Boyd Gaming (BYD) operates over two dozen casinos and hotels throughout the United States. The majority of these are in Las Vegas, but not on the famous Las Vegas Strip. Instead, these focus on the Las Vegas locals market, which is the second largest gaming market in the United States, behind only the Las Vegas Strip.

Boyd Gaming also has a large presence in the Midwest and South. These areas also rely more heavily on the local populations than tourist destination casinos. Recent results point to a bullish opportunity for investors. (See Boyd Gaming stock charts on TipRanks)

The Las Vegas Gaming Recovery

Las Vegas casinos shut their doors completely upon order of the governor when the COVID-19 Pandemic hit, in early 2020. As the lights were turned off on March 17, 2020 it was feared that the devastation for the local economy and for casinos would be unparalleled.

Several stimulus programs, enhanced unemployment pay, and the reopening with strict health guidelines averted this disaster and the casinos are again booming. According to the Nevada State Gaming Control Board, the casinos have hit record winnings four times in the last five months. As shown below, the Nevada gaming win has also eclipsed $1B for five straight months and exceeds all pre-pandemic highs.

Many travelers might still be reluctant to visit out-of-state markets as the Delta Variant raises infection rates. Because of this, the best bet is on the Las Vegas Locals market, and the Midwest and South markets, which are not dependent on air travel and visitors.

Boyd Gaming Q2 2021 Record Revenue and Profits

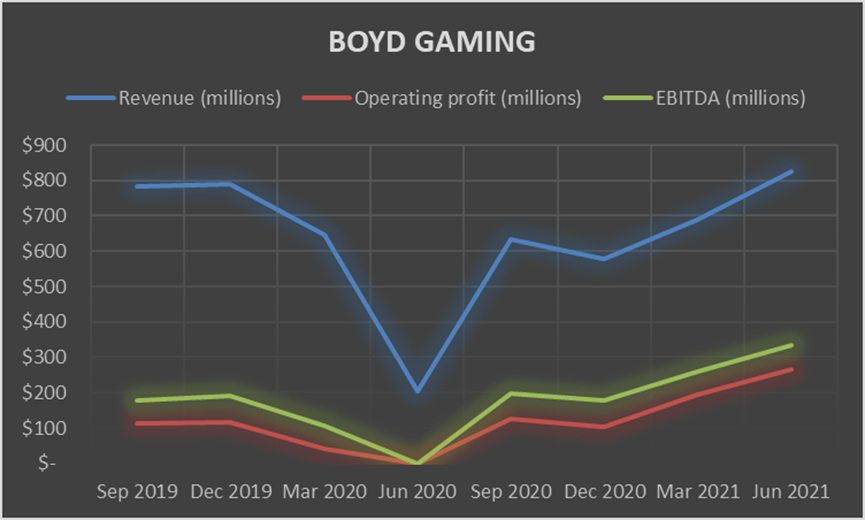

In Q2 2021 Boyd reported record revenue, EBITDA, and operating profits, easily surpassing Q2 2020 and 2019 results. The company also reported earnings per diluted share of $1.00 for the quarter. Revenue was $893M while EBITDAR came in at $409M, a very healthy 46% EBITDAR margin. Operating income was $266M, which was more than double the 2019 result for the same quarter. The trends are predominantly positive across the board.

Meanwhile, the stock trades at a discounted forward price-to-earnings (PE) ratio under 14.0 (non-GAAP) and just above 14.0 (GAAP). This is likely due to the risk of travel or other entertainment restrictions. However, Boyd is in a terrific position, as it caters to locals in Las Vegas and the Midwest and South.

Wall Street on Boyd Gaming

Wall Street also recognizes the tremendous potential for returns offered by Boyd Gaming, which has an analyst rating consensus of Strong Buy. All five analysts reported by TipRanks have rated the stock a “Buy” with an average analyst Boyd Gaming price target of $84.00. This target implies a near-term upside of more than 38%.

Summary on Boyd Gaming

The COVID-19 pandemic is still causing disruption to many industries, including gaming. Boyd Gaming, which relies predominantly on local players, has not only weathered the storm but is posting record revenues and profits.

The stock remains undervalued, as investors are reluctant to put all their chips in the game, making BYD stock one investors should consider. Analysts are also bullish, with price targets well above the current price, in a range of $60 per share. The recent weakness offers a compelling entry point for medium to long-term investors.

Disclosure: At the time of publication, Bradley Guichard did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.