‘Buy the dip’ has not become the ubiquitous phrase it is for no reason. With bank stocks recently falling in unison whether they are in danger of meeting the same fate as SVB and Signature bank or not, there are plenty of ‘buy the dip’ opportunities investors can take advantage of right now.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

And that’s what one CEO has been doing. Having watched shares of his firm Charles Schwab drop by more than 30% since the crisis began, CEO Walter Bettinger said on Tuesday that he purchased 50,000 shares for his own personal account. Bettinger also said he was not alone in doing so, claiming the bank’s clients were also loading up on SCHW shares.

It looks like the buying action has not been reserved for the online brokerage, either. Elsewhere, bank insiders have been busy scooping up shares of their own stocks, evidently feeling the pullback is too good to resist. If the insiders are loading up, that sends a strong signal to investors they must believe their company shares are undervalued.

In light of this, we dipped into the Insiders’ Hot Stocks tool at TipRanks and got the lowdown on three bank stocks showing some strong insider buying activity. Here are the details.

Fifth Third Bancorp (FITB)

Headquartered in Cincinnati, Ohio, Fifth Third Bancorp is one of the Midwest’s biggest consumer banks. Operating via its subsidiary Fifth Third Bank, its customer base includes retail, small businesses and investment clients, with the business split into several distinct segments: Commercial Banking, Branch Banking, Consumer Lending and Wealth and Asset Management.

In Fifth Third’s recent Q4 report, rising interest rates helped the company deliver a big expansion in interest margins – the difference between the bank’s rates for loans and its rates for deposits. The net interest margin (NIM) climbed 13 percentage points sequentially to 3.35%. Year-over-year, that figure was up by a much more significant 80 percentage points from the 4Q21 margin of 2.55%. The upshot is that net interest income increased by 32% year-over-year to $1.6 billion. Additionally, while expenses increased only by 1%, reported revenue rose 16% to $2.3 billion.

As with many other regional banks, FITB shares came under pressure in the wake of the bank collapses, falling by 26% since the crisis started.

One insider decided it is time to pounce. Director Gary Heminger loaded up in two blocks on a total of 47,500 shares at the start of the week – now worth $1.19 million.

He’s not the only one showing confidence. Assessing this bank’s prospects, Piper Sandler’s Scott Siefers highlights the NIM as the factor that sets FITB apart.

“FITB looks to us as if it should be able to sustain an upward trajectory through this year,” the analyst said. “Plus, it appears as if the company has positioned itself such that it should even be able to hold a NIM floor around 3.30% over the next couple years, even if rates fall by a couple hundred bps. So FITB’s main differentiating factor, in our view, is the consistency & resilience in its NII trajectory… Within its existing guidance, FITB strikes us as one of the best-positioned large regionals.”

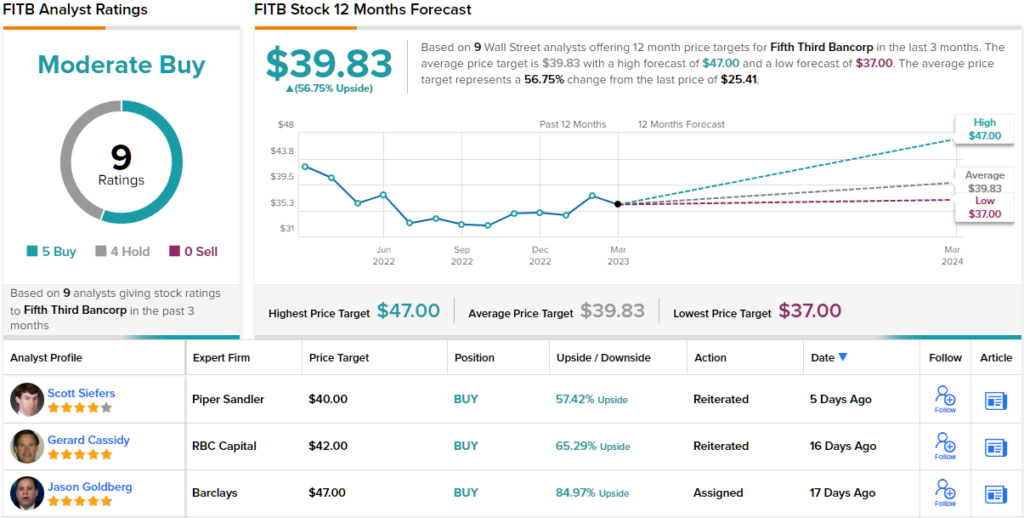

These comments form the basis for Siefer’s Overweight (i.e., Buy) rating while his $40 price target makes room for one-year returns of ~57%. (To watch Siefers’ track record, click here)

Elsewhere on Wall Street, the stock garners an additional 4 Buys and Holds, each, for a Moderate Buy consensus rating. Considering the average target stands at $39.83, the analysts, like Siefer, expect shares to rise ~57% in the months ahead. (See FITB stock forecast)

Stellar Bancorp (STEL)

Next up is another bank holding company. Stellar Bancorp subsidiary Stellar Bank, is a Houston, Texas-based institution, offering a wide-ranging set of commercial banking services. The bank mainly caters to small- to medium-sized businesses and individual customers based in Houston, Beaumont, Dallas and the surrounding areas in Texas.

