The Federal Reserve’s hawkish stance on monetary policy is still not going to reduce the 40-year high inflation overnight. Elsewhere in the world, Russia and Ukraine have a lot of walls to climb before the war can effectively be ended. Moreover, the sanctions on Russia are hardening and may further fuel inflation in the West.

On Wall Street, now that earnings season is almost over, investors are going back to focusing all their attention on inflation and the brewing recession, and thus, the choppiness in the markets is expected to continue.

In such precarious times, self-driven retail investors can actually turn the odds in their favor by investing in the right stock at the right time. One sure way to be better educated on stocks is to keep a close eye on what the world’s top experts are doing.

Wall Street analysts constitute that cohort of market experts who track the financials, fundamentals, developments, vision, and prospects of companies and industries by studying their business filings, participating in corporate events, and interviewing top executives.

In today’s Expert Spotlight piece, we will celebrate one of the top Wall Street analysts who, in her successful career, has helped numerous investors make accurate investment decisions.

Today’s Expert: Helane Becker

Our expert of the day, Helane Becker, is the managing director at Cowen & Co., specializing in airlines, air freight, and aircraft leasing. Her repertoire boasts of more than 40 years of rich experience as a Wall Street analyst. She is ranked #71 out of 7,952 analysts tracked by TipRanks and holds the 98th spot among the 19,594 experts in the TipRanks database.

The star ranking system of TipRanks takes into account an expert’s success rate, the average returns generated per rating, and statistical significance, which is directly proportional to the number of transactions or recommendations made by the expert. Becker is a five-star rated analyst on TipRanks, who has achieved 67% success on the 421 ratings she has given so far.

The stocks rated by the analyst have returned average gains of 17.8% over the past year. Furthermore, her recommendations generated an alpha of 5.6% over the S&P 500 index and 5.1% over the services sector performance in the past year.

Becker’s most accurate stock recommendation has been United Airlines Holdings (NASDAQ: UAL) in the period between December 08, 2009, and October 22, 2010, during which the stock had gained almost 181%.

Amid the current pullback, Becker made three stock recommendations in the past couple of months, all of which were Buys. Let us have a look at two of them.

Air Transport Services (NASDAQ: ATSG)

Air Transport Services Group provides airline operations, aircraft leases, aircraft maintenance, and other support services to the cargo transportation and package delivery industries. The recovery in economic activities like world trade proved to be a boon for the company, as evident from its stock performance throughout the course of this difficult year so far. ATSG stock has gained almost 6% year-to-date.

The company is gaining from strong demand for mid-sized freighters. Moreover, TipRanks also showed us that the general sentiment of corporate insiders regarding the stock is positive based on 13 informative insider transactions by 13 unique insiders over the past three months.

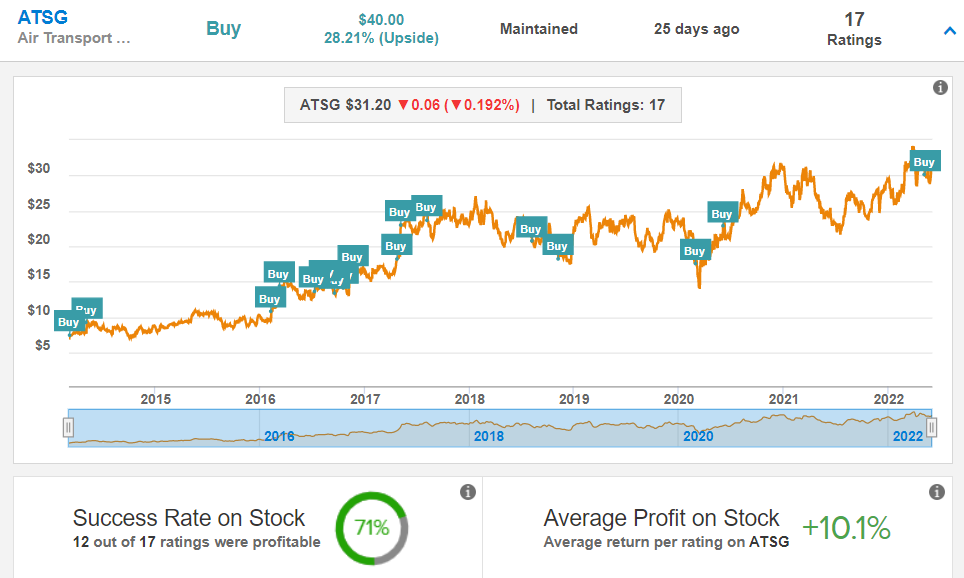

Early in May, Becker reiterated a Buy rating on ATSG stock and also lifted her price target to $40 from $31. Although management reinforced its outlook for 2022 adjusted EBITDA, the projection seems conservative to Becker considering the continued strength in Freighter demand, which is expected to remain strong.

Notably, 12 out of 17 ratings given by Becker for ATSG have been successful, generating an average profit of 10.1% per rating.

Wall Street is also bullish on the stock, with a Strong Buy consensus rating based on three unanimous Buys. The average ATSG price target is $38.33, implying 22.9% upside potential from current levels.

United Airlines, Inc.

United Airlines provides transportation of passengers as well as cargo. So, it benefits from both solid demand for shipping and a resurgence in travel activities, as travel opens after the pandemic.

In the first quarter of 2022, the carrier made strong Q2 guidance, saying that it expects the “highest quarterly revenue in our history in 2Q.” Moreover, despite reporting an adjusted loss per share in Q1, United Airlines claims to be on track to return to profitability in Q2.

The most concerning point is probably its declining capacity. The carrier expects its Q2 capacity to be off 14% from 2019 levels, a larger decline from its previous guidance of a 13% drop. Nonetheless, the upbeat guidance on both the top and bottom line is keeping investors and most analysts upbeat.

In an interview with CNBC in April, Becker reiterated that international travel is set to experience increased activities, and United Airlines is well-positioned to benefit from it. Three years of pent-up demand is expected to fuel this trend.

In April, Becker maintained her bullish stance on United Airlines with a Buy rating while raising the price target to $86.50 from $78. Apart from increased business and leisure travel, the analyst also looks at a strong summer for transatlantic travel, considering the addition of several leisure destinations by UAL around the transatlantic region.

Looking at the historical 77% success rate on her UAL ratings, Becker’s conviction on the stock can be trusted. Moreover, each of her ratings has generated a 22.2% profit on average.

Wall Street seems to be cautiously optimistic about UAL, with a Moderate Buy consensus rating based on 10 Buys, seven Holds, and one Sell. The average price target for United Airlines is $59.85, implying 35.2% upside potential.

Bottom Line

Given Becker’s confidence in her ratings of ATSG and UAL, combined with a history of successful ratings, it makes sense for investors to take into account her opinions while making investment decisions during uncertain times.

Read full Disclosure