Centamin (GB:CEY) is a mining company that deals in the exploration and development of gold. It is headquartered in Jersey and has operations in Egypt, Burkina Faso, and Cote d’Ivoire.

The company’s stock has been unstable in the last year, and it had been trading down by 3.3%. The downfall was mainly because the production numbers were hit due to the damage to assets in Burkina Faso.

However, since July, the stock has been in a recovery mode and has gained more than 12% in the last 3 months. The company’s strong performance in the first half of 2022 and production guidance numbers have led to the upward movement in the stock.

Production is back on track

The company witnessed the benefits of its reinvestment programs in its production as well as costs in the first half of 2022. The revenue during this period was $382 million from total gold sales of 2,03,587 ounces. The revenue increased by 4% as compared to the first half of 2021.

Rising costs of $931/ounce remain a concern and will hit the upper end of the cost guidance number. However, the company is taking some initiatives to control costs, and the benefits should be visible in 2023.

One such initiative is the 36MW solar plant, on which production will start in the third quarter of 2022. This will add significant cost benefits for the company.

In the first half, the company also made some significant investments in its Sukari mine in Egypt. Even though it led to more capex during the period, it also helped to push more projects towards completion. In 2022, the Sukari mine’s gold production will touch five million ounces after 13 years of operations.

Centamin has maintained its production guidance between 4,30,000 and 4,60,000 ounces for the full year.

Centamin’s dividends

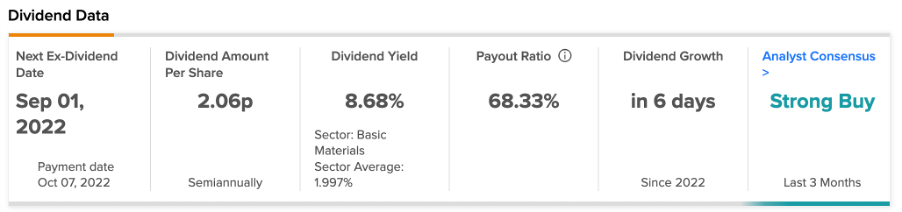

The company announced an interim dividend of $02.5 U.S. cents per share. This will hit the company with a payment of $29 million.

The company’s dividend yield of 8.68% makes it an attractive investment for income investors.

Are Centamin shares a good buy?

According to TipRanks’ analyst rating consensus, Centamin stock is a Strong Buy. The stock has three buy ratings.

The CEY price target isv142.99p, with a high and a low forecast of 189.3p and 109.9p, respectively. The price target implies a change of 54.3% from the current price level.

Conclusion

The company has a clear road of production ahead and the numbers will climb from here. When combined with higher prices of gold, this will cover the costs and boost profitability.

Centamin is backed by gold, which is treated as a safe haven during uncertain times. And, with the higher production numbers and cost savings, the overall story remains bullish.