Is it time for the beaten-down crypto market to begin its upward trend again? There are several signs that suggest the lows could well be in sight.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

After Coinbase (COIN) shares have cratered by an awful 76% on a year-to-date basis, and with the company about to report 3Q22 results today after the market close, could these signals help boost sentiment for the beleaguered leading crypto exchange?

Needham’s John Todaro is not so sure. “While we think that crypto prices could be nearing a bottom based on historical metrics, sentiment indicators, and leverage ratios, we believe that near-term market concerns could weigh into ’23,” the analyst said ahead of the print.

Todaro’s main concern is the still “muted trading environment” and while there have been indications of a “decoupling” between crypto assets and the broader market which might lead to the crypto space bottoming out ahead of equities, it has yet to be significant enough for Todaro to change tack, with the analyst saying he would “like to see a greater divergence between the two to confidently call a bottom in crypto.”

Elsewhere, despite the excitement around the Ethereum merge and anticipated windfall from staking revenue, Todaro reckons it “will not materially change between Q2 and Q3,” and despite believing that over the long-term staking could offer opportunities, in the near term, he expects it “could remain muted.”

Accordingly, there are downward revisions to Todaro’s Q3 estimates.

The anticipated Q3 revenue haul is lowered from $745 million to $603 million, Adj. EBITDA reduced from ($190m) to ($215m) and the EPS forecast brought down from ($2.57) to ($2.82).

There is a bright spot, however. “Despite these concerns,” Todaro summed up, “we are excited about the near-medium term opportunity with USDC and the Centre Consortium, as it could be a significant driver for increased interest income that would partially offset our lower transaction revenue estimates for Q3’22.”

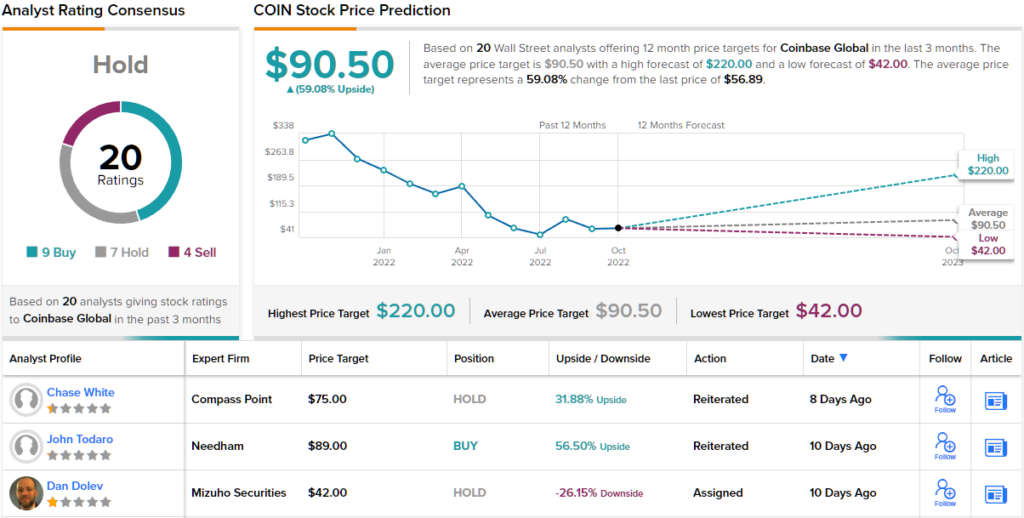

While there are revisions elsewhere, there’s no change to Todaro’s rating, which stays a Buy, or for the $89 price target, which makes room for 12-month gains of ~56%. (To watch Todaro’s track record, click here)

Turning now to the rest of the Street, where Coinbase gets mixed reviews from the analyst community. With 9 Buys, 7 Holds and 4 Sells, the stock receives a Hold consensus rating. However, on where the share price is heading, the outlook is far more upbeat; at $90.50, the figure implies shares will appreciate by 59% in the year ahead. It will be interesting to see whether the analysts update their models or change their COIN ratings after the earnings release. (See Coinbase stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.