The rising adoption of 5G and an increase in data centers are fueling the demand for semiconductor solutions, including ethernet switching platforms, embedded processors, and controllers.

According to a Grand View Research report, the semiconductor memory market globally is expected to be worth $134.64 billion by 2027, indicating a compounded annual growth rate (CAGR) of 5.9% between 2016 to 2027.

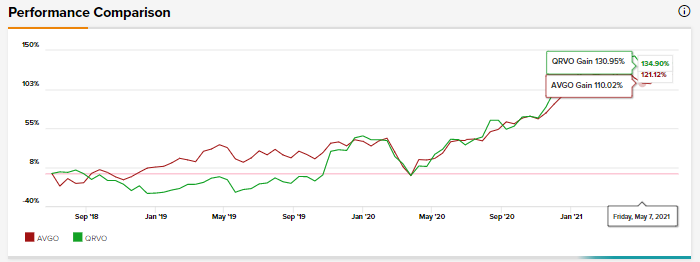

Using the TipRanks stock comparison tool, let us compare two semiconductor companies, Broadcom, and Qorvo, and see how Wall Street analysts feel about these stocks. We will be also looking at the risk factors for these stocks.

Broadcom is a designer, supplier and developer of semiconductor and infrastructure software solutions that include complex digital and mixed-signal complementary metal oxide semiconductor-based devices. Its infrastructure software segment includes the company’s BizOps and cybersecurity solutions.

Broadcom posted revenues of $6,610 million in fiscal Q2, up 15% year-over-year with GAAP diluted earnings of $3.30 per share, a rise of 82% year-over-year.

In the fiscal third quarter, AVGO expects revenues to come in at $6.75 billion while adjusted EBITDA is anticipated to be around 60% of projected revenue.

Following the Q2 earnings, Oppenheimer analyst Rick Schafer reiterated a Buy and a price target of $575 (21.6% upside) on the stock. Schafer commented in a note to investors, “As a leading semi-supplier to multiple franchise verticals, we believe AVGO is better positioned than most to secure supply. Top line is >90% booked for the year.”

“Backlog is non-cancellable and mgmt is closely tracking customer sell-through to minimize double ordering. We like AVGO’s dominant franchise-driven model and see cloud/5G leading solid mid-teens (%) growth in 2021,” Schafer added.

However, the AVGO stock could be at risk due to certain risk factors.

According to the new TipRanks Risk Factors tool for the company, the AVGO stock is at risk mainly from three factors: Finance and Corporate risk, Regulatory and Legal risk, and Production risk, each of which contributes 20% to the total risk for the stock.

Now let’s look at some of these risk factors in detail, starting with Financial risk. According to the risk factors detailed in AVGO’s filings, a majority of its revenues is generated from a small number of significant customers. Therefore, a loss of one or more of such customers could adversely affect its business.

This risk is noted by Oppenheimer analyst Schafer, who said that Apple (AAPL) supplier Foxconn accounts for approximately 20% of AVGO’s revenues, and Apple and Samsung together make up 25% to 30% of Broadcom’s total sales.

The analyst added, “The loss of content at either Apple or Samsung, or the loss of the strategic relationship with either, presents significant risk to the long-term growth of the company.”

Regarding Production risks, AVGO is heavily dependent upon Taiwan Semiconductor Mfg. Co (TSM) for the semiconductor wafers used in its products. TSM manufactured around 89% of wafers required by AVGO during the two consecutive fiscal quarters ending on May 2, 2021. (See Broadcom stock chart on TipRanks)

As a result, AVGO stated in its filing, “However, TSMC also fabricates wafers for other companies, including certain of our competitors, and could choose or be required to prioritize capacity for other customers or reduce or eliminate deliveries to us on short notice, or raise their prices to us, all of which could result in loss of revenue opportunities, damage our relationships with our customers, and harm our results of operations and gross margin.”

Analyst Schafer concurs with this risk, stating that the company’s gross margin stability could be threatened due to, “incremental margin pressure going forward from either Apple or Samsung would likely be negatively perceived by investors.”

Consensus among analysts on Wall Street is a Strong Buy based on 16 Buys and 2 Holds. The average Broadcom price target of $541.44 implies approximately 14.5% upside potential to current levels.

Qorvo is a semiconductor company that designs, supplies and manufactures radio frequency (RF), system-on-a-chip (SoC) , power management, Wi-Fi and cellular solutions. The company has two business segments: Mobile Products (MP) and Infrastructure and Defense Products (IDP).

In fiscal Q4, the company reported GAAP revenues of $1.07 billion, up 36% year-over-year and reported diluted earnings of $2.60 per share versus diluted earnings of $0.43 per share in the same quarter last year.

In the fiscal first quarter, Qorvo expects revenues to range between $1.065 billion to $1.095 billion and a non-GAAP gross margin of around 50%. QRVO anticipates Q1 non-GAAP diluted earnings of $2.45 per share at the midpoint of its guidance.

Last month, QRVO acquired California-based NextInput, a provider of micro-electromechanical systems (MEMS) -based sensors, for an undisclosed amount. These sensors are used in smartphones, wearables, automobiles and other applications.

Following the fiscal Q4 earnings, Charter Equity analyst Edward Snyder reiterated a Buy on the stock.

According to the new TipRanks Risk Factors tool for the company, the QRVO stock is at major risk from the Finance and Corporate risk factor at 22%, followed by Regulatory and Legal risk and Ability to Sell risk contributing 19% each to the total risk for the stock.

Similar to Broadcom, Qorvo also depends on several large customers, especially when it comes to its mobile products business segment. The company said in its annual filing that its two largest customers together contributed 39% to its revenues in FY21.

Analyst Snyder discussed this risk, saying in his research note, “As we’ve mentioned in several notes and investor calls over the last two years, Qorvo’s de-emphasis of Apple after its loss of the mid-high band module to Broadcom on iPhone 11 has paid off in better diversification of revenue.”

The analyst was upbeat about QRVO’s revenues diversification, saying, “This mutes seasonality as iPhone’s ramp in September doesn’t lift the top line as far while its trough in March is muted by the Spring launches of Samsung’s Galaxy and VOX (Vivo, Oppo, Xiaomi) phones. The positive impact on factory loading showed up as 100bps upside to gross margin this quarter. Its wider diversification also extends to products.”

According to Snyder, while Broadcom is focused on mid to high-band semiconductor modules, Qorvo is generating revenues in the low, mid, high, and ultra-high-band modules. That bodes well for the company.

Interestingly, in FY21, Qorvo’s international customers generated 59% of the company’s revenues while customers located in China made up 39% of its international revenues. The company stated in its filing that it continues to expect that China and other international markets will contribute significantly to its revenues.

However, the company admitted that a weakness in the Chinese economy or trade tensions between the United States and China could adversely affect its business. (See Qorvo stock chart on TipRanks)

Consensus among analysts on Wall Street is a Strong Buy based on 10 Buys and 2 Holds. The average Qorvo price target of $218.83 implies approximately 16.8% upside potential to current levels.

Bottomline

While analysts are bullish about both stocks, their risk profiles are a bit different. Compared to a sector average Financial and Corporate risk factor of 40.4%, Broadcom is at 20%, while for Qorvo it is 22%.

Based on this risk factor, it appears that Qorvo is a slightly riskier bet than Broadcom.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.