Winners and losers emerged following the latest round of earnings results from cloud stocks. For instance, software-as-a-service kingpin Salesforce (NYSE:CRM) took off, while Snowflake (NYSE:SNOW) melted down, as they took vastly different paths post-earnings. With macro headwinds weighing heavily on both cloud plays, questions linger as to how much investors should be willing to pay for the former high flyers.

Therefore, in this piece, we’ll use TipRanks’ Comparison Tool to better gauge where the two cloud stocks stand after a stormy earnings season.

Salesforce (NYSE:CRM)

Salesforce stock was a laggard through late 2021 and all of 2022. The enterprise cloud software giant shed 58% of its value from peak to trough — an excessive decline for one of the Dow Jones’ latest inductees. Undoubtedly, expectations got a bit too low as shares popped on a solid fourth-quarter earnings beat. It was a pleasant surprise after more than a year of excess bearishness. Despite macro headwinds, I view Salesforce as a juggernaut that could easily add to its latest relief rally gains. As such, I am bullish.

For the fourth quarter, Salesforce saw revenues rise 14%, while non-GAAP operating income more than doubled. Further, per-share earnings came in at $1.68, well ahead of the $1.36 estimates. Overall, the company still seems focused on improving profitability as the calls for cuts from Wall Street grow louder.

Like other tech firms, Salesforce has been forced to lay off staff, with hundreds of sales and marketing jobs cut in the latest wave. Indeed, such cuts are bracing for slower business in a tougher economy. That said, the leaner Salesforce won’t necessarily be considerably less innovative.

The company is very much aboard the artificial intelligence (AI) bandwagon, with continued advancements of its Einstein AI and a small bet on Toronto-based AI firm Cohere. With the ChatGPT app for Slack in the mix, I do not doubt the firm’s abilities to profit from the rise of generational AI. AI and Salesforce’s software suite may very well be a match made in heaven.

As Salesforce continues to lean out without sacrificing on the growth front, I don’t think it’s far-fetched to view the beaten-down tech titan as one of the firms that leads us out of this nasty bear market. Even after a more than 40% rally off the bottom, there’s ample room to run if shares are to eclipse their highs of above $311.75 again.

I think the stock presents compelling value at 5.8 times sales. Sure, growth has slowed and will continue to be sluggish as a recession strikes. However, longer-term, I think the profitability focus and AI bets will, in due time, pay off. Therefore, investors will need a long-term horizon for the stock to bear fruit.

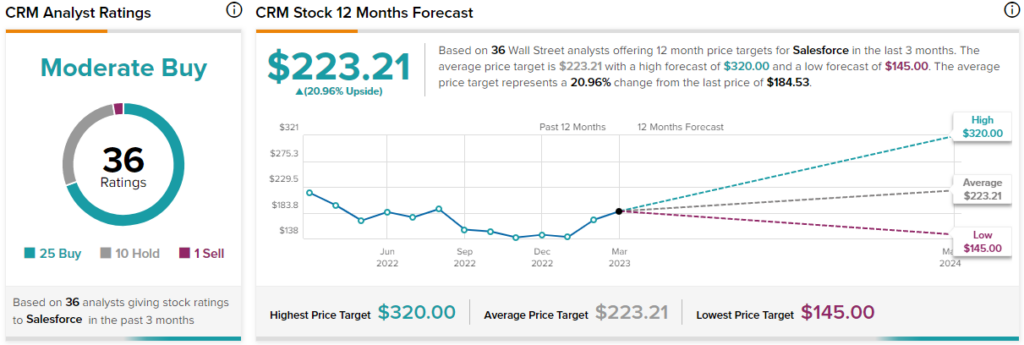

What is the Price Target for CRM Stock?

Salesforce comes in at a “Moderate Buy,” with 25 Buys, 10 Holds, and one Sell. The average CRM stock price target of $223.21 implies 21% upside potential.

Snowflake (NYSE:SNOW)

Snowflake also beat expectations on its latest fourth-quarter earnings results, with per-share earnings of $0.14, ahead of the $0.04 consensus. Still, Snowflake melted down 12% post-earnings, thanks to weak guidance. Indeed, guidance matters more than actual earnings themselves these days as macro headwinds mount. However, despite the cautious tone and still “rich” valuation, I remain bullish on the name.

Snowflake is only prudent to be cautious in the face of economic uncertainties. Indeed, the company’s usage-based revenue recognition model does tend to make the ups and downs that much more exaggerated. In any case, I view the modest forecast as setting the stage up for a potential beat down the road.

As a recession moves in, Snowflake’s headwinds will be that much more pronounced. Once the tides turn, though, look for Snowflake stock to make up for lost time, likely at a rate faster than its lower-growth peers. That’s because, like it or not, Snowflake is still a hyper-growth stock, with 54% product revenue growth in Q4. The next few quarters will not be easy, but looking beyond that, I view Snowflake as one of the high-tech innovators that will rise from the tech rubble.

Now, it will take time, perhaps years. Nonetheless, Snowflake is more than just another overinflated tech bubble that’s burst; I think it’s one of few stocks with a price-to-sales (P/S) multiple over 20 that’s still worth hanging onto.

In a market where guidance is (pretty much) everything, Snowflake looks like a firm that’s fallen on hard times rather than a firm that’s completely fallen off the long-term growth track.

What is the Price Target for SNOW Stock?

Wall Street loves Snowflake, with a “Strong Buy” consensus comprised of 22 Buys, five Holds, and one Sell. The average SNOW stock price target of $184.80 suggests 37.6% upside potential.

Conclusion

Salesforce and Snowflake are two cloud stocks that are moving in opposite directions. Still, Wall Street remains bullish on both but has a preference for Snowflake both in terms of recommendation (Strong Buy vs. Moderate Buy) and upside potential (37.6% vs. 21%).