Caterpillar Inc. (CAT) is a multinational industry leader in the construction of heavy machinery, development of power solutions, and production of locomotives. Specifically, the company is the biggest entity in the world in the heavy equipment playing field, featuring a dominant market share in the field of construction and mining machinery.

The company’s core operations extend over multiple sub-divisions. For convenience, we divide Caterpillar’s businesses into four branches: Construction, Resource, Energy and Transportation, and Financial Services.

The sentiment on Caterpillar’s shares is currently somewhat mixed. On the one hand, the company is well-positioned to enjoy the tailwinds powered by the $1 trillion infrastructure bill passed last November. Since these projects will require tons of heavy machinery, Caterpillar will certainly see a boost in revenues from increased infrastructure spending.

On the other hand, the company’s revenues are heavily determined by the underlying expansion of the economy. With the ongoing macroeconomic and political turmoil shocking the markets, some investors have been speculating that a recession is nearing. In that case, economic growth could pause, resulting in declining CAPEX levels across organizations, hurting Caterpillar’s cash flows.

In my view, Caterpillar is a quality company, and the recent dip in the stock price could be seen as an opportunity for long-term dividend growth investors. However, based on the current market environment, a potential decline in the company’s earnings could result in additional valuation compression. Hence, I am neutral on the stock.

Recent Results

Despite the market’s concerns regarding the company’s future prospects as a result of the ongoing trading environment, Caterpillar’s momentum lasted through Q1. The company reported revenues of $13.6 billion, 14.3% higher compared to last year.

The Construction Industries, Resource Industries, and Energy & Transportation segments recorded growth of 12%, 30%, and 12%, respectively. Increased revenues were mainly powered by loftier sales volumes, which were in turn supported by higher end-user demand for equipment and services. In addition, dealers expanded inventories further during the quarter, positively influencing the company’s top line. Advantageous price realization also contributed to the company’s results.

Nevertheless, the company’s expenses also rose as a result of the ongoing inflationary environment. Particularly, Caterpillar’s operating profit margin came in at 13.7%, compared to 15.3% in the prior-year period. Consequently, net income grew, but at a considerably gentler pace than revenues. Specifically, adjusted earnings-per-share landed at $2.88 against $2.87 in the first quarter of the previous year.

Capital Returns & Valuation

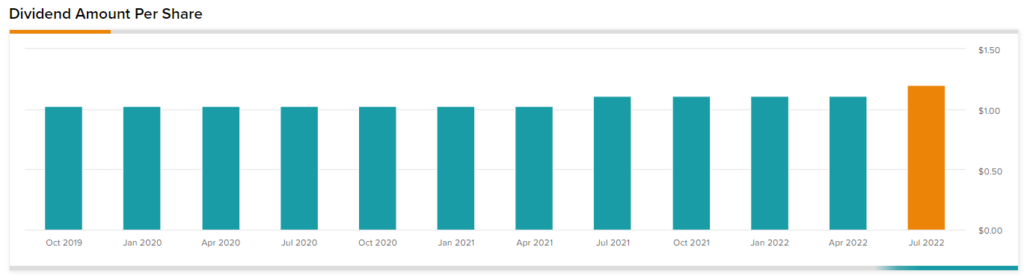

Caterpillar features an extended track record of increasing capital returns. The company has increased its dividend for 28 consecutive years and is thus a constituent of the S&P 500 Dividend Aristocrat Index. Its 10-year dividend per share compound annual growth rate stands at a noteworthy 6.8%. The latest DPS hike took place just a few days ago, with the quarterly rate growing by 8.1% to $1.20. This implies an acceleration compared to dividend growth, and it could signal that Caterpillar’s management appreciates its income-oriented investors during the ongoing inflationary environment.

Additionally, the company has a long history of stock repurchases as well. For context, since 1994, Caterpillar has repurchased and retired around 34% of its shares outstanding. During Q1, it continued returning cash to shareholders through buybacks, repurchasing another $820 million worth of shares.

Despite the company’s cyclical business model, Caterpillar’s dominance in its sphere of operations and consistently increasing capital returns have resulted in investors attaching a somewhat premium multiple on the stock, historically. Consensus estimates point toward the company achieving EPS of $12.44 in fiscal 2022, which means shares are currently attached to a forward P/E of around 14.9. I have mixed feelings about this multiple. It’s a fair one assuming Caterpillar’s earnings are sustained at current levels moving forward and even improve slightly, like in Q1. However, it could be a rich one if revenue growth can’t sustain the ongoing rise in costs, suppressing the company’s margins further. Thus, investors should consider both scenarios before allocating capital to the stock.

Wall Street’s Take

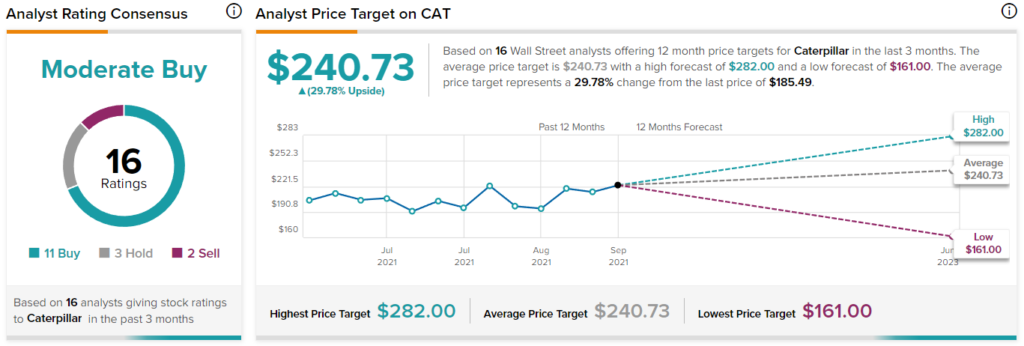

Turning to Wall Street, Caterpillar has a Moderate Buy consensus rating based on 11 Buys, three Holds, and two Sells assigned in the past three months. At $240.73, the average Caterpillar stock forecast implies 29.78% upside potential.

Takeaway

Caterpillar’s investment case is moderately polarizing at this point. There are catalysts that could support the case for revenue growth, but also arguments to be made that supporting the cooling of the economy could result in revenue declines.

The valuation also appears quite attractive from a long-term investor’s point of view, with strong capital returns providing a margin of safety to the current multiple. Shares currently yield 2.44%, while assuming an EPS of $12.44, the payout ratio stands around a healthy 38%. Combined with the acceleration of the latest dividend increase, dividend-growth investors are likely to sustain robust buying volumes on the stock. Then again, the market doesn’t like uncertainty these days, so it’s hard to tell if the ongoing multiple compression will be halted. Accordingly, I am neutral on the stock.

Read full Disclosure