Bristol-Myers Squibb (BMY) is engaged in the discovery, development, licensing, producing, marketing, distribution, and sale of biopharmaceutical products internationally.

Following the company’s acquisitions of Celgene and MyoKardia, the company has benefited by expanding its oncology, hematology, immunology, and cardiovascular portfolios, which should continue producing robust cash flows for years to come.

The company’s latest results were rather impressive, with growth in both top and bottom lines, while management’s guidance points towards a great 2022.

Due to its robust financials, worthwhile dividend, and inexpensive valuation, I am bullish on Bristol-Myers Squibb.

Latest Results

Bristol-Myers Squibb’s Q4 results were quite strong despite investor concerns, as indicated by the stock’s lagging price over the past year.

Revenues grew 8.1% to $12 billion, while adjusted EPS came in at $1.83, a substantial improvement from $1.46 last year.

A great contributor to the company’s growth was Eliquis, which prevents blood clots, and whose sales grew 18% to $2.7 billion driven by strength in

the U.S. and key international markets. Opdivo, which treats forms of cancer, also performed well, posting sales growth of 11% to $2 billion, again, driven by strong U.S. sales.

The company experienced strong growth in the United States, where the company sourced $7.5 billion, an increase of 12% compared to the prior-year period, while international sales also remained at satisfactory levels, growing by 4%.

Q4 wrapped the company’s FY 2021 quite admiringly, with annual revenues growing 9% to $46.4 billion and adjusted EPS coming in at $7.51, compared to $6.44 last year.

For 2022, the company anticipates adjusted EPS to land between

$7.65 and $7.95 with revenue of around $47 billion for the year, indicating further net income growth.

Capital Returns

Following better-than-expected results in 2021 and a solid outlook for 2022, the company enjoys increased capital allocation flexibility, illustrated through its aggressive capital returns.

In December last year, the company authorized a $15-billion share buy-back program to occur over several years. An accelerated share repurchase program of up to $5 billion will be executed through the first quarter of 2022.

As far its dividend goes, Briston-Myers has hiked it for 15 consecutive years, with the latest increase being by a satisfactory 10.2%. I believe that dividend growth will continue to land in the high-single to low-double digits, contributing meaningfully to shareholder returns.

With the current payout ratio standing close to 30% based on management’s guidance, the company should have plenty of room to safely grow the dividend going forward.

Wall Street’s Take

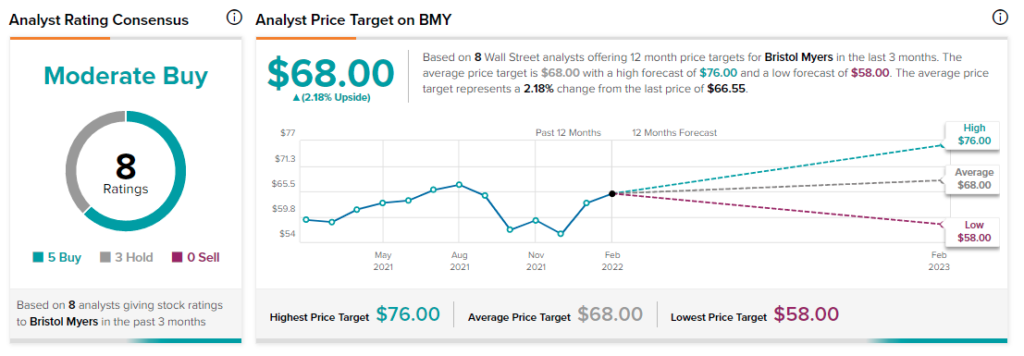

Turning to Wall Street, Bristol-Myers Squibb has a Moderate Buy consensus rating, based on five Buys and three Holds assigned in the past three months. At $68, the average Bristol-Myers Squibb stock forecast implies 2.2% upside potential.

Conclusion

In my view, Bristol-Myers Squibb is one of the better plays in the healthcare sector for several reasons. The company has a highly profitable, diversified portfolio which should keep generating robust cash flows in the medium to long term.

The company is actively rewarding shareholders with growing capital returns, yet the stock is rather cheaply valued at a forward P/E of just over 8. Following a solid 2021, it appears that 2022 will also be an exciting year for the company.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure