Wall Street analysts are highly bullish about fracking pioneer Chesapeake Energy’s (NASDAQ:CHK) growth prospects following its turnaround. An economic rebound from the pandemic, soaring energy prices, and a focus on natural gas assets helped the exploration and production company improve its financial position last year.

Often called the poster child of the U.S. shale revolution, Chesapeake filed for bankruptcy in June 2020 due to the massive debt it accumulated because of rapid expansion. The COVID-19 pandemic exacerbated the company’s challenges as energy prices slumped due to a collapse in demand. Nonetheless, Chesapeake emerged from bankruptcy in early 2021 after $7.8 billion of debt was equitized under a court-approved plan.

Chesapeake Focusing on Natural Gas

Chesapeake has a strong presence in three top U.S. oil and gas plays – the Eagle Ford, Haynesville, and Marcellus shales. However, the company intends to divest Eagle Ford, marking its retreat from oil operations to become a pure-play natural gas player with a greater focus on its assets in Haynesville and Marcellus.

Chesapeake’s Q3 2022 net production of 4.11 billion cubic feet equivalent per day comprised 90% natural gas and 10% liquids. The company is particularly optimistic about the growth potential in the Haynesville basin. During the Q3 conference call, CEO Domenic Dell’Osso stated that the company remains “super bullish” on the longer-term supply-demand fundamentals in the U.S., particularly for the Haynesville basin.

In its Q3 earnings report, Chesapeake disclosed that it was operating five rigs in Marcellus, two in Eagle Ford, and six in the Haynesville basin. As per the Wall Street Journal, the company recently added a seventh rig in the Haynesville basin, a massive dry natural gas formation in Northwest Louisiana and East Texas. There were 69 drilling rigs operating in this basin in early January, compared to 32 in 2020 summer.

S&P Global Commodity Insights estimates that the U.S. is on track to double its LNG exports to nearly 24 billion cubic feet a day by 2030. Experts believe that much of the supply growth required to export more gas will be derived from the Haynesville basin. This is because unlike the Haynesville basin, the Northeastern U.S. gas fields neither have proximity to large LNG ports nor extensive pipelines to the Gulf Coast. Given this scenario, Chesapeake’s focus on the Haynesville basin will drive its long-term growth.

Chesapeake’s Q3 adjusted EPS came in at $5.06 a share, up considerably from $2.38 per share in the prior-year quarter, thanks to higher natural gas prices. Robust profits helped the company return $1.9 billion to shareholders through dividends and share repurchases in the first nine months of 2022.

Is CHK Stock a Buy?

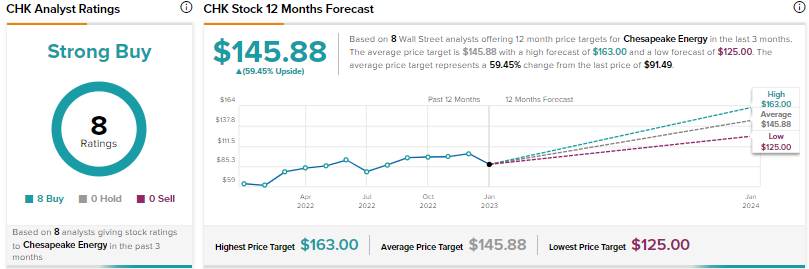

While natural gas prices have declined from the peak levels seen in 2022, Wall Street remains highly bullish about Chesapeake. The Strong Buy consensus rating for Chesapeake Energy stock is based on eight unanimous Buys. The average CHK stock price target of $145.88 implies 59.5% upside potential. CHK’s dividend yield stands at 2.4% (dividend yield is about 11% if we include variable dividends).

Conclusion

Despite near-term fluctuations in natural gas prices, Wall Street analysts are optimistic about Chesapeake’s prospects in the years ahead due to the company’s turnaround efforts and its presence in two of the leading gas shale plays.