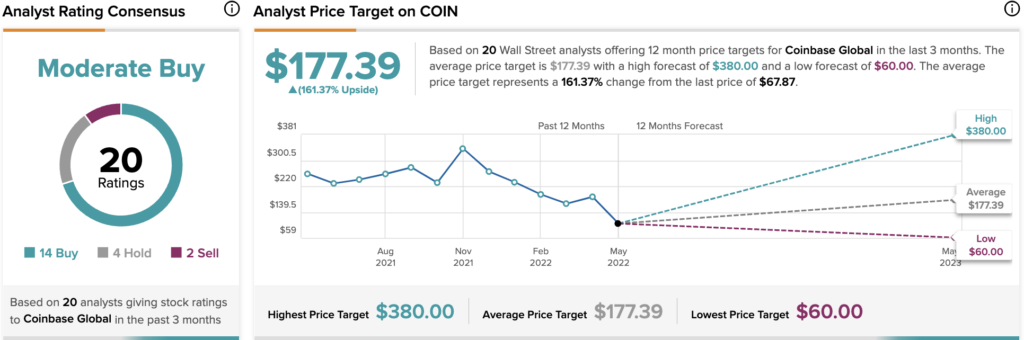

According to TipRanks’ analyst rating consensus, COIN is a Moderate Buy, based on 14 Buy, four Hold, and two Sell ratings. The average Coinbase Global price target is $177.39 implying 161.37% upside potential.

The Takeaway

Clearly, there’s a lot to consider here. On one hand, analysts on Wall Street generally seem to be fairly bullish on COIN stock, and Wood apparently isn’t deterred by the stock’s downward slide.

On the other hand, Coinbase’s quarterly business and financial results were rather subpar. Certainly, it’s not a great sign that the company swung from profitability to a net earnings loss.

Then, there’s the bankruptcy scare and the chatter about cryptocurrency confiscation. Sometimes, it’s difficult to sift through the noise and determine what’s realistic and what’s not.

At the end of the day, a small, speculative stake in COIN stock could make sense if you’re long-term bullish on cryptocurrency and the blockchain. Otherwise, it’s probably better to stay out of the fray, and have a relaxing day.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure