There’s no two ways about it, there wasn’t much to like about CarMax’s (KMX) latest quarterly results. Investors voiced their displeasure, sending shares down by 25% in the subsequent session as the company failed to meet expectations on both the top-and bottom-line in fiscal 2023’s second quarter.

The auto retailer delivered revenue of $8.14 billion, amounting to a 1.9% year-over-year increase yet missing the consensus estimate by $410 million.

EPS clocked in at $0.79, declining from $1.72 in the same period a year ago and some distance below Street expectations of $1.39. Used car unit comps declined by 8.3%, also missing the analysts’ forecast for a low- to mid-single digit drop.

Buying activity this year has been impacted by the inflationary environment, with consumers evidently unwilling to pay for increasingly high car prices. This is a point picked up by Oppenheimer’s Brian Nagel who believes the recent trends suggest the company “continues to fall victim to a more challenged macro backdrop and particularly to still elevated prices for used cars.”

That said, the 5-star analyst thinks the company has been making the right moves and believes the company’s fortunes will change once the macro environment gets friendlier.

“As we have discussed, over the past several years, KMX has invested aggressively to develop well its omni-channel offering,” Nagel reminded investors. “We remain decidedly confident that a now much more all-encompassing consumer offering will serve KMX very well, as cyclical macro challenges subside… We recommend longer-term oriented investors use weakness in KMX shares as a buying opportunity.”

Load up, then, appears to be Nagel’s message; as such, the analyst reiterated an Outperform (i.e. Buy) rating along with a $125 price target. Following the shares’ decimation, there’s now potential upside of 88% from current levels. (To watch Nagel’s track record, click here)

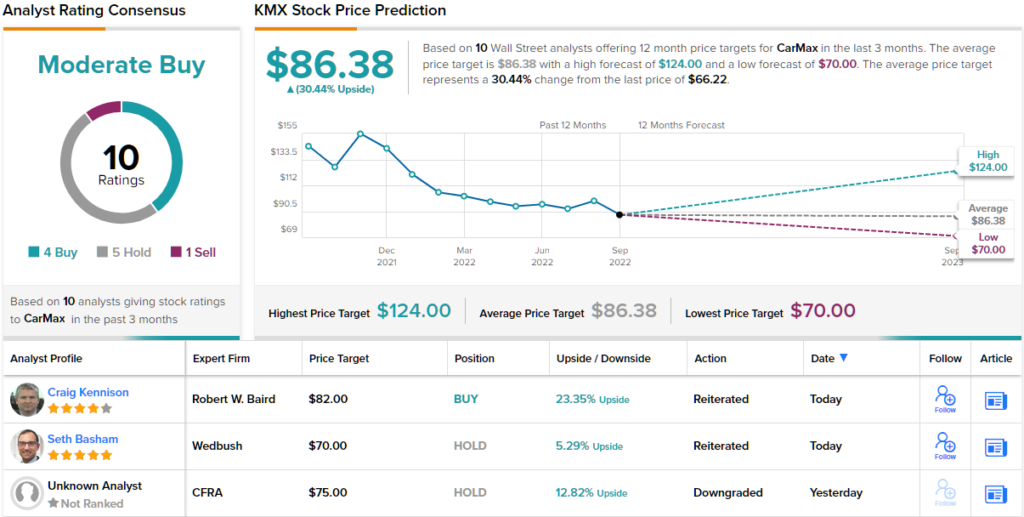

And what about the rest of the Street? The view is rather mixed; based on 4 Buys and Holds, each, plus 1 Sell, the stock ekes out a Moderate Buy consensus rating. Going by the $86.38 average target, the shares are expected to be changing hands for a 30% premium a year from now. (See CarMax stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.