Shares of video-streaming firm Netflix (NFLX) have been dealt a devastating blow. Many investors have given up on the SVOD (streaming video on demand) market, with many rivals also falling in sympathy with the streaming pioneer. It’s been two brutal quarters in a row, and there’s a bit of fear heading into the second quarter.

At this juncture, it seems like many expect recent subscriber losses could mark the start of a trend. Indeed, inflation’s impact on the average consumer has not helped the cause, and if a recession becomes a self-fulfilling prophecy, it’s hard to judge just how much Netflix stock ought to be worth at this juncture.

One thing is clear; the company isn’t the same innovator it was during the 2008 recession, making a full recovery from this 76% peak-to-trough plunge harder to come by. Further, there are so many rivals in the space that the economic profits will likely diminish further. That’s the danger of not having a moat. Arguably, rivals like Disney (DIS) have demolished the moat, with deep-pocketed firms ready to move in and steal Netflix’s lunch.

Though Netflix is in hot water, I still believe there’s a lot of growth to be had in video streaming. It’s less about technology and algorithms these days and more about content. High-quality exclusive content will triumph, and firms reluctant to spend could be on the receiving end.

In any case, streaming is evolving into what television was over two decades ago. It’s still a profitable place to be in. It’s just harder to leverage technologies to build a moat source. Companies like Amazon (AMZN), who’ve thrown in their streaming services alongside a broader bundle, could make it harder to thrive in streaming.

It almost seems like a waste to pay for Netflix when you’re already a Prime user and can stream Prime Video content for free. As we move into a recession, many consumers will realize this as they look for subscriptions to remove from their monthly budgets. Unfortunately for Netflix, just keeping the content wheel spinning is not enough to bring back the multiple the stock sported before 2022 took a big bite out of its value.

Still, CEO Reed Hastings is a remarkable leader, and he’ll be sure to explore new growth levers to bring his firm back to the top. Though Netflix’s post-streaming growth plans are hazy, I remain bullish on NFLX stock at these valuations. The stock goes for 16.7 times trailing earnings, making it cheaper than most so-called value stocks.

Yes, Netflix’s best days may be behind it, but there are new frontiers it can explore. From the metaverse to video games, Netflix could find itself becoming more of an entertainment powerhouse and less of a video streamer.

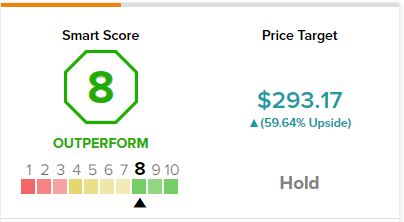

Also worth noting, on TipRanks, NFLX receives a Smart Score rating of 8 out of 10, indicating a high potential for the stock to outperform the broader market.

Netflix Rumored to Acquire Roku

An acquisition is likely the best way forward as Netflix looks to make it through the recent slate of headwinds. In a prior piece, I stated that it’d be a good idea if Hastings were to acquire a large video-game firm to accelerate its gaming efforts.

While such a deal may still be on the table amid the consolidation of gaming companies, rumors of a Roku (ROKU) deal have hogged the headlines of late. Could Netflix want to scoop up the streaming-stick maker that’s just dipped a toe into the content-creation waters? I’d argue that the deal doesn’t make much sense. Analysts have dismissed a Roku-Netflix tie-up as “hard to understand” or even “absurd.” I agree with these skeptical analysts.

Roku stock, which has lost more than 80% of its value from peak levels, is in a world of pain. The $11.3 billion media device maker looks like it’d be a digestible deal for Netflix.

As Netflix looks to innovate to grow again, why would it want exposure to streaming hardware, which is in a decline of its own? Roku is in a commoditized market, and it may not be the best use of funds for Netflix, which needs every dollar to be invested wisely, if not on content, on forward-thinking projects that can help boost growth, not fuel its deceleration.

Personally, I think rumors of Netflix buying Roku will not result in anything official. The initial pop in Roku stock is about as far as it goes, in my opinion.

Wall Street’s Take

Turning to Wall Street, NFLX stock comes in as a Hold. Out of 40 analyst ratings, there are nine Buy recommendations, 27 Hold recommendations, and four Sell recommendations.

The average Netflix price target is $293.17, implying upside potential of 59.9%. Analyst price targets range from a low of $186 per share to a high of $405 per share.

The Bottom Line on Netflix Stock

Netflix needs to prove it’s a worthy member of FAANG. With that, the company needs to evolve as its primary market matures. FAANG companies have a knack for adapting and resisting the growth-waning effects of corporate aging. For now, Netflix is a worthy FAANG member, and I think it will get past these tough times en route to seeing new highs again.

Netflix can acquire its way to a new market, but I’d argue a gaming firm makes more sense than a hardware maker and streaming lightweight like Roku.