Inarguably, one of the greatest developments in the broader investing space was the meteoric rise of cryptocurrencies in 2021, which invariably took crypto exchange and wallet service provider Coinbase (COIN) along for a wickedly bullish ride. However, circumstances have dramatically changed, necessitating a cautious outlook. For the time being, I am bearish on COIN stock.

Following the dramatic rise and rapid fall from grace of Bitcoin (BTC-USD) in late 2017, outside observers of digital assets were left assessing the sector’s vagaries. On one hand, cryptos generated tremendous enthusiasm, finally garnering some respect. On the other, the implosion of the bubble left many wondering if Bitcoin was like every other investment scheme gone bad.

However, the radical paradigm shift of the 2021 crypto bull market proved that the underlying industry had finally gone mainstream. Not only had institutional investors piled into the space, financial services firm Fidelity made waves when it opened the doors to allow bitcoin to be integrated in 401(k) retirement plans. Suddenly, everybody caught the crypto bug, a classic sign that a bubble was brewing.

Although the troubles started late last year, once the calendar turned to 2022, the headwinds of the moment – namely inflation and warfare in eastern Europe – truly sucked enthusiasm out of the once-hot arena. Naturally, COIN stock slipped under the pessimistic pivot, leaving many shareholders rushing for the exits.

Still, some contrarians have wondered: is there a discounted opportunity in COIN stock? While no one can say for certain, the fundamentals suggest that investors should wait and keep the powder keg dry.

On TipRanks, COIN scores a 4 out of 10 on the Smart Score spectrum. This indicates a potential for the stock to perform in-line with the broader market.

COIN Stock and the Bitcoin Dependency Problem

Throughout the ebb and flow of the crypto complex, the most hardened proponents will argue that Bitcoin or other virtual currencies can one day replace fiat currencies. If not, the argument goes, they can run parallel with fiat bank notes, thereby creating an alternative, self-sustaining economic ecosystem.

However, one of the blatantly obvious challenges about using Bitcoin or other crypto as a legitimate currency – and not as a medium of speculation – is the volatility dilemma. Without some level of defined predictability, it’s difficult (if not impossible) to use BTC as legal tender.

For instance, in one year, a single BTC unit could buy a nice suit. In another year, it could buy a nice car. Such extremities are unheard of in any other legitimate currency.

Unfortunately, a similar conundrum impacts COIN stock. Fundamentally, Coinbase’s revenue trend is highly and directly correlated – specifically, a correlation coefficient of 94% – with the average annual price of bitcoin.

The extremely strong correlation isn’t by itself the issue. Rather, it’s that Bitcoin is inherently volatile and unpredictable, meaning that Coinbase’s sales trajectory will be to a large extent volatile and unpredictable as well.

Therefore, this dynamic behooves investors to think shrewdly and callously about COIN stock. During the good times, there may not be a better investment than Coinbase. But during the rough outings, you must consider getting out while the going is good.

Coinbase Overshot the Runway

Further, the other nagging headwind pushing against COIN stock is that the underlying business may be fundamentally overvalued relative to the trajectory of Bitcoin. In other words, the rapid expansion of its income statement is far too excessive than what the lift in the crypto market justifies.

Between 2015 through 2018, the annual average price of Bitcoin increased by a factor of 27.5 times. During the same period, Coinbase’s revenue increased by a factor of a little over 30 times. The magnitude difference between these two rates is only 9%, a very tight figure.

In contrast, from 2018 through 2021, the average price of Bitcoin increased by a factor of 6.3 times. Coinbase’s revenue, however, increased by 16.2 times during the same frame. The magnitude difference between these two rates is 157%, suggesting that Coinbase’s operations expanded too far beyond what the expansion of the Bitcoin market was capable of justifying.

Stated differently, it’s not terribly surprising under this context that COIN stock is struggling. Moreover, investors should anticipate a steeper correction before picking up the Coinbase discount.

Wall Street’s Take

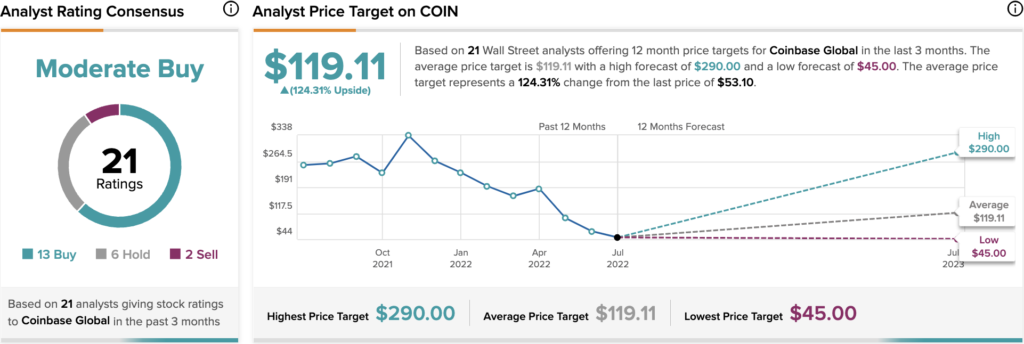

According to TipRanks’ analyst rating consensus, COIN is a Moderate Buy, based on 13 Buys, six holds and two sell ratings. The average Coinbase price target is $119.11, implying 124.31% upside potential.

Approach with Healthy Skepticism

While the crypto market took investors on a remarkably joyous ride throughout much of 2021, euphoria generally tends to fade. When it does, the morning-after effect can be painfully vexing. Further, Coinbase may require a significant correction as too much optimism may have been baked into COIN stock. Once the toxicity has been flushed out, speculators may want to move in, but not before then.

Read full Disclosure