Cloudflare (NET), a provider of online infrastructure and website security, recently released its Q4 financial results and offered an outlook for FY22. Despite strong Q4 earnings and encouraging projections, Cloudflare’s stock continued to fall as investor sentiment remained negative.

Since there was nothing wrong with Cloudflare’s fourth-quarter results, the price reduction may be attributable to macro factors like rising inflation and predicted interest rate rises.

Given Cloudflare’s unique growth potential, the share price has risen about 35% in the last year.

Q4 in a Nutshell

Cloudflare generated $193.6 million in revenue, up 54% year-over-year in the fourth quarter. In addition, the business posted break-even non-GAAP profits per share, which was in line with the consensus projection.

Further, Cloudflare added 156 large customers (those who pay the firm more than $100,000 per year) in Q4, an increase of 71% year-over-year, bringing the total number of large customers to 1,416. Aside from solid customer growth, the company’s retention rate is still high, with increased revenue from existing customers.

In addition, it anticipates total revenues in the range of $927-$931 million for 2022. It also anticipates adjusted profits to be in the $0.03 to $0.04 per share range.

What’s Ahead?

Cloudflare’s growth should be supported by current technological trends such as enterprise digital transformation and 5G adoption, as well as a high retention rate and constant introduction of new products. Further, Cloudflare’s products should continue to be in high demand due to the rising need for security solutions, which is becoming increasingly important as a result of increased cyberattacks.

Highlighting Cloudflare’s strong client additions and rising net retention, Needham analyst Alex Henderson expects Cloudflare’s growth to accelerate in the near future. He expects Cloudflare to sustain a growth rate of at least 50% through CY22 and CY23.

In the long run, Henderson expects the firm will “become a major cloud company.” He adds, “We believe NET to deliver 30%-50% Revenue growth over the next 3-5 years and sustain Gross Margins in the mid-to-high 70% range while delivering operating leverage.”

As a result, Henderson reiterated his Buy rating on Cloudflare stock and a price target of $245.

Wall Street’s Take

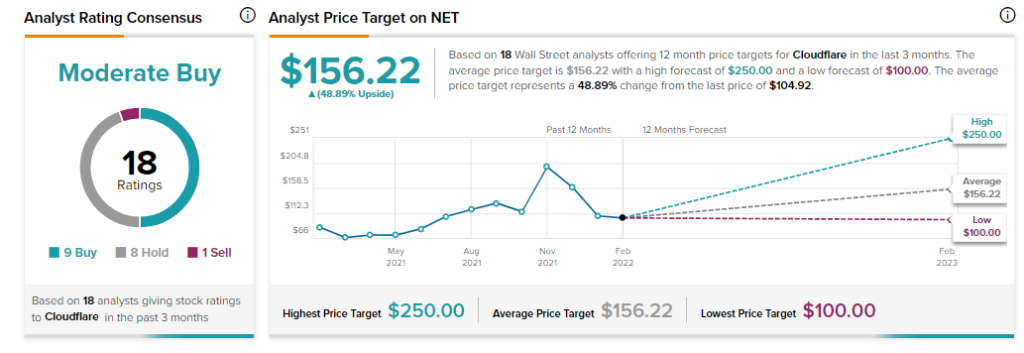

However, Cloudflare does not impress all experts. On TipRanks, Cloudflare has a Moderate Buy average rating, based on 9 Buys, 8 Holds, and 1 Sell. The average Cloudflare stock prediction of $156.22 implies upside potential of approximately 48.9% to current levels for this stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure