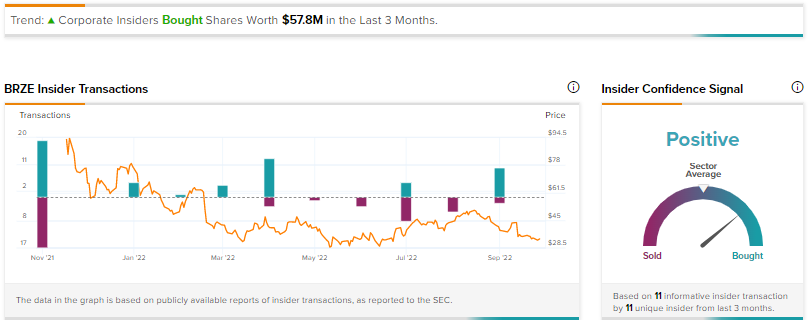

There have been notable insider trades in shares of Braze (NASDAQ:BRZE), a customer engagement platform. According to TipRanks’ Insider Trading Activity tool, insiders purchased Braze stock worth $57.8 million in the last three months. Consequently, the insider confidence signal is Positive for Braze.

Braze helps its clients process customer data in real-time and optimize their cross-channel marketing campaigns. It helps brands continuously evolve their customer engagement strategies.

Rise in Insider Trading in BRZE Stock

There has been a rise in insider transactions in Braze stock since the company announced its second-quarter results on September 12. The company’s Q2 results topped expectations, but investors were concerned about the Q3 outlook. Braze guided for a higher-than-expected Q3 loss and decelerating revenue growth.

While there have been several insider transactions since the Q2 results, we will focus on transactions disclosed this week. As per an SEC filing, on September 22, Matthew Jacobson (a director and owner of over 10% stake in BRZE), along with related entities, bought 110,650 shares in multiple transactions for an aggregate amount of $3.76 million.

On the same day, director Douglas A. Pepper and related entities as well as ICONIQ Strategic Partners VI, L.P. (owner of more than 10% stake in BRZE) each bought 110,650 shares for a total consideration of $3.76 million.

Meanwhile, the company’s CFO, Isabelle Winkles, sold 17,062 shares (allotted by way of options) on September 22 at a weighted average price of $33.90 per share. Aggregate proceeds from the sale were $578,402. The CFO still holds 33,197 BRZE shares and also owns derivative securities.

Interestingly, TipRanks also offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is Braze a Good Stock to Buy?

Wall Street is highly bullish on Braze stock. On TipRanks, Braze earns a Strong Buy consensus rating based on 12 unanimous Buys. The average BRZE stock price target of $52.09 implies 54.4% upside potential from current levels. Shares have plunged 56.3% year to date.

Final Thoughts

While the Q3 outlook issued by Braze spooked investors, many insiders are displaying their confidence by buying the stock. Wall Street analysts also seem highly optimistic about the company’s growth prospects.