Shares of Nike (NYSE: NKE) are down 32.2% year-to-date due to adverse macro conditions. In late June, the athletic apparel and footwear giant posted better-than-expected results for the fourth quarter of FY22 (ended May 31, 2022). However, investors and Wall Street community seem to be concerned about the impact of soaring inflation, supply chain woes, and an impending recession on Nike and other consumer discretionary companies.

Nike Faces Near-Term Challenges

Nike’s Q4 FY22 results exceeded analysts’ expectations, but both revenue and earnings were down year-over-year. Revenue declined 1% to $12.2 billion, and earnings per share (EPS) fell 3.2% to $0.90. Revenue from North America, Nike’s largest market, declined 5% due to a high inflationary environment. Furthermore, Nike’s revenue from China fell 19% due to COVID-led lockdowns.

Coming to guidance, Nike expects Q1 FY23 revenue to range from flat to slightly increased. The company’s outlook reflects COVID-19 disruption in China and the impact of currency headwinds. Nike expects its full-year revenue to grow in the low-double-digits on a currency-neutral basis. Near-term profitability will likely be under pressure due to higher ocean freight costs, a rise in input costs, increased markdowns, and supply chain investments.

However, Nike continues to be optimistic about its long-term strategy and growth potential due to multiple structural tailwinds, including the “expanded definition of sport,” growing focus on health and wellness as well as comfort, and the shift toward digital channels.

Wall Street is Cautiously Optimistic

Following the recent results, Guggenheim analyst Robert Drbul reduced his full-year EPS estimate for Nike. Drbul acknowledges that Nike is not immune from the challenges triggered by the pandemic, logistics pressures, and geopolitical tensions.

That said, Drbul believes that many of these headwinds are transitory. Drbul lowered his price target for Nike stock to $155 from $160, but maintained a Buy rating as he believes that the ongoing uncertainty provides a buying opportunity.

Recently, Stifel analyst Jim Duffy lowered his price target on Nike stock to $130 from $135, but maintained a Buy rating. Duffy slashed his estimates for almost all Americas Sports and Lifestyle Brands companies in his coverage to reflect increased inventories, reduced traffic, and early promotions.

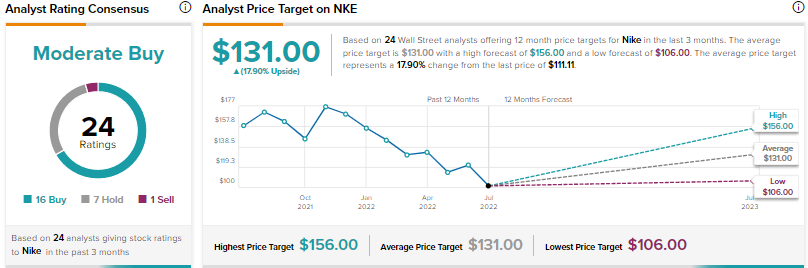

Overall, the Street is cautiously optimistic on Nike stock, with a Moderate Buy consensus rating based on 16 Buys, seven Holds, and one Sell. The average Nike price target of $131 implies 17.9% upside potential from current levels.

Conclusion

Several analysts continue to believe in Nike’s long-term growth potential, which is supported by the company’s strong brand power, continued innovation, and focus on direct-to-consumer business.

However, many analysts are cautious due to a possible slowdown in consumer spending on discretionary products amid high inflation and a looming recession.

In a positive turn, as per TipRanks Smart Score System, Nike scores a nine out of 10, indicating that the stock is likely to outperform the broader market.