The bank is a new concern, having formed via a merger of equals between Allegiance Bank and Community Bank of Texas, N.A.. The merger became effective on October 1, 2022.

The company’s fourth quarter results reflected the first as a combined entity and showed contrasting fortunes between the top-and bottom-line. Revenue rose by 108.5% year-over-year to $126.25 million, beating the Street’s call by $6.16 million. However, core EPS of $0.15 badly missed the $0.72 consensus estimate.

Shares fell following the Q4 print and dropped once again in the wake of the SVB debacle, though not as badly as other bank stocks have lagged.

Yet, two insiders evidently think the time is right to pounce. On Monday, director Joe Swinbank bought 37,841 shares – currently worth $991,000, while director Joe Penland bought 10,000 shares worth $262,000.

Stephens analyst Matt Olney is also bullish on this stock, and lays out a clear case for buying in, as the potential gains clearly outweigh the risks. He writes: “With the macro-uncertainty, we continue to believe STEL is well positioned due to its strong funding, excellent credit reputation and strong operating footprint in southeast Texas.”

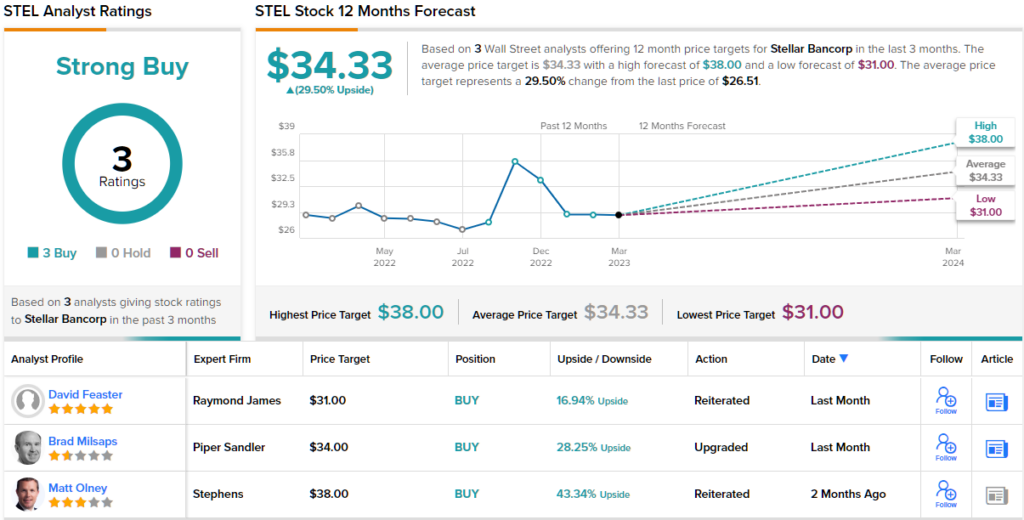

To this end, Olney puts an Overweight (i.e., Buy) rating on STEL shares and backs it up with a $38 price target. This suggests the shares will climb 44% higher over the next 12 months. (To watch Olney’s track record, click here)

Other analysts back Olney’s take. 3 Buys and no Holds or Sells have been assigned in the last three months, so the word on the Street is that STEL is a Strong Buy. The $34.33 average price target puts the upside potential at 29.50%. (See STEL stock forecast)

Coastal Financial (CCB)

The final bank stock we’ll look at is that of holding company Coastal Financial, whose operations run through its subsidiary, Coastal Community Bank. Headquartered in Everett, Washington, the company oversees 14 full-service branches in the greater Puget Sound area. Small and medium-sized businesses, professionals, and individuals all use Coastal’s full range of banking services while through its CCBX division, Coastal also provides Banking-as-a-Service to broker dealers and digital financial services companies.

The company’s revenues have been climbing at a brisk pace and that was the case again in the recent Q4 report. Revenue reached $96.24 million, for a 147.2% year-over-year increase while the company generated net income of $13.1 million, amounting to EPS of $0.96. This compares well to the net income of $11.1 million ($0.82) shown in the prior quarter and the $7.29 million net income generated in 4Q21. The company saw out the year with total assets of $3.14 billion, a 19.3% increase on the $2.64 billion as of the end of 2021.

Still, the shares were unable to withstand the force of the banking meltdown and took a bad hit in a series of sessions recently – falling by 26%, before posting a recovery.

4 C-suite members took advantage of the pullback, with the most notable purchase being that of director Steven Hovde. On Tuesday, he bought 30,000 shares. Their market value currently exceeds $1 million.

This stock has also caught the attention of Raymond James’ David Feaster who wrote: “Given the strong growth outlook with defensive characteristics ahead of a potential credit cycle, we view the risk/reward favorably and do not believe current valuation contemplates the meaningful potential earnings power from its BaaS segment (CCBX). As it continues to validate the business model through the cycle, we anticipate significant potential for multiple expansion given its highly profitable business model (+20% ROATCE) with de minimis credit risk.”

Based on that assessment, Feaster has a Strong Buy rating for CCB shares backed by a $57 price target. The implication for investors? Upside of 59% from the current trading price.

Some stocks fly under Wall Street’s radar and CCB appears to be one of those right now; Feaster’s review is the sole one on record. (See CCB stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.