ChargePoint (CHPT) might have been affected by the supply chain snags impacting scores of companies recently, but that didn’t stop it delivering a beat on the top-line in its fiscal second quarter 2023 results.

The company’s revenue haul increased by 93% year-over-year to reach $108.29 million, above consensus at $103.2 million. With demand still outstripping supply, that figure would have been higher but for the supply chain woes.

Networked charging systems revenue reached $84.1 million, a 106% YoY uptick from the $40.9 million delivered during the same period last year, while subscription revenue hit $20.2 million, up by 68% from the $12.1 million generated in F2Q22.

The bottom-line performance, however, was unable to withstand the macro elements; along with the aforementioned issue, higher costs related to stock-based compensation and logistics led to EPS of -$0.28 a $0.04 miss vs. the Street’s call for -$0.24.

Looking ahead, for FQ3, ChargePoint exepcts sales of roughly $130 million, while the company reiterated its target for FY23 revenue between $450-$500 million – the same as the Street had expected.

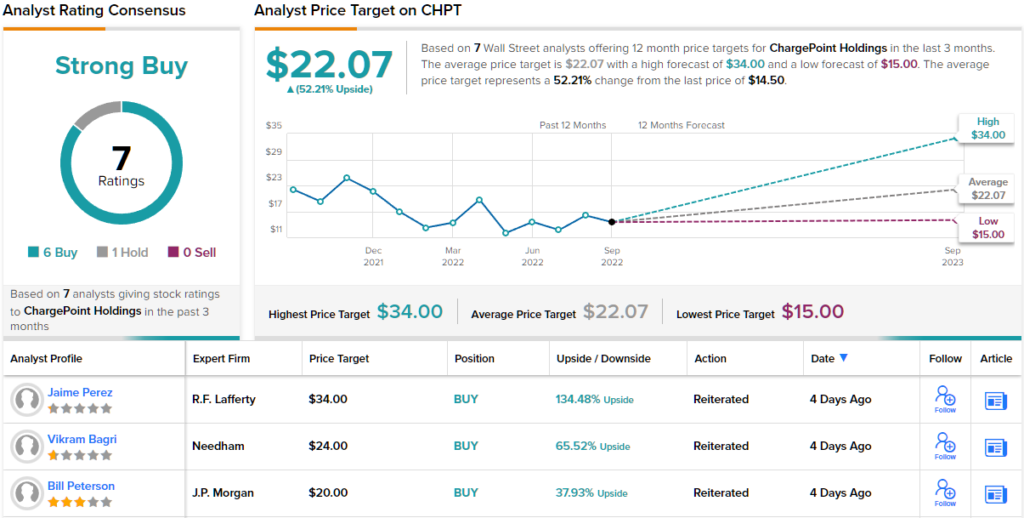

The fact the company stuck to its guidance is not to be sniffed at in the current environment. Even so, Needham’s Vikram Bagri thinks ChargePoint might be playing it safe here.

“We see multiple potential sources of upside to FY23 guidance,” the analyst said. “This includes momentum in return to work policies, which should drive recovery in the commercial segment. In addition, guidance does not reflect a meaningful benefit from infrastructure bill spending this year, which could drive estimates higher. Furthermore, fleet billings could be a source of strength as partnerships represent a ~15mm vehicle opportunity. Finally, conversion of backlog sooner than expected could also be a driver of upside.”

Highlighting the company’s ability to “consistently exceed expectations due to strong execution,” Bagri maintained a Buy rating along with a $24 price target, suggesting shares will climb 65% higher in the year ahead.

Looking at the consensus breakdown, 4 analysts remain on the fence here but 6 others join Bagri in the bull camp, all providing this name with a Moderate Buy consensus rating. The forecast calls for one-year returns of 52%, considering the average price target comes in at $22.07. (See ChargePoint stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.