The big asset-management stocks have been feeling considerable pressure on their share prices amid the brutal bear market that’s dragged on for the whole year. Undoubtedly, BlackRock (NYSE: BLK) and Blackstone (NYSE: BX) are heavyweights when it comes to asset management. Still, they haven’t been able to steer clear of the pain aimed at the broader financial industry. Nonetheless, let’s use TipRanks’ Comparison Tool to check out BlackRock and Blackstone stock to determine which is viewed more favorably by Wall Street analysts amid their vicious 40% declines.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

As the Federal Reserve continues talking tough in its rate-driven battle with sky-high inflation, it’s hard to find any sort of relief in any sector. Though higher interest rates aren’t kryptonite for the big asset managers, harsh macro storm clouds and the threat of a recession have caused shares of BX and BLK to drop like a rock (or should I say a stone).

Given accelerating negative momentum in the month of September, one has to think investment outflows start to weigh more heavily on the top and bottom line.

There aren’t easy answers for the asset-management heavyweights, as rising downside and recession risks could entice Wall Street analysts to slash price targets further.

BlackRock itself recently turned less bullish on stocks, noting that it “doesn’t see a soft landing.” Though the Fed is doing its best to minimize the economic damage, as it raises rates to chop the inflation tree down, it may prove difficult to tame inflation without enduring considerable economic damage.

BlackRock (BLK)

BlackRock is a top asset manager with nearly $8.5 trillion in AUM as of the end of June 2022 and one of the most respected names in the business. With the firm turning a tad more bearish on equities following its decline, questions linger as to how bad equity outflows could get amid the ongoing sell-off.

Undoubtedly, many investors know BlackRock as the company behind the vast roster of iShares ETFs (Exchange-Traded Funds). Indeed, ETFs and other passive-investing products have grown increasingly popular among young investors over the last decade.

Though the recent bear market in stocks could cause the ETF market to lose a step, the longer-term industry outlook still seems quite bright as more young investors look to pursue DIY (do-it-yourself) investing. Not all pundits are bullish on passive investing, though. Dr. Michael Burry (from the Big Short) sees a bubble in passive investing. Burry has also been quite vocal about his bearish stance on today’s market.

If Burry is right and ETFs are poised for serious outflows in some sort of bubble-bursting scenario, BlackRock could get rocked (forgive the pun) even further.

In any case, I view BlackRock as conservatively valued at this juncture. The stock trades at 15.1x trailing earnings and 4.5x sales. With a 3.55% dividend yield, BLK stock seems more of an oversold dividend juggernaut with sizeable upside potential in the event of a market rebound.

It’s hard to tell if passive investing is, in fact, in a bubble. There have been no signs so far, with positive flows experienced in the early innings of the market sell-off.

What is the Price Target for BLK Stock?

Wall Street continues to praise BlackRock stock, with a “Strong Buy” rating, eight Buys, and just one Hold. While many analysts were caught off-guard by the violent slip in shares, I do think analysts are right not to “panic downgrade” the stock. It’s still on the right track, with the average BLK stock price target of $712.67 implying 24.4% upside potential.

Blackstone (BX)

Blackstone is an alternative asset kingpin down by about the same magnitude as BlackRock stock. As a recession looms, the macro pressure will be hard to avoid. That said, I do think Blackstone’s alternative asset mix (think real estate and fixed income) could make it subject to less risk than its peers.

Further, the swelling dividend (currently yielding 6.1%) is hard to ignore, especially for investors seeking safety from hot inflation. Indeed, there’s more to Blackstone than just the lofty dividend. Demand for less-correlated alternative assets by clients will likely continue to rise as investors seek to move beyond stocks for greater diversification. If anything, the stock market plunge could pave the way for an increased appetite for higher-return alternative assets.

Despite recent recession-risk-related pressure, Blackstone is on an impressive streak, beating earnings per share (EPS) estimates for eight straight quarters. I think Blackstone can extend its streak further going into 2023.

At writing, BX stock trades at 15.8x trailing earnings and 5.9x sales. Based on these multiples, Blackstone is the pricier play than BlackRock, but for a good reason, at least according to Wall Street analysts, who remain incredibly bullish.

What is the Price Target for BX Stock?

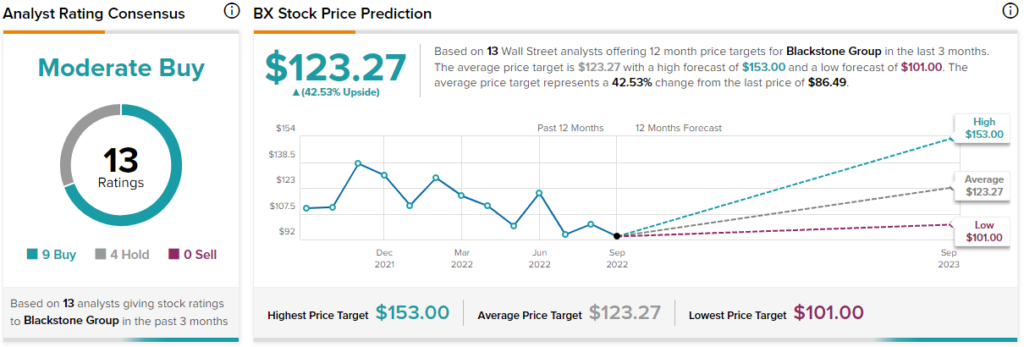

Wall Street can’t get enough of Blackstone, with the average BX stock price target coming in at $123.27. If analysts are right, shares could have 42.5% in upside potential, not including the 6.1% dividend yield.

Conclusion: Wall Street Expects More Upside from BX Stock

It’s hard to choose between the asset managers that can act as a rock (or stone) for any long-term portfolio. Their dividends are rich but could continue to swell as shares continue to sink. At this juncture, Wall Street expects more action from Blackstone.