monday.com (MNDY) shares closed 24.5% higher on Tuesday, August 17, after the company announced impressive second-quarter earnings results, and rose 16.7% further at market close the following day.

A 94% increase in revenues and narrower-than-expected diluted loss per share, both compared year-over-year, were the highlights of the quarter. Strong adoption of this Work OS (operating system) was a top-line tailwind.

Moreover, a very optimistic outlook for the third quarter as well as full-year 2021 gave investors another reason to celebrate. For revenues, monday.com projects 74% to 76% year-over-year growth in the third quarter, and a 74%-75% year-over-year growth for the full year of 2021.

monday.com’s open platform enables organizations to easily build customized work management tools. The second-quarter earnings release was its first after going public in June this year. (See monday.com stock charts on TipRanks)

It seems like monday.com has really done its homework to strengthen its foundation before going public. For the past two years, the company has been focused on heavily investing in its direct sales engine to boost its upmarket movement. These efforts are reflected in the quarter under review.

Notably, monday.com’s upmarket move witnessed strong traction, as total customers with more than $50,000 annual recurring revenue (ARR) continued to increase throughout the second quarter. monday.com’s robust go-to-market offering, which provides a self-service funnel as well as a direct sales engine, was the primary driver of the company’s upmarket acceleration.

monday.com is expected to continue investing heavily in growth initiatives, particularly around Sales and Marketing, and Research and Development. Interestingly, as evident from the balance sheet, the company is in a net-cash position, which situates monday.com comfortably to pursue growth initiatives and investments.

Needham analysts, led by Scott Berg, recently evaluated monday.com’s second quarter results, and assigned a Buy rating on the stock. The price target was also increased to $350 from $265 on optimism regarding a higher than expected near-term revenue growth outlook. Revenue growth is expected to drive the valuation multiple higher, making the stock more expensive pretty soon.

Berg believes that the company’s new offerings, workdocs and freemium, are expected to be key growth drivers. Notably, workdocs expands the platform’s document collaboration capabilities, while freemium provides free access to the platform for up to two seats.

“We believe both of these enhancements will expand the top off the funnel by providing new entry points for customers. With workdocs specifically, this is another example of the Monday’s focus on platform innovation which is helping drive deeper adoption and stickiness of the software across its customers,” said Berg.

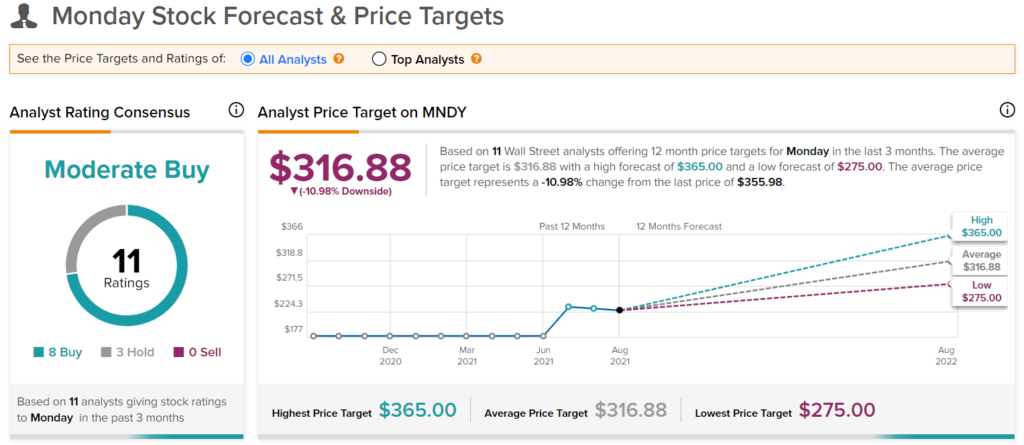

The Wall Street consensus, however, is cautiously optimistic about monday.com, with a Moderate Buy based on 8 Buys and 3 Holds. The average monday.com price target of $316.88 implies 11% downside potential from current levels over the next 12 months.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.