Whitehaven Coal (ASX:WHC) shares have been an investor favourite amid the volatile market; surging more than 320% year-to-date. Even after this phenomenal growth, the majority of analysts still think Whitehaven’s stock has more room to run, according to TipRanks insights.

The Australian coal producer has seen increased demand and prices for the commodity, as the energy crisis in Europe forced countries to restart their coal-fired plants to meet electricity needs.

Whitehaven has used these gains to reward investors, with the stock offering a strong dividend yield of 5.2%, compared to the sector average of 2.2%.

Floods dampened Whitehaven’s flame

Flooding in New South Wales dealt Whitehaven a blow in the September quarter, and saw its share price retreat as a result. The company’s production dropped, as floods impacted the Maules Creek mine.

The company still hopes to meet its FY23 production target as it expects a number of other mines to exceed output estimates. Moreover, Whitehaven hopes to continue to enjoy strong coal prices for the rest of the fiscal year.

Most analysts positive on Whitehaven’s outlook

Despite Whitehaven reporting a steep decline in its September quarter production, Credit Suisse analyst Alex Ren on Thursday reiterated a Buy rating on the stock. Ren is a 5-star analyst whose recommendations have been profitable 88% of the time, delivering average returns of 90% per transaction.

Macquarie analyst Hayden Bairstow, Morgan Stanley analyst Rahul Anand, and Ord Minnett analyst Dylan Kelly also joined Ren in reaffirming Buy ratings on Whitehaven.

However, Citigroup analyst Paul McTaggart bucked the trend, maintaining a Sell rating on Whitehaven shares. McTaggart’s overall recommendations have been profitable 48% of the time, delivering average returns of 12%.

Whitehaven share price target

According to TipRanks’ analyst rating consensus, Whitehaven stock is a Moderate Buy based on seven Buys, one Hold, and one Sell.

The average Whitehaven share price target of AU$9.45 implies over 5% downside potential.

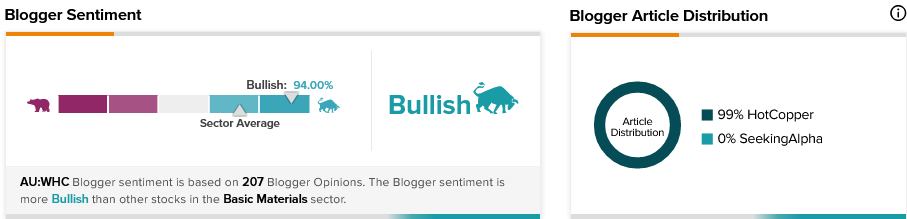

Whitehaven stock is receiving positive mentions on financial blogs. TipRanks data shows that financial blogger opinions are 94% Bullish on Whitehaven, compared to a sector average of 72%.