Cisco Systems (CSCO) is a technology company that offers networking gear, software, telecommunications equipment, and other services and products.

Given the latest tech sell-off, Cisco has lost around 21% of its value year-to-date. However, the company is rapidly expanding. CSCO’s growth is fueled by new product launches and widespread adoption of its software and subscription-based products.

Coming to the second-quarter earnings release, Cisco outperformed expectations on both the top and bottom lines. Revenues increased 6% year-over-year to $12.7 billion, while earnings per share improved 6% to $0.84 per share.

On May 18, the company will report its Q3-2022 earnings. Let’s see how the business is expected to perform in the upcoming quarter.

Will the Earnings Growth Momentum Continue?

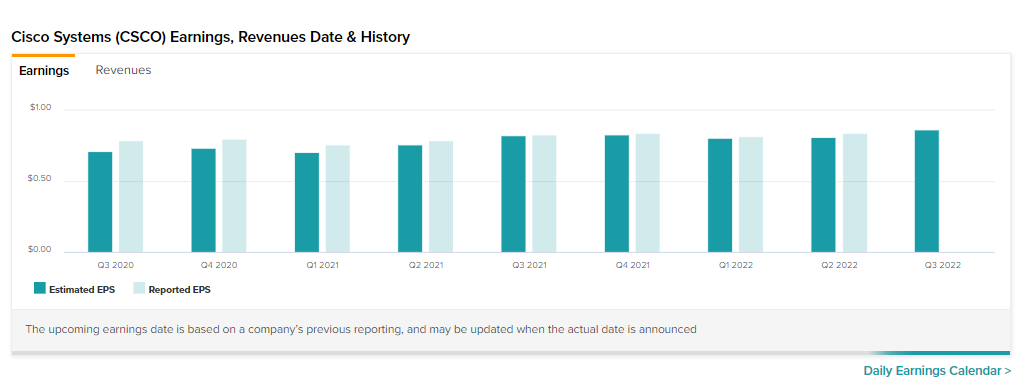

According to analysts, Cisco is projected to report adjusted earnings of $0.86 per share in its fiscal third quarter. This represents a year-over-year increase of 3.6%.

As shown in the graph above, Cisco has surpassed earnings forecasts for the past eight quarters. It’s likely that the company will be able to do so again in the upcoming quarter.

Cisco forecasts adjusted earnings per share to range between $0.85 and $0.87 in the third quarter, with revenue growth of 3%-5% year-over-year.

For 2022, Cisco anticipates earnings per share of $3.41 to $3.46 and revenue growth of 5.5% – 6.5% year-over-year.

Wall Street’s Take

According to the study, Jonathan Ruykhaver of Robert W. Baird expects the company to produce “another fairly solid quarter.” However, the analyst prefers to remain on the sidelines for the time being due to ‘geopolitical events, pricing increases, and supply chain issues.”

As a result, the five-star analyst maintained a Hold rating on the stock and a price target of $62 per share. This implies 25.8% upside potential from current levels.

On TipRanks, Cisco stock commands a Moderate Buy consensus rating based on nine Buys, six Holds, and one Sell. As for price targets, the average Cisco price target of $62.92 implies 27.6% upside potential from current levels.

Bottom Line

Cisco should continue to grow at a strong rate thanks to its new product releases, impressive track record, and leadership position in the networking space. However, the ongoing semiconductor chip shortage, inflation, and macroeconomic concerns may have an impact on the company’s third-quarter performance to some extent.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure