Over the last year, U.S. telecom equities have gained only 3%, as the industry looks to be trapped in uncertainty due to a continuing chip scarcity, virus worries, and cut-throat competition.

AT&T (NYSE: T) is one such example of an American telecommunications corporation that has been lagging lately. Over the last year, the company’s stock has lost nearly 25% of its value.

However, it’s difficult to overlook the potentially significant catalysts that are just around the bend. The 5G upgrade cycle, in particular, is on the horizon. Furthermore, the internet giant’s fiber and HBO Max platforms fuel its growth.

AT&T CEO John Stankey recently gave greater insight into the company’s business strategies and expressed optimism about the cellular industry’s demand patterns.

Updates on AT&T’s Business Plans

Stankey feels AT&T is well-positioned to benefit from the wireless industry’s solid demand trend. He claims that, as a result of its increased network performance and go-to-market strategy, the firm is gaining market share in underpenetrated markets.

He also spoke about the company’s 5G deployment plans, which he said are on track. Furthermore, the corporation is optimistic about its fiber construction plans and anticipates various prospects in this area in the future.

Further, Stankey stated that the regulatory approval process for the WarnerMedia-Discovery proposed agreement is on pace. Following the completion of the transaction, the business expects to pay an annual dividend of $8 billion to $9 billion, implying a payout ratio of around 40% on an estimated free cash flow of $20 billion.

Notably, AT&T is integrating WarnerMedia’s media assets with Discovery to form a proposed stand-alone entity, Warner Bros. Discovery. The main goal is to unwind its costly media investments so that it may focus on its core business of delivering phone and internet services.

SEE: TOP 5G STOCKS FOR DECEMBER 2021 >>>

Improving Cash Position

On a sequential basis, the company’s cash situation increased significantly, while the debt load reduced. AT&T reported $21.3 billion in cash and cash equivalents at the end of Q3, compared to $11.9 billion at the end of Q221. Furthermore, net debt fell by $10.0 billion sequentially, with a net debt-to-adjusted EBITDA ratio of 3.17x at the end of the third quarter.

Further, it’s comforting to know that the company continues to pay decent dividends in 2021. The corporation paid a $0.52 per share dividend on November 01, 2021, which was the most recent T dividend date.

It will be interesting to see how AT&T plans to lower its massive debt load in the coming days, as well as whether it will suffer any liquidity issues as a result of the pandemic’s interruptions.

Falling Website Traffic Trends

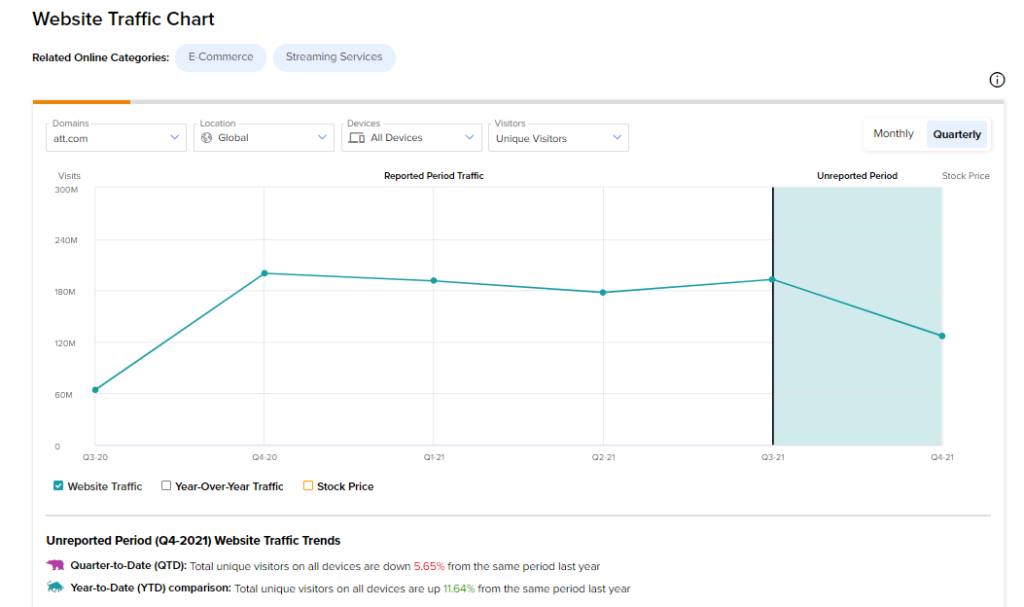

Interestingly, we discovered using TipRanks’ Website Traffic tool — which estimates a company’s website traffic volume from data collected from Semrush — att.com traffic has been declining this quarter (Q4) for AT&T.

The number of unique visits to AT&T’s website from all devices declined 5.7% in the fourth quarter-to-date period.

In addition, we discovered that from September to October, there was a 4.2% drop in unique visitors and a 1.1% drop from October to November.

Overall, the firm’s website visits have been on a downward trend, which does not speak well for the company. The company’s continual drop in subscribers might be attributable to fierce competition in this industry.

Wall Street’s Take

Turning to Wall Street, the stock has a Hold consensus rating, based on 3 Buy, 5 Holds and 1 Sell rating assigned in the past three months. As for the price target, the average T price target of $30.13 implies 30.6% upside potential to current levels.

Disclosure: At the time of publication, Shalu Saraf did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >