Cameco (CCJ) is the world’s largest uranium producer, with operations spanning across the United States, Canada, and Kazakhstan. I am bearish on the stock.

The Situation in Kazakhstan and Why it Matters to Cameco

Riots have erupted in Kazakhstan after locals grew concerned about rising energy prices. The situation is volatile to the extent that corporate practices, including banking and mining operations, were halted. Furthermore, Russia has sent troops into the country to try and stabilize matters after many were killed, with an additional 400 people hospitalized.

This event brings broader implications to the energy sector, as Kazakstan is the largest supplier of uranium in the world. Cameco holds 40% ownership of the Inkai mine in Kazakhstan, which contains an approximated 100.7 million pounds of uranium reserves. Halting operations in Kazakstan could dent Cameco’s profits severely, with inventory having already drawn down by 12% during the previous quarter amid existing supply-chain concerns.

It would be naive to look at the situation in Kazakhstan in isolation to draw a conclusion. But if we intertwine the event with lockdowns rolling out due to the spread of Omicron, and inflationary pressure from workers, it’s safe to say that there’s a calamitous headwind heading Cameco’s way.

A Weak Outlook for the Miners

I’m incredibly bearish on mining stocks for 2022. It’s increasingly likely that the surge in metal prices has come to an end, with GDP growth stagnating and speculation in the futures market finding calm.

Cameco could suffer from income statement pressure if wage demands and non-core inflation continue to grow with stagnation inventory value. The miners could be set for a period of downward mean reversion in 2022 if this situation would fully manifest itself, especially considering their outperformance last year.

Overvalued

Cameco stock is undervalued, as things stand. The stock’s PS ratio is trading at a .96x premium relative to its 5-year average, suggesting that the market got a bit ahead of itself last year and that we could see reality kick in soon.

A mining stock is always well-judged if you consider its price to book value ratio; this is a helpful metric considering the asset-heavy nature of a mining house. According to Cameco’s PB ratio, the stock is overvalued by 0.59x relative to its 5-year average and 0.48x relative to its sector peers, suggesting that there’s an apparent chasm between the stock’s fair value and its current market value.

Wall Street’s Take

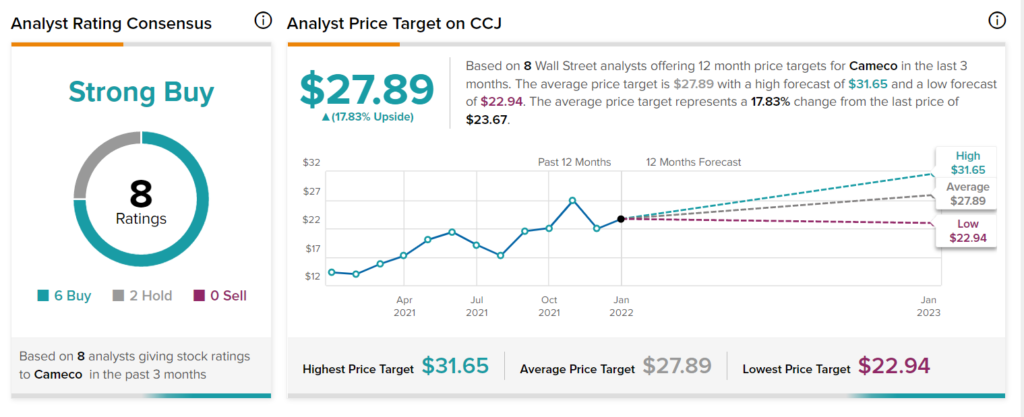

Turning to Wall Street, Cameco has a Strong Buy consensus rating, based on six Buys and two Holds assigned in the past three months. The average Cameco price target of $27.89 implies 17.8% upside potential.

Concluding Thoughts

Cameco is set for a reality check, as the stock is overvalued to the hilt. Moreover, the riots in Kazakstan could cause a decline in Cameco stock because of its exposure to the country’s Uranium sector via its Inkai mine.

Download the TipRanks mobile app now

Disclosure: At the time of publication, Steve Gray Booyens did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >