Despite Block (SQ) falling short of Street targets for the headline metrics in its latest quarterly statement, investors appeared sanguine about the misses. Instead, the focus turned to the thriving Cash App and Seller ecosystems.

Revenue fell by 22% year-over-year to $3.96 billion, coming in shy of the $3.78 billion Wall Street had in mind. Adj. EPS of $0.18 also missed the $0.20 consensus estimate. Gross payment volume increased by 31% to $43.5 billion, but the Street was anticipating $45.39 billion. Operating income rose by 34% to $1.29 billion – consensus had $1.30 billion.

However, although Cash App transactions for bitcoin declined and were behind the revenue miss, Cash App showed signs of reacceleration, with gross profits up 11% quarter-over-quarter.

While Block did not provide guidance, there was also a quarter-to-date update which hit the right notes. On account of easing worldwide pandemic restrictions, through the end of April, Seller GPV is anticipated to rise by 29%. And excluding Afterpay, given an uptick in transacting users and healthy engagement trends, Cash App gross profit is expected to show a ~15% year-over-year increase through the end of April.

As such, Needham analyst Mayank Tandon sees enough reasons to keep the bull thesis intact.

“Coming off what we view as largely an in-line quarter, we remain upbeat on the shares and believe that both the Seller and Cash App ecosystems benefit from the continued lessening of pandemic restrictions around the globe,” the 5-star analyst said. “With the shares trading at an EV/FY23 revenue (ex-Bitcoin) multiple of ~4.5x, we view the risk-reward as favorable for large cap payments investors and view the upcoming analyst day (May 18) as a potential catalyst for the shares as management’s growth plans are given more clarity.”

Therefore, Tandon rates SQ shares a Buy, although the price target is lowered from $175 to $135. Nevertheless, there’s still upside of 61% from current levels. (To watch Tandon’s track record, click here)

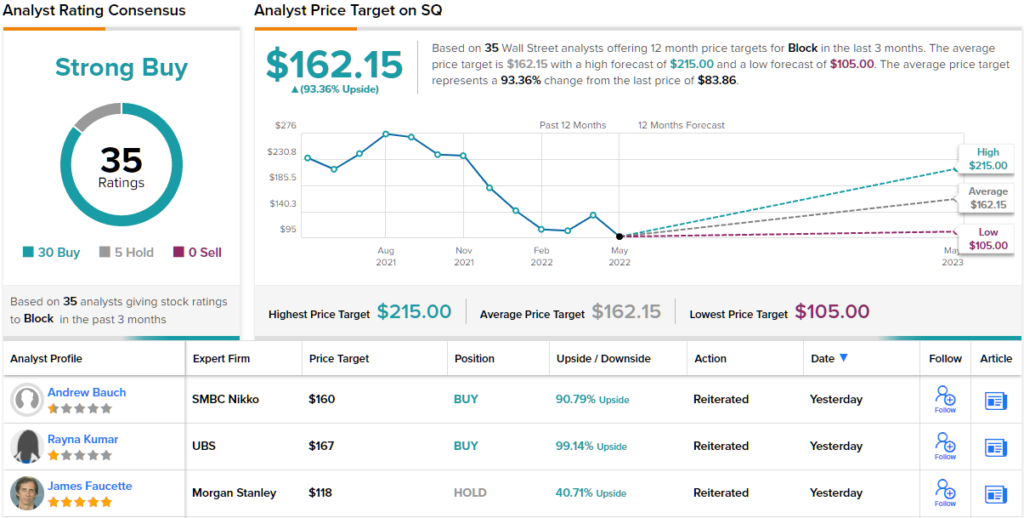

The Street’s average target is more positive than Tandon will allow, and at $162.15, is set to generate returns of ~93% over the one-year timeframe. Most analysts also remain in SQ’s corner. The stock’s Strong Buy consensus rating is based on 30 Buys vs. 5 Holds. (See Block stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.