Based in Ohio, Cleveland-Cliffs (CLF) is among the largest flat-rolled steel producers in North America. I am bullish on the stock.

As America entered into the Industrial Age in the 1800s and early 1900s, steel was in high demand to build railroads. As a result, steel moguls made millions of dollars, and people flocked to steel manufacturing towns for jobs.

Fast-forward to the 2020s, and times have changed dramatically. Steel isn’t on people’s minds much anymore, and steel producers like Cleveland-Cliffs weren’t exactly the talk of the town during the past decade.

In 2022, however, supply chain disruptions have driven strong demand and elevated prices for commodities, including steel. CLF stock shot up in February and March, benefiting current shareholders. Is the stock too pricey now, though?

That’s a valid question for value-focused traders, so it’s important to consider the outlook for steel, and for Cleveland-Cliffs in particular, during these turbulent times. As it turns out, though, Cleveland-Cliffs appears to be well-positioned to thrive amid the current steel-market landscape.

Still a Bargain

Since CLF stock has rallied from $16 and change in late January to the current price of nearly $30, value hunters might question whether the stock is still worth owning.

Does a near-doubling of the share price indicate an overvalued stock? Not necessarily. Investors should consider the big picture here. From 2011 to 2019, CLF stock was mired in a prolonged, painful bear market. The share price was clobbered to the point where it could still be deeply discounted even if it doubled and then doubled again.

Besides, we have to bear in mind that commodities-linked stocks tend to be volatile assets. A share-price doubling in the world of metal miners isn’t always a big deal, to be honest. Trade these types of stocks long enough, and you’ll see some 10x or even greater moves.

So, let’s not get hung up on the recent rally in CLF stock. Currently, Cleveland-Cliffs’s trailing P/E ratio is just 4.2. This indicates that, even with the recently elevated share price, CLF stock is still a good value due to the company’s earnings — which we’ll definitely cover in a moment.

Higher Margins for Cleveland-Cliffs

As you might expect, the Cleveland-Cliffs share price has followed the steel price to a certain extent. It’s not a perfect one-to-one correlation, but investing in Cleveland-Cliffs means that you’ll want to pay close attention to the movements of steel prices, and to the outlook for the steel industry in general.

The crisis in Ukraine, it seems, has exacerbated an already supply-constrained commodities market in 2022. Russia and Ukraine are both important steel producers, after all.

The upshot of these disruptions is a strong need for domestic steel production. Is Cleveland-Cliffs willing and able to step up?

By all indications, Cleveland-Cliffs Chief Executive Lourenco Goncalves is confident that his company has the drive and the wherewithal to continue its pace of steel production — and to benefit financially.

According to The Wall Street Journal, Cleveland-Cliffs has its own supply of iron ore in the U.S., and purchased a chain of scrap yards last year to reduce the company’s exposure to the volatile scrap market.

This should stand Cleveland-Cliffs in good stead during a time of elevated commodities prices.

“We will benefit through higher margins on steel because our cost structure is not nearly as impacted,” Goncalves clarified.

Protecting and Strengthening

In the wake of Cleveland-Cliffs’ Q1 2022 results, Goncalves emphasized his company’s foresight in preparing for isolationism in the global commodities markets.

“Over the past eight years, our strategy has been to protect and strengthen Cleveland-Cliffs against the consequences of de-globalization, which we have always seen as inevitable,” Goncalves explained.

Today, in light of the crisis in Ukraine and many nations striving to achieve self-sufficiency in commodity production, Cleveland-Cliffs’ eight-year strategy seems almost prophetic, or at least providential.

At the very least, we can say that Goncalves is justified in bragging that “while other flat-rolled steelmakers scramble and pay high prices for their needed feedstock, we stand out from the crowd due to our preparation for the current geopolitical climate.”

Goncalves’s braggadocio is backed up by Cleveland-Cliffs’ first-quarter data, which decisively “beat the Street,” as they say. Notably, Wall Street had modeled $5.4 billion in sales and adjusted EPS of $1.46 for Q1 2022, while Cleveland-Cliffs delivered $6 billion in sales and adjusted EPS of $1.71.

Wall Street’s Take

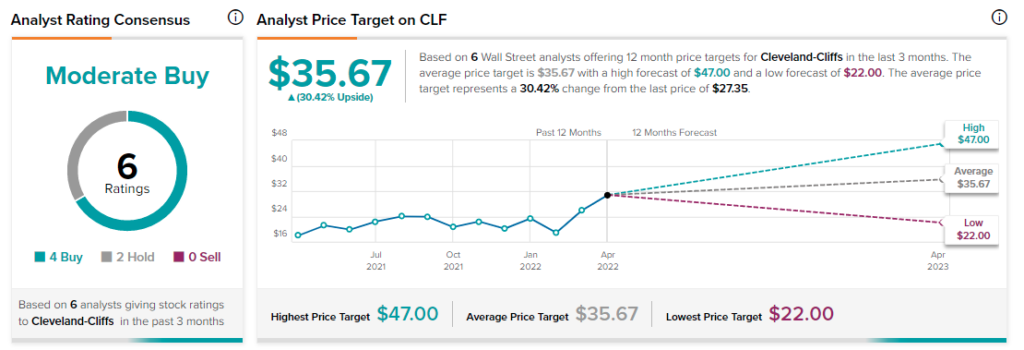

According to TipRanks, CLF is a Moderate Buy, based on four Buy and two Hold ratings. The average Cleveland-Cliffs price target is $35.67, implying 30.4% upside potential.

Takeaway

Even after a short-term share-price rally on the back of the global commodities crunch, CLF stock remains a long-term bargain that’s hard to resist.

It appears, overall, that Cleveland-Cliffs’ long-term self-protective strategy is paying off big time. The quarterly fiscal data reinforces this point, and paints an irrefutably bullish picture for CLF stock.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure