Analysts ganged up on Cloudflare (NYSE:NET) stock not too long ago, but they might feel foolish about their price-target cuts soon. Indeed, they’re probably already scrambling to revise their predictions. Looking ahead, I’m strongly bullish on Cloudflare stock because the company is taking artificial intelligence (AI) security in bold new directions.

Cloudflare is a well-known cloud services provider. More specifically, Cloudflare focuses on using cloud-based solutions to prevent fraud and detect security threats. It’s a highly-respected company, but Cloudflare fell out of favor in late April as the NET stock price dropped like a rock before quickly recovering.

In hindsight, we can see that this was a terrific buying opportunity. So, is it too late to take a share position now? If you’re bullish on AI, Cloudflare still deserves your attention as NET stock is, I believe, still headed for the clouds.

Analysts Gang Up on Cloudflare

It’s funny how a company can be a darling of the market one day and then a pariah the very next day. Analysts didn’t seem to have a major problem with Cloudflare until the company released its first-quarter 2023 earnings data and forward guidance. Then, all of a sudden, Wall Street piled on Cloudflare with price-target reductions.

That’s somewhat surprising, considering Cloudflare’s perfectly acceptable quarterly results. In Q1 2023, Cloudflare reported non-GAAP net income per diluted share of $0.08. This demonstrated a major improvement over the year-earlier quarter’s result of $0.01 and also beat the consensus estimate of $0.03 per share. Furthermore, Cloudflare’s quarterly revenue increased by 37% to $290.2 million and was nearly in line with the consensus forecast of $290.8 million.

Not only that, but Cloudflare disclosed Q1-2023 operating cash flow of $36.4 million and free cash flow totaling $13.9 million. Both of those figures were negative in the prior-year quarter, so again, Cloudflare appears to be moving in the right direction.

Why did investors dump NET stock, then? The culprit was Cloudflare’s outlook for the current quarter, as Cloudflare CFO Thomas Seifert warned of a “material lengthening of sales cycles and a significant backend-weighting of linearity.” With that, Cloudflare projected Q2-2023 total revenue of $305 million to $306 million, thereby falling short of the analyst community’s call for $320 million in quarterly revenue.

That might not sound like the end of the world, but analysts went to town on Cloudflare. Lower-revised price targets for NET stock included $60 from JMP Securities (lowered from the previous target of $90), $50 from Piper Sandler (lowered from $64), $50 from Cantor Fitzgerald (from an earlier $65), and an obscenely pessimistic $40 from Guggenheim (lowered from $43), to name a few.

Cloudflare Hits Back with a One-Two AI Punch

At $61 and change, NET stock is already above all of those lowball price targets. Yet, the momentum could easily continue as Cloudflare is taking control of its future with a pair of power-packed press releases that pertain to the topic on everyone’s mind in 2023 — AI.

Don’t get the wrong impression here, as Cloudflare isn’t just bandwagon-jumping. Cloudflare is dead-serious about an aspect of the machine-learning revolution that many people aren’t talking about — safety and security. For instance, Cloudflare has unleashed its distributed object storage software, Cloudflare R2 Storage, specifically to provide “essential infrastructure for leading generative artificial intelligence (AI) companies.”

With this product, Cloudflare is “providing the first developer platform built for the age of AI,” according to CEO Matthew Prince. That might or not be an exaggeration, but it’s still a smart move for Prince and his company to specifically address the potentially underserved AI-developer niche market in 2023.

Just a day after that announcement, Cloudflare promoted Cloudflare One for AI, a suite of zero-trust security controls designed to “enable enterprises to safely and securely use the latest generative AI tools without putting intellectual property and customer data at risk.” This is a brilliant move during a time when so many businesses want to leverage the power of generative AI (like the ChatGPT chatbot) but are concerned about user security.

That’s a valid concern, and Cloudflare is moving quickly to address it. Once again, Prince might be exaggerating when he claims, “Cloudflare’s Zero Trust products are the first to provide the guard rails for AI tools.” Nevertheless, Cloudflare One for AI could become a go-to product suite for reluctant businesses that don’t have their own tools to ensure secure, zero-trust access to generative AI applications.

What is the Average Price Target for NET Stock?

Turning to Wall Street, NET comes in as a Moderate Buy, based on nine Buys, 10 Holds, and one Sell rating. However, the average Cloudflare stock price target is $52.94, implying 13.4% downside potential.

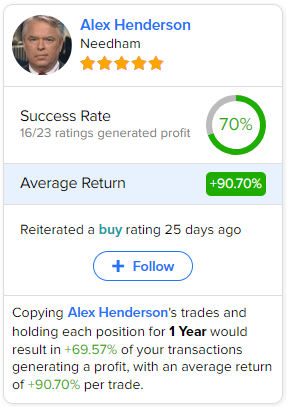

If you’re wondering which analyst you should follow if you want to buy and sell NET stock, the most profitable analyst covering NET stock (on a one-year timeframe) is Alex Henderson of Needham, with an average return of 90.70% per rating. See below.

Conclusion: Should You Consider Cloudflare Stock?

Even the smartest Wall Street analysts can’t get it right every time. I feel that they overreacted to Cloudflare’s downbeat but realistic current-quarter guidance. Soon enough, they’ll probably have to revise their Cloudflare stock price targets higher, and I believe that right now is a good time to consider NET stock.

The share price has risen over the past month but hasn’t shot to the moon. Moreover, Cloudflare should gain significant value as the company threatens its competitors (and rebuts its critics) with best-in-class tech tools for the AI security market.