Amid the broader stock market plunge, certain mid-cap stocks have taken more than their fair share of damage. In this article, we’ll use TipRanks’ Comparison Tool to look at two very different mid-cap stocks (PTON and BOX). One mid-cap has held its own far better than industry peers and the broader market averages, while the other has suffered one of the biggest knockout blows – a 96% decline from peak to trough.

Undoubtedly, it’s far tougher on smaller firms when it gets harder to raise capital. Many sport less bountiful balance sheets, with earnings prospects still in the earlier growth stages.

Indeed, every company goes through the process of aging. First comes growth, then comes a push to profitability, and eventually, a firm matures and begins paying a growing dividend. Though there are exceptions to the corporate lifecycle, it’s difficult for a vast majority of firms to resist aging.

These days, younger companies reliant on sales growth (with lacking profits) have been taking on amplified damage relative to their large-cap counterparts. Arguably, higher rates favor the behemoths in the space, as they leverage their liquidity positions to acquire beaten-down rivals or pressure them out of business.

Without further ado, consider the following two mid-cap names to see where Wall Street stands as we march into the fourth quarter of 2022.

Peloton (NASDAQ: PTON)

Peloton is the fitness equipment maker that’s a poster child for the great tech-driven crash of 2022. The stock has fallen from $171 and change per share to a measly $7. That’s a 96% drop. Dip-buyers have been punished harshly, and with no bottom in sight, it’s tough to draw a line in the sand for the $2.3 billion commoditized discretionary equipment maker heading into an economic downturn.

It’s hard to believe that Peloton stock is at a new low. It’s as though the 2020 stay-at-home boom never happened. While the company may have overinvested when times were good, I think the leaner version (after recent waves of layoffs) of Peloton can begin pedaling forward again as the worst of recession headwinds come to pass.

Undoubtedly, discretionary stocks like Peloton tend to overswing to the downside in anticipation of tougher times. Though the company doesn’t seem to have much going for it other than takeover chatter, I view shares of PTON as an intriguing “cigar butt” stock to pick up now that everyone has turned so bearish on it.

Though shares have plunged 96%, investors shouldn’t assume a bottom is in sight until Peloton can lean out and find a way to turn the tides without stretching itself financially.

Two Peloton co-founders have departed the firm amid its management restructuring. That’s never a good sign for investors.

With a wider-than-expected loss reported in each of the four last quarters, Peloton stock is rolling quickly down a hill without a pair of brakes.

As rates rise and capital becomes tight, some may view Peloton as a “zombie company” whose days are numbered. The trajectory is not pretty, and there was a considerable (nearly $600 million) debt load at the end of the June quarter. Regardless, many analysts are still confident that the fallen pandemic darling can turn the tides.

What is the Price Target for PTON Stock?

Wall Street is upbeat, with a “Moderate Buy” rating. The average PTON stock price target is at $15.94, implying more than 127.1% upside over the next year. That’s a lot of gains, but investors must be comfortable with the high-risk profile.

Box, Inc. (NYSE: BOX)

At the other end of the spectrum, we have Box, a relatively steady ship in the tech industry’s rough waters. Shares are down just north of 26% from their all-time high of over $33 per share, almost beating the S&P 500 (SPX) and beating the Nasdaq 100 (NDX), which are currently in the midst of a vicious bear market.

The $3.5 billion cloud storage and collaboration company have certainly bucked the trend, with continued customer wins and steady guidance and GAAP earnings in the $0.01-0.02 range. Box stock may not be wildly profitable, but it’s only the cusp of a profitable push, even amid rising macro headwinds. Further, Box seems to be one of few mid-cap tech companies that can grow profitability – and sustainably so.

Undoubtedly, Box was never a hyper-growth sensation that investors grew euphoric over during the 2021 stock market rally. On a relative basis, Box is a tortoise racing against many hares. With rates rising, Box is one of few firms that can continue moving forward under its own power.

As the company continues upselling a new slate of products to its growing client base, I expect the firm will have no issue meeting (and even beating) expectations as enterprise spending budgets contract.

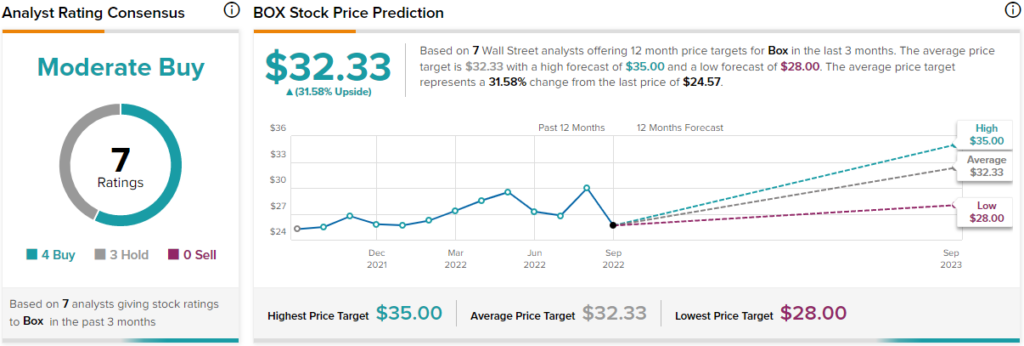

What is the Price Target for BOX Stock?

Box is a unique mid-cap tech company that doesn’t get as much love from mainstream investors. Analysts like the stock, though, with a “Moderate Buy” rating and the average BOX stock price target of $32.33, implying 31.6% upside potential from here.

Conclusion: PTON Has High Upside Potential, but BOX is Safer

Peloton and Box are two very different mid-cap stocks that Wall Street favors going into 2023. Peloton has a far more significant upside, but the risk profile is also way higher. Personally, I think Box stock is a more prudent choice for investors looking to de-risk.