After absorbing the severe market shock of the COVID-19 crisis, Walt Disney (NYSE:DIS) went on to deliver astonishing gains. At its peak, DIS stock breached the $200 level, an all-time high for the company. Fundamentally, Disney offered cheap at-home entertainment, thus commanding a premium during the shelter-in-place days. Though this narrative took a hit following the relaxing of COVID policies, economic pressures make the entertainment giant relevant again. I am bullish on DIS.

Launched in November 2019, Disney’s streaming service, Disney+, has already attracted significant attention. Not only did it provide meaningful competition to the streaming arena, the Magic Kingdom offered an unparalleled content library. By leveraging its marquee franchises, Disney could take on the giants of the rapidly burgeoning streaming market. Indeed, management did just that with the introduction of the Star Wars-themed “The Mandalorian.”

When the COVID-19 crisis first capsized the U.S. economy, DIS stock received no exemption from volatility. However, as investors took a breather during the spring doldrums of 2020, they realized that certain companies cynically benefitted from the pandemic. Essentially, Disney now had a captive audience, particularly with live sporting events being canceled at the time.

As The Wall Street Journal pointed out, this was bad news for cable TV providers. However, DIS stock benefitted as the underlying company could still distribute already-produced content from its vast media empire.

Unfortunately for Disney, as fears of COVID-19 faded, consumers were eager to get out of the house. After all, Americans collectively endured roughly two years of cabin fever. Quickly, a new term emerged in the pop culture lexicon: revenge travel or the desire to seek out experiences that the pandemic denied.

Perhaps not coincidentally, DIS stock incurred a loss exceeding 36% on a year-to-date basis. However, in the trailing month, shares only lost 1%, likely indicating a sentiment shift.

Entertainment Returns Home for DIS Stock

On paper, the latest data regarding the employment situation might augur well for revenge traveling, thus possibly hurting DIS stock. Nevertheless, as a whole, circumstances favor cheap at-home entertainment platforms, making Disney an intriguing contrarian opportunity.

To be fair, as TipRanks reporter Kailas Salunkhe mentioned, the November jobs report came in hotter than expected. The U.S. economy added 263,000 jobs, far exceeding Wall Street’s expectations of 200,000 jobs. However, the devil’s in the details.

Per Salunkhe, there were “major job gains in leisure and hospitality, healthcare, and government. Sectors including retail trade, transportation, and housing, on the other hand, witnessed declines.” In addition, “large and small businesses have been undertaking headcount reductions while medium establishments seem to have fared better during this period.”

Stated differently, many of the high-paying, white-collar corporate jobs incurred losses. Filling in the gaps are less-compensated occupations, such as those in the retail sector. Fundamentally, this development may help DIS stock at the expense of companies benefitting from revenge travel. Interestingly, U.S. Global Jets ETF (NYSEARCA:JETS) is down nearly 14% for the year.

Therefore, it’s quite possible that collective discretionary funds for big-ticket items or experiences waned considerably. Adding to this speculation, the personal saving rate, which soared to a record height in April 2020, succumbed to near-all-time recorded lows as of the latest read (October 2022).

Bluntly, not too many people have the funds lying around to go vacationing in exotic locations. However, most folks should have the money to spend a few bucks every month for quality streaming entertainment. Again, combined with Disney’s marquee franchises, the company could provide escapism during difficult times at a very attractive rate.

Is DIS Stock a Sell or Buy?

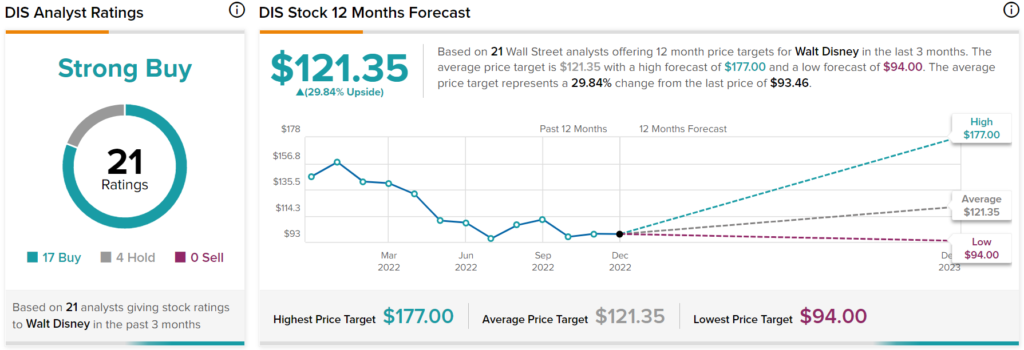

Turning to Wall Street, DIS stock has a Strong Buy consensus rating based on 17 Buys, four Holds, and zero Sells assigned in the past three months. The average DIS stock price target is $121.35, implying 29.84% upside potential.

Quantitative Data Supports Disney’s Contrarian Case

To be fair, DIS stock could use a little bit of work on the financial component of its investment proposition. Still, investors have some positive attributes to work with. The company continues to deliver decent income-statement metrics. For instance, Disney’s three-year revenue growth rate (on a per-share basis) is 2.7%, which actually ranks better than nearly 63% of the competition. Also, its net margin is 8.2%, higher than almost 64% of players listed in the diversified media industry.

These aren’t blisteringly positive stats, to be quite honest. However, with fundamental catalysts favoring the Magic Kingdom, they could be more than good enough for DIS stock.