Challenging – this is one word getting extra use these days, frequently describing the headwinds industries affected the most by COVID-19 are facing.

Undoubtedly, it is an apt description of the situation A&D giant Boeing (BA) currently finds itself in. Appearing to be on the verge of bankruptcy after the initial coronavirus wave, the recent spike in cases hasn’t made predicting what’s on tap in the near-term any easier.

With its Q2 earnings release on the horizon (July 29), Cowen analyst Cai von Rumohr argues the Street is underestimating the headwinds Boeing must face on the way to recovery.

“Q2 will be a mess… Broadly ranged Q2 estimates look high, and spiking U.S. COVID-19 cases & rising China tensions are headwinds for MAX delivery ramp in 2021 and complicate supply chain coordination… Combined with incoming supplier materials, COVID-19 disruptions, and customer deferrals, we also see $9 billion cash outflow vs. Street’s $6.6 billion,” Rumohr noted.

Boeing’s 737 Max has been grounded since March 2019, following a couple of fatal accidents. It is now expected to be back in circulation by the fall. But in the current climate, who will want any new MAX airliners?

Focus right now is squarely on survival, as many airlines are looking for ways to shrink fleets, not add to them. Although Rumohr believes customers have existing 737 orders, the analyst thinks most will seek to defer deliveries. However, some might even go further; There are rumors that American Airlines – the company behind the initial push for Boeing’s 737 Max project – is considering canceling some of its Max 737 orders.

Adding another layer of uncertainty, the trade disputes with China – who in 2018 made up 28% of 737 deliveries – mean the superpower is unlikely to confirm Max deliveries before the November US presidential election.

Boeing management previously said it expected the majority of completed MAX jets to be delivered in the first year following recertification, but Rumohr doesn’t believe this target will be met.

“The recent cut of SPR’s MAX rate from 12-14/month to 6-7 suggests that ‘majority’ may mean closer to 51% than 70-80%. We’re assuming ~300 737 deliveries in 2021 (vs. Street’s ~400) and total BA revenues of $74 billion vs. Street’s $89 billion,” the analyst said.

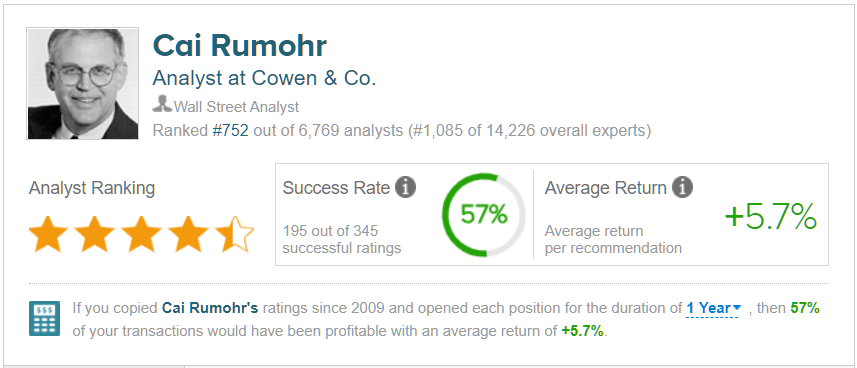

To this end, Rumohr rates BA a Market Perform (i.e. Hold) along with a $150 price target. There’s a 17% downside in the cards, should the average price target of $150 be met over the next 12 months. (To watch Rumohr’s track record, click here)

The rest of the Street is a bit more optimistic. 7 Buys and Holds, each, plus 2 Sells coalesce into a Moderate Buy consensus rating. The average price target hits $191.57, and implies possible upside of 7% in the year ahead. (See BA stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.