Shares of Canada Goose (NYSE:GOOS) are currently trading at a depressed valuation, opening the possibility of the company becoming an acquisition target. The Toronto-based luxury apparel company, known for its high-quality parkas, is currently trading at a valuation that is notably lower than that of its industry peers. With the luxury fashion industry experiencing consolidation, Canada Goose gaining attention from potential acquirers becomes increasingly plausible. Thus, I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Unpacking Why Canada Goose Could be an Acquisition Target

To gain a deeper understanding of why Canada Goose is poised to emerge as an appealing acquisition target, we have to talk about the factors that make the stock attractively priced. They can be broken down into Canada Goose’s ongoing financial performance and anticipated future results, which we will contextualize against the valuations of its counterparts within the industry.

1. Recent Results – Strong Sales Growth

In its most recent Q1 results for Fiscal 2023, Canada Goose posted revenues of C$84.8 million, implying a 21.3% increase year-over-year. Impressively, the company’s growth held up pretty well compared to last year’s growth of 24.2%. This is despite growing concerns over the luxury industry slowing down following a crazy post-pandemic spending spree.

The company’s growth was driven by a larger store count, stronger same-store sales, and high DTC (direct-to-consumer) growth, including higher online sales. Specifically, the company ended the quarter with 54 permanent stores compared to 43 at the end of the prior-year period.

North America contributed significantly to the top line’s expansion, with revenues growing by 31.3% in Canada and by 15.3% in the U.S. Canada Goose’s growth in Asia Pacific was even more impressive, with revenues surging by 52.2%, as the company’s brand gained traction among consumers, particularly in China.

2. Management’s Fiscal 2024 Guidance

According to management’s guidance, the company is poised to maintain its robust revenue growth trajectory in the near future, and this growth is expected to be driven by two primary catalysts. Firstly, there are plans to open 16 new retail stores, all of which should be open and running during the latter half of the year. Secondly, the company expects a surge in DTC sales, including a notable increase in same-store sales, with projections reaching the mid-to-high 70s as a percentage of the total revenue.

With these compelling factors in mind, the company’s management is optimistic about its revenue prospects for Fiscal Year 2024, estimating a range between C$1.4 billion and C$1.5 billion in total revenue, including a second-quarter projection of C$270 million to C$290 million. At the midpoint of this range, the company anticipates a remarkable year-over-year sales growth rate of 19.1%, a significant uptick compared to its five-year average of 15.5%.

3. Undervaluation Versus Peers Creates Acquisition Opportunity

Now that we’ve taken a brief look at the company’s growth and ongoing momentum, we can go on to see why Canada Goose’s undervaluation versus its industry peers could create an acquisition opportunity.

Looking at the company’s current rate of expansion and future projections, as well as its underlying brand value, Canada Goose appears severely undervalued. Essentially, we can see that based on management’s guidance, Wall Street expects the company to post EPS of C$1.24 for Fiscal 2024, implying a forward P/E ratio of 15.5.

For context, luxury giants LVMH Moët Hennessy Louis Vuitton (FR:MC) and Hermes International (FR:RMS) trade at forward P/Es of 21.5 and 45.8, respectively. Of course, their unparalleled moat in the luxury industry warrants a premium valuation. Still, these multiples also highlight Canada Goose’s way-below-average valuation, which is even more exposed when taking into account the company’s above-average growth metrics.

If we take a long-term point of view, we can see that the company’s adjusted EBIT (earnings before interest and taxes) margin is expected to reach 30% by 2028 based on the company’s latest Investor Day presentation. This margin is expected to be on projected sales of C$3 billion, implying an EBIT of C$900 million that year.

Given that the company’s market cap is currently C$2.05 billion, shares are trading at just 2.3x its expected EBIT four years down the road. Yes, this is quite far out, but it highlights the stock’s undervaluation on a long-term basis as well.

Based on this argument, I can easily see one of the luxury giants scooping up Canada Goose at a discount. This is not uncommon in the industry. Almost three years ago, LVMH acquired the then publically-traded Tiffany & Co. on the cheap. Now, Tapestry (NYSE:TAP) is poised to buy Capri Holdings (NYSE:CPRI), the powerhouse behind Michael Kors, Versace, and Jimmy Choo, which has also been trading at a significant markdown.

Is GOOS Stock a Buy, According to Analysts?

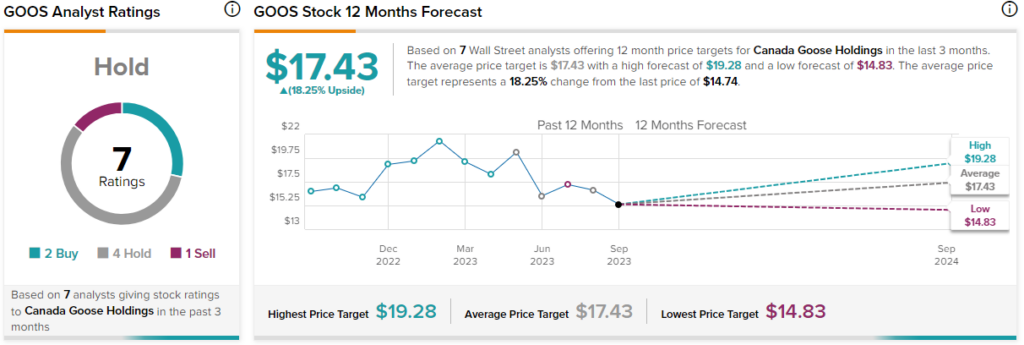

As far as Wall Street’s view on the stock goes, Canada Goose features a Hold consensus rating based on two Buys, four Holds, and one Sell recommendation assigned in the past three months. At $17.43, the average Canada Goose stock price target suggests 18.3% upside potential.

Conclusion

In conclusion, Canada Goose’s undervalued stock presents a compelling case for a potential acquisition. Its consistent sales growth, expansion plans, and strong guidance for Fiscal Year 2024 indicate a bright future. However, it’s the stark undervaluation relative to industry peers and long-term potential that makes it an attractive target for luxury giants.

As history has shown in the industry, acquisitions at a discount are not uncommon. Thus, Canada Goose’s current valuation may indeed draw the attention of a larger player seeking to capitalize on its growth story.