Delta Airlines (DAL) will publish its first-quarter 2022 results before the market opens today.

The company announced solid fourth-quarter results, with both the top and bottom lines outperforming expectations. The company earned $0.22 per share, considerably better than analyst projections of $0.14 per share, while sales of $9.47 billion were also higher than the Street’s estimate of $9.21 billion.

Beginning in 2022, the global airline has seen a revival in demand due to a rebound in leisure and corporate travel. However, the Omicron variant, personnel concerns, and the jump in oil costs precipitated by the Russia-Ukraine situation may have had a negative impact on the first quarter to some extent.

Website Trends Are Hopeful

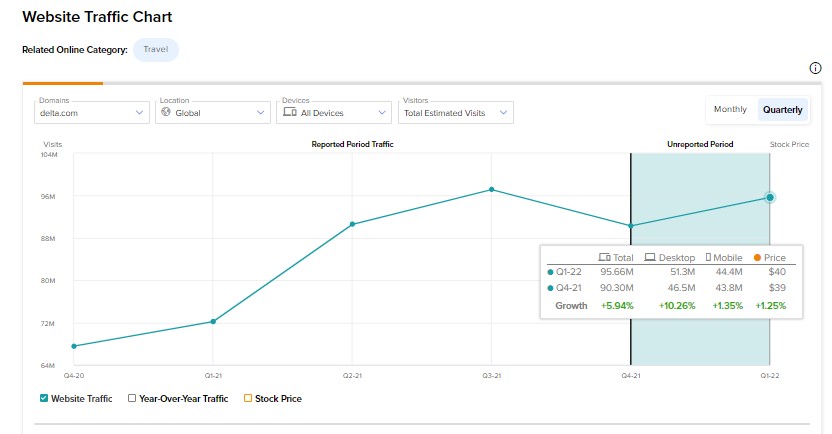

To gain a better understanding of the company’s performance ahead of the fiscal Q1 print, we used TipRanks’ new online tool to track user visits to its website. Surprisingly, the tool revealed positive patterns on the website, which may be reassuring to investors.

In Q1, we discovered that overall anticipated visits to the Delta Airlines website increased. In particular, the total estimated worldwide visits to delta.com increased by 5.9% from the fourth quarter of 2021.

Q4 Expectations

According to analysts, Delta Airlines is expected to report an adjusted loss of $1.27 per share and revenues of $9.47 billion in Q1.

Delta’s CFO Dan Janki has already warned investors about the expected loss in the first quarter. During the Q4 conference call, Janki said, “With omicron impacting our near-term outlook, we expect losses in January and February months with a return to profitability in the month of March. Despite expectations for a loss in the March quarter, we remain positioned to generate a healthy profit in the June, September, and December quarters, resulting in a meaningful profit in 2022.”

On a more upbeat note, Delta Airlines upped its revenue forecast for the first quarter last month. Adjusted revenue for Q1 is now expected to be roughly 78% of pre-pandemic levels, up from 72-76% previously forecast.

Analyst’s Positive View

Ahead of the Q1 results, Jefferies analyst Sheila Kahyaoglu is bullish on airline stocks.

According to the analyst, Delta’s revenue recovery would accelerate in the coming quarter. Furthermore, Kahyaoglu expects DAL to generate solid profitability, driven by “structural cost takeout and yield accretion,” as the company has been able to maintain a pricing premium over its peers.

However, “rising fuel prices and inflationary pressures” remain concerns, according to Kahyaoglu.

Kahyaoglu maintained her Buy rating on the stock and increased the price target to $45.00 from $38.00.

Wall Street’s Take

The majority of Wall Street experts agree with Kahyaoglu and believe the stock is a smart investment.

Delta Airlines stock commands a Strong Buy consensus rating based on 12 Buys and 3 Holds. As for price targets, the average DAL price target of $47.79 implies 23.7% upside potential from current levels.

Bottom Line

Due to a recovery in the travel environment, the airline industry has undoubtedly picked up speed. However, near-term challenges such as personnel issues and rising fuel prices continue to be a source of concern. Increasing inflation may have a detrimental effect on demand, leading to travelers staying at home.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure