Canadian Pacific (CP) is a railroad company that operates in Canada and in the U.S. We are neutral on the stock.

Canadian Pacific: Growth Catalysts

The railroad industry has been around for over 200 years. With most investors and entrepreneurs choosing to focus on new technologies and innovations, railways often get overlooked because they are classified as yesterday’s technology.

However, railways are still critical infrastructures that are necessary for transporting goods. Canadian Pacific is one of the main players in North America, a very large swath of land.

In fact, it operates in a duopoly in Canada alongside the larger Canadian National Railway (CNI). For a competitor to replicate CP’s railway network, it would cost billions of dollars and take up a lot of time.

It is for this reason that new competitors aren’t springing up to challenge the established giants, and why CP is willing to spend over $30 billion to acquire competitor Kansas City Southern instead of building its own new tracks.

The acquisition will create the first railroad company with a railroad network that connects Canada, the U.S., and Mexico. Management expects the combined company to generate synergies of $1 billion, although these synergies might take a few years to be realized.

In the short term, growth in 2022 is expected to be driven by potash, fertilizer, sulfur, strong demand for steel, and easing supply chains. In addition, because railways are essential for the economy, CP should be minimally impacted by inflation.

This is because it likely has the pricing power to pass on increased costs to customers who have very few alternatives for transporting goods.

Risks

As great as the potential for the Kansas City Southern acquisition is, it came at a hefty price tag. CP paid $31 billion for a company that generated $527 million in net income and $439 million in free cash flow for Fiscal Year 2021.

Like any acquisition, there is always the risk that the expected synergies don’t work out as intended. When this scenario is combined with a very large price tag, shareholder value can be destroyed.

This is especially true since CP has issued a total of $6.6 billion and C$2.2 billion denominated debt for Kansas City Southern. CP’s total debt load has now ballooned from $7.9 billion to $16.1 billion.

This will also impact the company’s dividend growth and stock buybacks. Management has stated that buybacks and dividend growth will be paused while CP pays down the acquisition debt over the next 24 months. This is definitely not ideal for income-seeking investors.

However, there are other risks associated with the firm. According to Tipranks’ Risk Analysis, Canadian Pacific disclosed 20 risks in its most recent earnings report. The highest amount of risk came from the Macro & Political category.

Wall Street’s Take

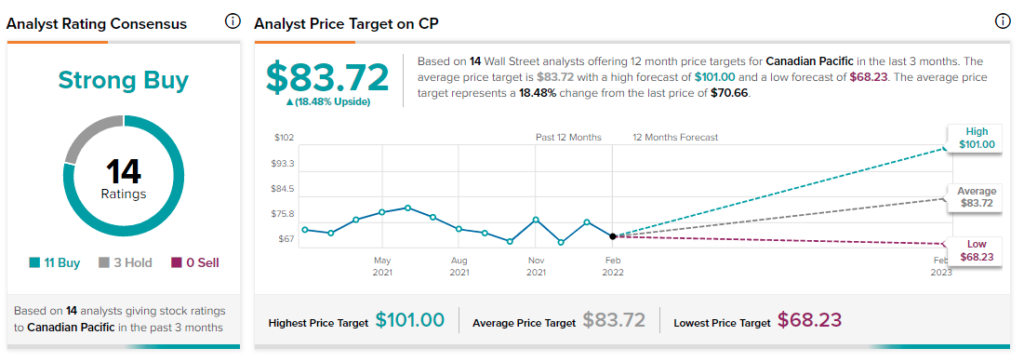

Turning to Wall Street, Canadian Pacific has a Strong Buy consensus rating based on 11 Buys and three Holds assigned in the past three months. The average Canadian Pacific price target of $83.72 implies 18.5% upside potential.

Analyst price targets range from a low of $68.23 per share to a high of $101 per share.

Final Thoughts

Canadian Pacific is an essential business with high barriers to entry that the economy relies on. In addition, its KCS acquisition will make it the only railroad company in North America with a railway network that connects Canada, U.S., and Mexico.

However, we remain neutral because the price tag of $31 billion seems pretty high at the moment, and integration risks are always present when combining companies.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure