Caterpillar (CAT) stock looks like one of the most compelling value plays on the Dow Jones Industrial Average these days, having fallen 18.7% from its peak hit back in the spring.

Undoubtedly, many investors are less sanguine about the economy, with stagflation fears now taking the place of the “Roaring ’20s.”

Indeed, Caterpillar is one of the cyclical industrials that will be among the first to fall on any modest signs of economic weakness. Given how quickly sentiment has changed, it’s not a mystery to see shares of CAT make the oversold list.

As market jitters pass, though, Caterpillar is a top candidate to come roaring out of the gate, as the bull market resumes. As such, I remain bullish on CAT stock. (See Analysts’ Top Stocks on TipRanks)

Technological Trends

The company not only has incredible tailwinds that remain at its back (increased infrastructure spending in the U.S. and China), but many investors may be discounting the firm’s ability to capitalize on the electrification of heavy-duty machinery.

In addition, Caterpillar is also a stealthy way to play the rise of automation at work sites and mines, or further innovation leading to remote-controlled machinery.

Autonomous Caterpillar technology seems like a long way off. Given the sorts of acquisitions that Caterpillar has been making in recent years, however, it may be closer than many analysts expect.

In the meantime, CAT stock will continue trading like a cyclical, not a tech stock. This could change over time, though. Innovative technology investor Cathie Wood, star of her ARK Capital line of funds, has spotted Caterpillar’s innovative capabilities.

As a result, she’s included Caterpillar, a blue-chip large-cap value stock, within her ARK Autonomous Technology and Robotics ETF (ARKQ).

It’s not just long-term tech-driven tailwinds that make CAT stock an excellent option today. There are many further catalysts that could lift the name out of its steep correction.

Could Rare Megacycle Give Lift to CAT?

Just a week ago, CAT stock put in an apparent bottom, thanks in part to incredibly bullish comments from Cowen’s Matt Elkott. Cowen initiated CAT stock as a Buy with a $241 price target, noting of a “megacycle” that could be underway.

While the cyclicals like CAT tend to be the first to fold ahead of an economic downturn, the reverse is also true in the face of a substantial economic expansion.

Growth in China may be showing signs of slowing down, but this won’t last forever. Once COVID-induced supply shortages are resolved, the world economy could pick up where it left off before the “Roaring ’20s” comments were replaced with “stagflation” or “hyperinflation.”

If Cowen is correct, the upside in CAT stock could be huge, making the name a timely play for near- and long-term investors alike. In the meantime, slowed earnings and missed sales due to global supply chain issues are likely already baked into CAT stock here, making shares a compelling value proposition.

Wall Street’s Take

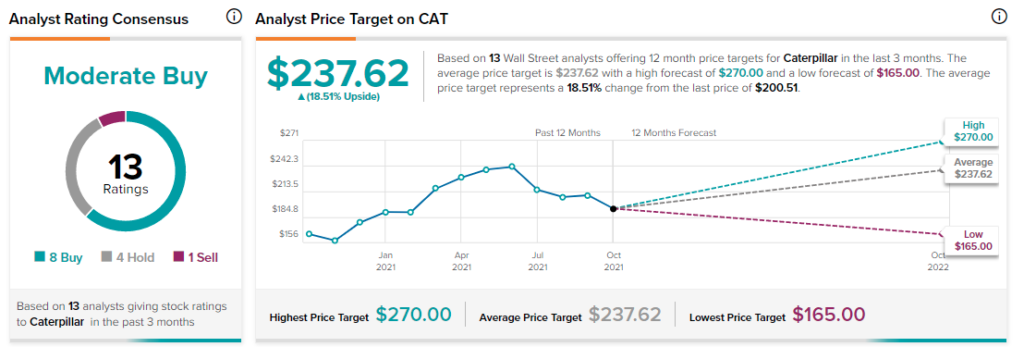

According to TipRanks’ analyst rating consensus, CAT stock comes in as a Buy. Out of 13 analyst ratings, there are eight Buy recommendations, four Hold recommendations, and one Sell recommendation.

The average Caterpillar price target is $237.62. Analyst price targets range from a low of $165 per share, to a high of $270 per share.

Disclosure: Joey Frenette owned shares of Caterpillar at the time of publication.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.