“Tesla (TSLA) is overvalued” phrase is one used in abundance and when looking at the company from several angles, Morgan Stanley’s Adam Jonas thinks that it might be apt.

“There are clear areas where we wish market expectations would be lowered,” says the analyst. Which ones, then? Well, given input cost inflation, auto margin expectations are “too high,” and the market is also too optimistic on FSD (full-self driving) with Jonas believing L4/L5 autonomy at scale is “well over a decade away.” And don’t bank on China, either, as the future there is “highly uncertain.”

That said, there are other less lauded aspects of Tesla that demand greater attention. It is the part Tesla is expected to play in “building-out” the US and West Europe’s renewable energy infrastructure, that is “underappreciated,” and what investors should really be taking notice of is Tesla’s “leadership in the Mother of All Capex Cycles (the MACC).”

The world might be currently gripped both by inflation and war, but looking at the bright side of these macro negatives, Jonas thinks the result will be “energy innovation.”

“The lack of energy supply (both structural and idiosyncratic, renewable and fossil) ranks high amongst global challenges,” says Jonas and what the global renewable energy infrastructure and supply chain needs is a complete overhaul; through 2040, this will call for as much as 20 to 40 TWh of battery capacity and $10 to $20 trillion of “accumulated capex spend.”

And portfolios with names “exposed to this capex cycle can drive powerful alpha.”

As such, while the upside for Tesla based on other verticals might be capped, there is another opportunity.

“We think attributes like AI, autonomous and EV are fully if not over-appreciated here,” opined the 5-star analyst. “In fact, we believe Tesla’s more ‘gritty’ capabilities in terms of manufacturing, material sourcing, supply chain and infrastructure will drive the next leg of growth to the story. Tesla’s prowess as a tech company is known. Enter the industrial powerhouse?”

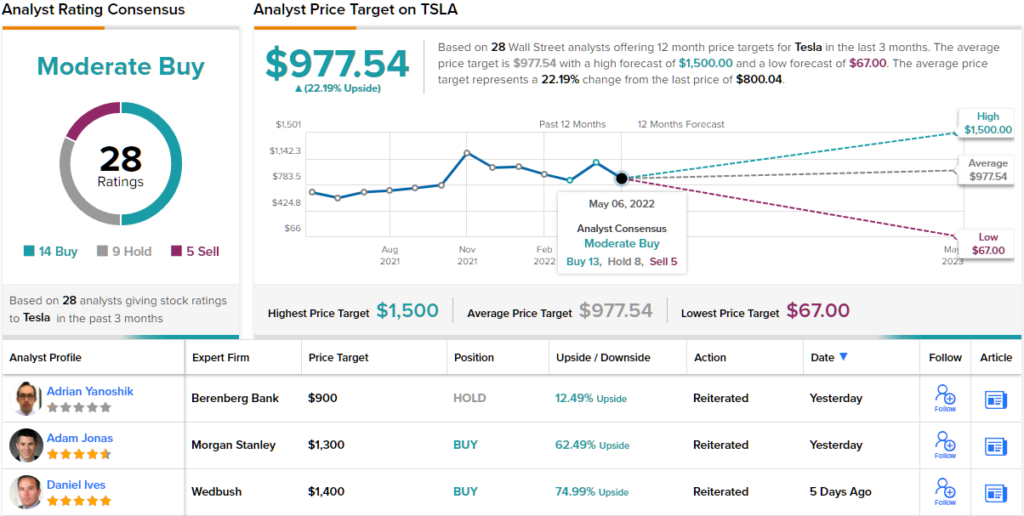

To this end, Jonas reiterated an Overweight (i.e., Buy) rating backed by a $1,300 price target. Should the figure be met, investors are looking at upside of 62%. (To watch Jonas’ track record, click here)

Tesla elicits a wide spectrum of opinions and that is reflected by the current Street ratings. With 14 Buys, 8 Holds and 5 Sells, the analyst consensus rates this stock a Moderate Buy. The average price target currently stands at $977.54, implying shares will climb 22% higher in the year ahead. (See Tesla stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.