Investors of GPU leader Nvidia (NVDA) are enjoying a stellar 2020. Shares have skyrocketed nearly 50%, riding on the COVID-19 driven macro environment, which has sent people to work/learn/play from home and make use of Nvidia’s core premises – gaming and data center. The stock has easily outperformed its sector (the SOXX – down 3% year-to-date) and the broader market. So, ahead of Thursday’s anticipated earnings, Street expectations are high for Nvidia to build on the previous report’s strong sales growth.

Can the company live up to expectations? 5-star Oppenheimer analyst Rick Schafer says ‘yes.’ Schafer expects the data center division to post a strong Q1, and exhibit growth of 10% quarter-over-quarter and 70% year-over-year – the uptick on account of “increased cloud/hyperscaler spend driven by WFH/LFH trends.” Gaming is the other segment to make hay of the WFH trend, although Schafer expects “seasonal weakness in F1Q followed by 2H inflection.”

Looking ahead, secular trends are on Nvidia’s side again, with ray-tracing content on the rise and hitting “critical mass,” Nvidia should benefit from the expected launch of the 7nm gaming GPU late this year. The “increased performance/RTX content should drive above-average CY20 gaming cycle,” Schafer noted.

The analyst concluded, “NVDA trades 35x (ex-cash) our new CY21E EPS, in line w/ its 3-year historical trading range. Robust 1H DC spend appears on track to continue into 2H. Gaming positioned for refresh led by increased content/ performance. Net, structural growth drivers appear intact, and we remain buyers.” (To watch Schafer’s track record, click here)

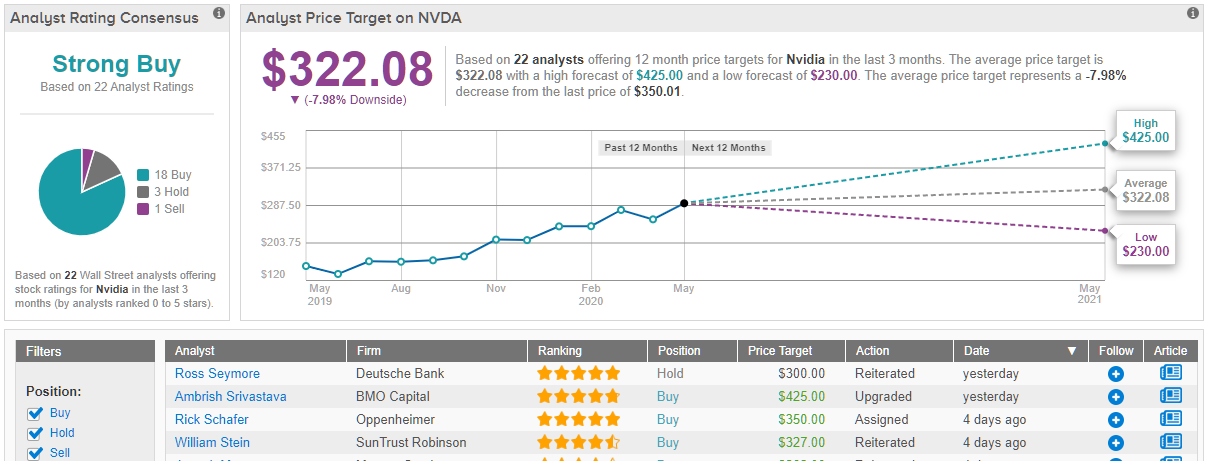

With a background like that, it’s no wonder that the gaming chip giant has attracted rave reviews from the analysts. Nvidia’s analyst consensus rating is a Strong Buy, with 18 analysts giving it the thumbs up in the last three months. Interestingly, though, the average price target of $322.08 indicates possible downside of 8%. As Nvidia stock has surged so far ahead over the past few months, expect the analysts to readjust models shortly. (See Nvidia stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.