With the rising popularity and use of cryptocurrencies globally, instances of crypto crimes involving millions of dollars have increased manifold. In the United States, federal and other agencies are working hard to limit the financial impact of crypto crimes and preferably avert them. In this scenario, the onus also falls on big and small crypto-technology providers, like Coinbase Global, Inc. (NASDAQ:COIN) and Riot Blockchain, Inc. (NASDAQ:RIOT), to strengthen their technologies against all types of crypto crimes.

On Thursday, a Wall Street Journal report revealed that the Federal Bureau of Investigation (FBI) and other investigators managed to recover $30 million in cryptocurrency stolen by North Korean hackers (Lazarus Group) over the years. In another fraudulent activity by the Lazarus Group, the U.S. Justice Department recovered cryptocurrency worth $0.5 million in July this year.

It is worth mentioning that the U.S. Justice Department announced that the prime trader of EmpiresX, a cryptocurrency platform, pleaded guilty in a crypto crime case on Thursday. Joshua David Nicholas confessed to his involvement in stealing $100 million worth of investors’ funds. Popular cryptocurrencies include Bitcoin (BTC-USD), Ethereum (ETH-USD), and others.

In this article, crypto technology providers, Coinbase Global and Riot Blockchain, are discussed. Also, a consolidated chart, designed using TipRanks’ Stock Comparison tool, is provided for the knowledge of prospective investors.

Coinbase Global, Inc. (NASDAQ:COIN)

The cryptocurrency exchange platform equips its ecosystem partners with stacking, crypto payment, and data access technologies through Coinbase Cloud. The $16.5 billion company also provides a blockchain analytics tool (Coinbase Analytics), and a technologically-advanced product for easy interaction between customers and crypto asset issuers (Coinbase Earn).

In August, the company stated that it is focused on strengthening the scope and reach of its Coinbase Retail App, Coinbase Prime, Staking, Coinbase Cloud, and Web3 products. For 2022, it expects technology & development and general & administrative expenses to be within the $4-$4.25 billion range.

Is Coinbase Stock a Buy or Sell?

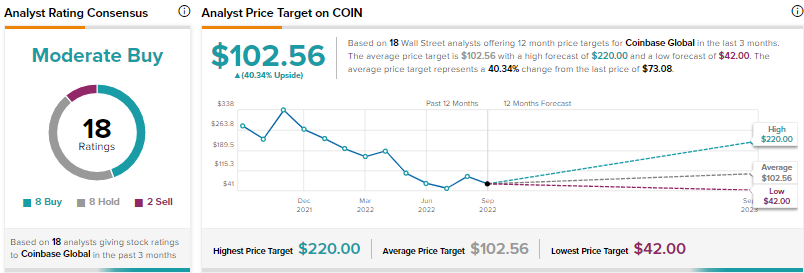

On TipRanks, analysts are optimistic but also cautious about the prospects of Coinbase. The company has a Moderate Buy consensus rating based on eight Buys, eight Holds, and two Sells. Because the total number of Holds and Sells exceeds the number of Buys, a wait-and-watch approach could be a nice idea for prospective investors.

Also, financial bloggers are just 68% Bullish on COIN stock versus the sector average of 65%. However, hedge funds are Very Positive on the stock, having increased their exposure by buying 1.1 million shares in the last quarter.

COIN’s average price target is $102.56, which reflects 40.34% upside potential from the current level. COIN stock has declined 70.9% since the beginning of 2022.

Riot Blockchain, Inc. (NASDAQ:RIOT)

The $1.2 billion crypto mining company has expertise in developing and operating the critical technological framework required in the crypto space. It is focused on developing Bitcoin mining technologies (immersion-cooling) through organic and inorganic means.

In August 2022, the company’s CEO, Jason Les, said, “Going forward, we will continue to focus on executional excellence as we work in pursuit of developing Riot into the world’s leading Bitcoin-driven infrastructure platform.”

What Is the Price Target of Riot Blockchain Stock?

On TipRanks, RIOT’s average price target is $14.83, which represents 98.79% upside potential from the current level. The highest price target is $17, and the lowest is $12.

Notably, RIOT stock has a Strong Buy consensus rating based on six Buys. Also, hedge funds have increased their holdings in the stock by purchasing 311.8 thousand shares in the last quarter. Meanwhile, financial bloggers are 60% Bullish on RIOT stock versus the sector average of 68%.

Year-to-date, shares of RIOT have decreased by 67.2%.

Concluding Remarks

From the above discussion, it is clear that cryptocurrency platforms, crypto technology providers, and investors have to play important roles in preventing fraudulent activities in the crypto space. Also, the U.S. government is willing to take all measures to safeguard the interest of investors.

In March, President Joe Biden, in his executive order, stressed on the importance of cybersecurity, and concerns related to the impact of crypto crimes on investors, the economy, consumers, and businesses. In August, the Senate Agricultural Committee put forward a bill that recommended the name of the Commodity Futures Trading Commission (CFTC) to regulate the spot trading of digital commodities.

Read full Disclosure