Chipotle (CMG) is possibly one of the more curious success stories of this year. The fast-casual restaurant chain belongs in a category that, overall, has been hit hard by the coronavirus. Closures, furloughs, and a cloudy outlook have all taken their toll on numerous industry stalwarts.

But not on Chipotle. The stock is up by 26% in the new decade, recently blasting its way over the $1,000 mark to notch an all-time high. Wedbush analyst Nick Setyan is expecting “continued comp and EPS outperformance to lead to further multiple expansion.”

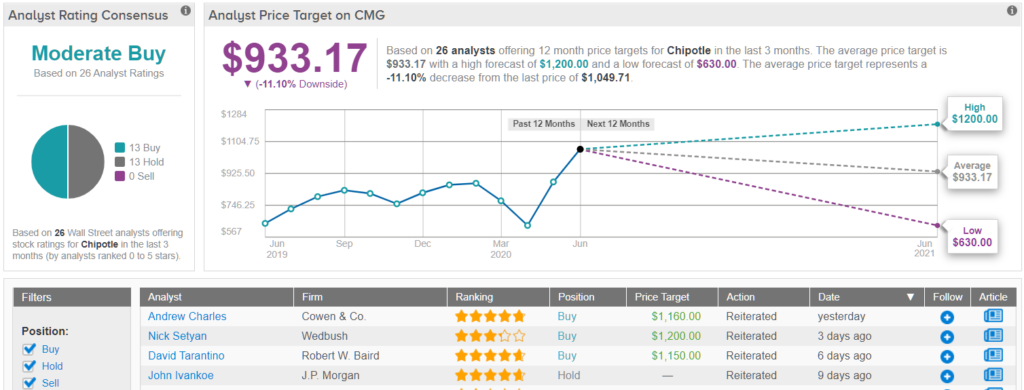

Setyan rates Chipotle an Outperform and gives the price target a tasty add on – from $870 to $1,200. Investors could be pocketing a 13% gain if Setyan’s target is reached over the next 12 months. (To watch Setyan’s track record, click here)

Part of Chipotle’s success in 2020 came from the company’s efforts to improve its digital segment. These efforts are paying off as sales saw a dramatic uptick over the last year, and flourished during the pandemic’s peak.

Additionally, recent checks indicate that the volume at stores is higher than anticipated. The latest data suggests same store sales (SSS) were up by high single or low double-digits at restaurants operating at 50% capacity. Those operating at under 25% capacity have seen a low single-digit bump, too.

The figures have certainly impressed Setyan. “Based on the strength of our checks, we increase our Q2 SSS growth estimate to -9% from -20% (cons. -15.7%),” the analyst said.

Looking ahead to 2H20, “CMG’s ability to capitalize on accelerated digital/delivery adoption,” is given further credence by the “relative strength of CMG’s current comp trajectory.” Accordingly, Setyan boosted 2H:20 SSS growth estimates, even going so far as to suggest comps might turn positive by 3Q. For Q4, the number could land at 3% (from the previous -5%).

Turning now to the rest of the Street, opinion on Chipotle’s prospects is split evenly. 13 Buys and Holds, each, add up to a Moderate Buy consensus rating. The average price target of $933.17 indicates possible downside of 11% in the year ahead. (See Chipotle stock analysis on TipRanks)