Blackrock (BLK) has plummeted roughly 29% from its 52-week highs as the ongoing unrest in capital markets has softened the demand for the company’s asset management services. With a 3.1% yield and strong dividend expansion prospects, Blackrock stock could present an attractive entry point for dividend-growth investors. Still, there is more downside potential at the current valuation. Consequently, I am neutral on the stock.

An Asset Management Behemoth with Elevated Risks

Blackrock is one of the most prominent investment management firms, boasting roughly $9.0 trillion of assets under management (AUM) as of its latest quarterly report. The company contributed heavily to pioneering the exchange-traded-fund (ETF) revolution.

With investors heavily gravitating toward low-cost ETFs over the past decade, the company attracted massive fund inflows at the expense of higher-priced mutual funds that were previously the norm. In fact, this helped the company grow to be the largest asset management firm in terms of total AUM.

When mixed with a leading brand in the investment management industry, the company’s enormous size becomes an effective competitive advantage. Specifically, the iShares line of ETFs is prevalent amongst investors for its low fees. Thus, Blackrock is well-positioned to keep dominating the asset management industry.

However, Blackrock’s performance is highly susceptible to the underlying conditions of the capital markets. During favorable market environments (e.g., the decade-long bull run following the Great Financial Crisis), the company attracts growing inflows from investors. During unfavorable conditions in the capital markets, however, precisely the opposite occurs, hurting the company’s financials.

Q2 Results: Sustained Net Income Generation Despite the Challenges

Blackrock’s Q2 results reflected the second scenario, as just mentioned, with the current uneasiness in capital markets hurting the company’s results. Global equity and debt markets underwent their most destructive first-half decline in decades.

This came as investors responded to the uncertainty associated with growing recession fears, surging inflation, interest rate increases, and geopolitical pressures. Overall, these market dips, along with substantial dollar appreciation against major currencies, lowered the value of BlackRock’s AUM by $1.7 trillion year-to-date.

With lower fees on AUM, the company’s revenues declined 6% to $4.53 billion, resulting in operating income falling by 14% to $1.67 billion. In addition, Blackrock’s adjusted EPS plummeted 30% to $7.36. These numbers illustrate its sensitivity to capital market downturns.

That said, the company remained very profitable on an absolute basis, with net margins coming in at 24.7%, which illustrates Blackrock’s lean and high-margin business model.

Blackrock’s Dividend Growth Prospects are Attractive

Blackrock has a long track record of growing dividend payments. Since initiating quarterly dividends in 2003, Blackrock has hiked it every year except for 2008-09, when the dividend was held constant because of the Great Financial Crisis. Still, dividends have never been slashed, and its 10-year dividend per share CAGR stands at 12.1%. Furthermore, following the stock’s decline year-to-date, its yield has now been pushed close to 3.1%.

Consensus EPS estimates stand at $33.72 for the year. They imply a year-over-year decline of around 14%, likely predicting a profitability improvement over the year’s second half. This estimate also implies a payout of 57.8%, notably higher than Blackrock’s historical range of between 38% and 50%.

Thus, dividend growth could slow down moving forward but remain in the high-single digits in my view. Along with an above-average yield, it should adequately serve dividend-growth investors.

The Valuation is Reasonable, but Not Cheap

Based on consensus EPS estimates, the stock is currently trading at a forward P/E of 19. This is not an expensive multiple, especially if Blackrock’s earnings rebound. Still, it’s not a cheap multiple either in a rising-rates environment.

Investors likely value the company’s industry dominance and size, assigning a premium to the stock. The fact that the company completes substantial buybacks further sustains an elevated multiple. In Q1 and Q2, the company repurchased $500 million in each quarter. For context, the company has retired more than 20% of its outstanding shares over the past decade.

Overall, while the current multiple could present a good entry point for long-term investors, the short-term margin of safety against further downside could be thin.

Wall Street’s Take on BLK Stock

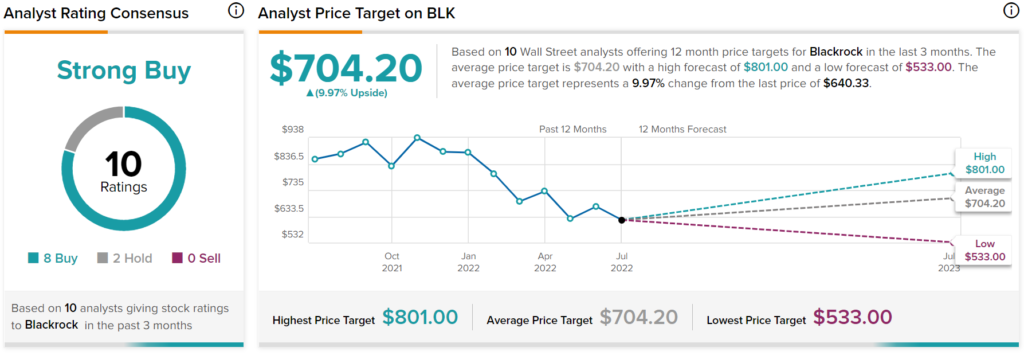

Turning Wall Street, Blackrock has a Strong Buy consensus rating based on eight Buys and two Holds assigned in the past three months. At $704.20, the average BLK price prediction implies 10% upside potential.

Takeaway – Blackrock is a Fine Long-Term Dividend Growth Pick

Blackrock isn’t going anywhere anytime soon. The company’s superiority in the asset management space is tremendous, providing a moat in a competitive industry. While its latest results reflected the ongoing unrest in capital markets, its bottom line remained rather rich.

Overall, I believe that Blackrock remains a great dividend growth opportunity, but only for investors that aim to hold shares over the long term. This is because further short-term downside could materialize if macro tensions persist, especially at the stock’s current, somewhat rich multiple.