The Blackberry (BB) story is defined by its transformation from a leading smartphone maker to its current incarnation as a security software specialist. Yet, it is also marked by a decline from glory days to a company struggling to pick up momentum.

There have been signs of a turnaround recently after the company announced an alliance with Amazon Web Services (AWS) to collaborate on BlackBerry’s intelligent vehicle data platform, IVY.

However, Blackberry stock was once again back to its underwhelming ways following the release of FQ3 earnings last week. Investors evidently did not like the print and sent shares tumbling by 16% in the subsequent session.

BlackBerry’s latest quarterly statement made for an uncomfortable read. While on the bright side, the company managed a beat on the bottom line on an adjusted basis with Non-GAAP EPS of $0.02 coming in ahead of the Street’s call by $0.03, on a GAAP basis, at earnings of -$0.23 per share, the figure missed consensus estimates by $0.16.

The company didn’t fare any better on the topline, either, with revenue declining 20% year-over-year to $224 million and coming in $0.72 million shy of the forecasts.

Key software metrics also came in soft. On a GAAP basis, software/services revenue fell year-over-year from $185 to $162 million, while licensing revenue dropped from $82 million to $56 million.

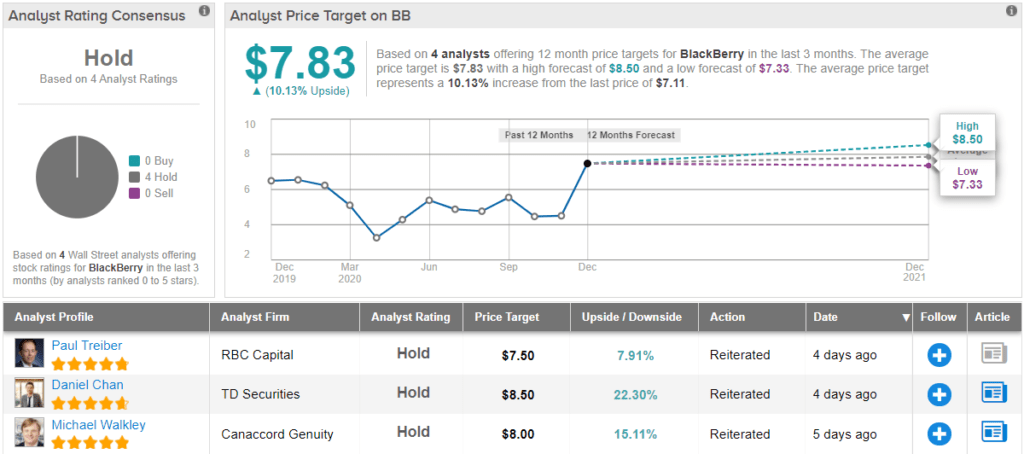

For RBC analyst Paul Treiber, Blackberry remains a “show me story.” Accordingly, Treiber rates the stock a Sector Perform (i.e. Hold) along with a $7.5 price target. This figure implies about 8% upside from current levels. (To watch Treiber’s track record, click here)

“The investor debate on BlackBerry stems from the company’s future opportunity compared to its current momentum,” the 5-star analyst noted. “Pending stronger growth or better visibility to BlackBerry’s emerging opportunities, we see the valuation re-rating in BlackBerry’s shares sustained at current levels… Our target multiple is justified below peers (at 7.1x), given BlackBerry’s lower growth.”

The rest of the Street concurs. BB stock has a Hold consensus rating, based on Holds only – 4, as it happens. At $7.83, the average price target is slightly higher than Treiber’s and implies shares will add 13% of gains in the year ahead. (See BlackBerry stock analysis on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.