CarGurus, Inc. (CARG) is an online auto marketplace for buying and selling used and new cars with a presence both in the U.S. and International markets. Since the easing of the pandemic in 2021, the company has consistently outperformed expectations throughout all quarters.

CARG stock has gained 48.7% over the past year vis-à-vis gaining just 7.3% year-to-date. However, after CarGurus announced its fourth-quarter results on February 24, which significantly outperformed estimates, the stock has gained about 16.4%.

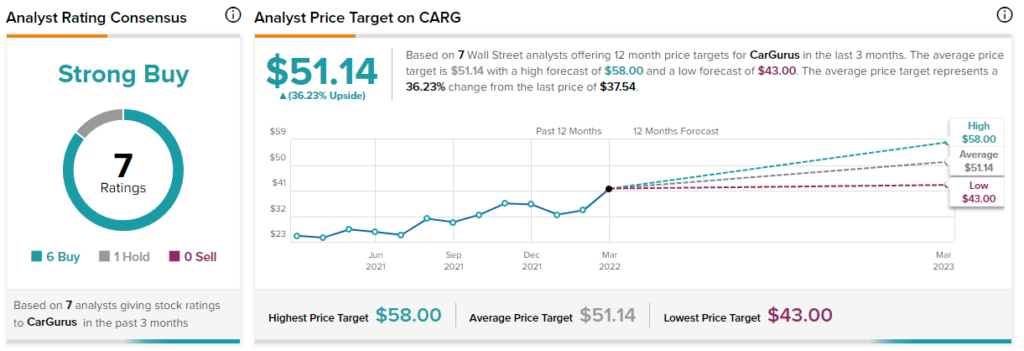

Remarkably, the stock closed down 9% at $37.54 yesterday amid the broader market sell-off of an interest rate hike at the Fed meeting scheduled for Wednesday, March, 16.

After attending the 2022 National Automobile Dealers Asssociation (NADA) Conference in Las Vegas held between March 10 and 13, Needham analyst Chris Pierce updated his model estimates for CARG and reiterated his Buy rating on the stock. The analyst has a price target of $52 on CARG, which implies 38.5% upside potential to current levels.

Pierce has increased his FY23 revenue estimates based on higher Product revenue, while the adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) estimate remains conservative and below consensus. The analyst’s $52 price target for CARG is based on an Enterprise Value/adj. EBITDA multiple of 20x his FY23 estimate.

Commenting on his valuation, Pierce said, “We think investors should look to ’23, given that CARG’s stress-tested subscription model drives the bulk of adj EBITDA. Our new, estimated adj EBITDA CAGR of 18% through ’26 easily supports a 20x multiple.”

Let’s analyze CarGurus’ latest financial results vis-à-vis the analyst’s view on the stock.

Q4 and FY2021 Financials

In Q4, CARG’s revenue jumped 124% year-over-year to $339.34 million and meaningfully outpaced Street estimates of $279.89 million.

Similarly, non-GAAP earnings for the quarter stood at $0.43 per share, 13 cents higher than analyst estimates of $0.30 per share. The number even came in higher than the year-ago period’s figure of $0.32 per share.

For the full year fiscal 2021, CarGurus revenue advanced 73% annually to $951.4 million and non-GAAP earnings of $1.58 per share grew 47.7% over the FY20 figure of $1.07 per share.

Moreover, the company’s adjusted EBITDA for FY21 of $249.5 million increased 55% over FY20.

Key Performance Metrics

At year-end, CarGurus’ total paying dealers of 30,630 decreased by one dealer compared to FY20’s number of 30,631. On December 31, 2021, both US and International total paying dealers stood at 23,860 and 6,770, respectively.

In the longer term, Pierce expects CARG’s U.S.-paying dealers to be around 27,500, well below its all-time high of 28,400 numbers registered in Q2FY19.

Likewise, at year-end, CARG’s Quarterly Average Revenue per Subscribing Dealer (QARSD) in the U.S. improved 6% year-over-year to $5,633, and QARSD in the International segment improved 46% to $1,546.

Pierce forecasts U.S. QARSD of $6,537 per dealer in FY26, implying a growth of 16% compared to Q4FY21 and representing a six-year compound annual growth rate (CAGR) of 2.5% through FY26.

Notably, CarGurus another important metric, average a monthly unique users declined in both the segments in Q4FY21 compared to the prior-year period. The company defines monthly unique user as an individual who has visited any such website within a calendar month, based on data as measured by Google Analytics.

CarGurus’ U.S. average monthly unique users fell 15% to 28.6 million and International average monthly unique users declined 4% to 6.9 million.

For FY26, the analyst forecasts CARG’s U.S. monthly unique users to increase by 30% over Q4FY21 to 37.1 million.

Q1FY22 Outlook

Based on current business momentum, CarGurus forecasts Q1 revenue to fall in the range of $390 million to $410 million, much higher compared to the consensus estimate of $302.22 million.

Additionally, non-GAAP earnings are projected in the range of $0.31 per share to $0.33 per share, in line with the consensus estimate of $0.33 per share.

However, analyst Pierce projects very optimistic figures for Q1FY22 compared to both the company and consensus estimates. His estimate of revenue is $398 million, adjusted EBITDA is $48 million, and non-GAAP earnings are $0.33 per share.

Conclusion

CarGurus’ future growth potential is based on the performance of three verticals, namely the acquisition of CarOffer, CarGurus Instant Max Cash Offer (IMCO), and lastly, its accelerated transition to digital capabilities.

Analyst Pierce views CarOffer as a forerunner in the dealer community, driving higher revenues through “new conversions and higher retention, and adopt a positive view towards a fully digital CARG solution, given its traffic share in the U.S.”

For CarGurus IMCO, dealers at the NADA conference were not well aware of the product, but the analyst expects the awareness to improve post the event.

And finally, about CARG’s digital transformation the analyst said, “Recent management changes and additions point to CARG embracing a shift to digital, and given investor enthusiasm for other companies leading the industry transformation we think CARG’s multiple can expand as it shifts from primarily operating a lead-gen model to a fuller product suite helping dealers source buyers, transact digitally, and source and move lot inventory digitally.”

Other analysts on the Street are also bullish on the CARG stock with a Strong Buy consensus rating based on six Buys and one Hold. The average CarGurus stock prediction of $51.14 implies 36.2% upside potential to current levels, at the time of writing.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure