BP Plc (BP) is a London-based integrated oil and gas company. It operates through three segments: Upstream, Downstream, and Rosneft.

The Upstream segment engages in the oil and natural gas exploration, field development, and production; midstream transportation, storage and processing; and marketing and trade of natural gas.

The Downstream segment refines, manufactures, markets, transports, supplies, and trades in crude oil, petroleum, and petrochemicals products to wholesale and retail customers.

The Rosneft segment engages in the exploration and production of hydrocarbons in the United States, Canada, Vietnam, Venezuela, Brazil, Algeria, the United Arab Emirates, Turkmenistan, and Norway; and offers jet fuel, bunkering, bitumen, and lubricants.

BP has a moderate balance sheet and is now facing challenges both positive and negative amid the war in Ukraine and the soaring oil prices.

I am bullish on BP stock despite the latest business news of canceling Russian-based business ventures. Oil Stocks should continue to benefit from increased oil prices.

BP Business News

The war in Ukraine has resulted in big oil companies that had entered various deals with Russian oil companies looking to withdraw their operations. BP has canceled its Russian-based business ventures, warning investors that it would incur Q1 impairment charges of as much as $25 billion.

An impairment charge of nearly $25 billion would represent more than a quarter of BP’s current market capitalization.

There will now be an anticipation of a very weak Q1 2022, and even Q2 2022 for BP.

However, investors will be happy to know that BP has stated that its decision to stop business operations in Russia would not impact its short- and long-term financial targets.

As well, international discussions with Iran to reach a nuclear deal could lead to Iran oil reserves supplying the global market, which should push oil prices to stabilize and even deflate.

This is not bad news for BP as it would take a considerable time for oil prices to reach lower levels amid supply shortages and strong demand. In other words, oil prices could stabilize at high levels and provide a revenue and profitability boost for BP.

How High Can Oil Prices Go?

All bets are off as oil prices move based on not only fundamentals but mostly on emotions and expectations. Oil traders bet that oil prices could reach $200 a barrel in March 2022.

The reality is that now oil prices are extremely elevated and any positive deal either with Iran or a more strategic release of international oil reserves could stabilize them. The million-dollar question of how high can oil prices reach before they start to return to normal levels is not an easy one to answer.

Fundamentals – Risks

BP has a D/E ratio of 0.89 as per the latest quarter which is considered high.

In 2021, BP — despite a negative sales growth of 18.46% — reported a net income growth of 134.74% to $5.5 billion, and a surge of free cash flow growth of 8,339.57% to $9.25 billion.

The forward dividend and yield of $1.28 and 4.55% are very attractive, but they may come under pressure due to the impairment charges.

Valuation

BP is relatively attractive based on its P/E Ratio (13.2x) compared to the U.S. Oil and Gas industry average (16.1x) and based on its P/B Ratio (1.2x) compared to the U.S. Oil and Gas industry average (2.2x).

Wall Street’s Take

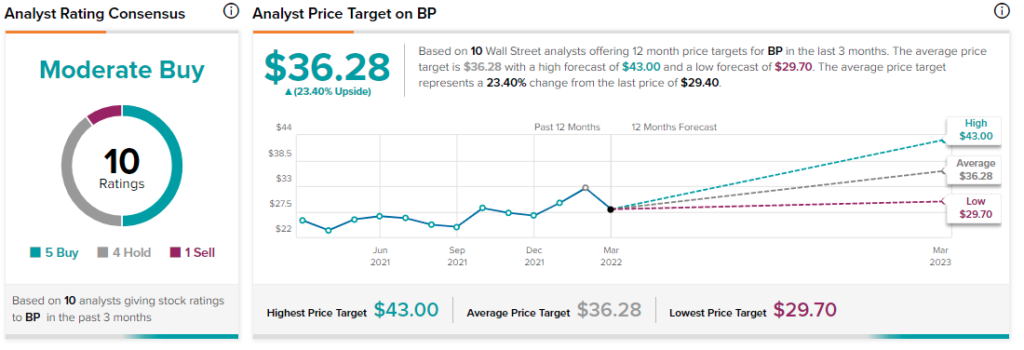

BP has a Moderate Buy consensus based on five Buys, four Holds, and one Sell. The average BP price target of $36.28 represents 23.4% upside potential.

Conclusion

BP is now facing a major challenge. A bold decision to withdraw from its Russian ventures will harm its financials with a large impairment charge.

However, the stock is now considered to be attractive, and the oil company remains confident about its long-term financial targets.

Oil prices could remain at high levels for quite some time, and this should be positive for BP.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.