Not all biotechs are highflyers in 2020. Despite some pharma companies’ elevated coronavirus driven valuations, some have had to settle for more pedestrian performances.

Take for instance biotech Biogen (BIIB). The large cap has had a middling 2020 so far, with shares down by 6% since the turn of the year.

Might that be about to change in the second half of the year, following a recent encouraging development?

On Wednesday, Biogen disclosed it had submitted a BLA (biologics license application) to the U.S. Food and Drug Administration (FDA) for its potential Alzheimer treatment, aducanumab.

Focus now turns to the FDA’s reaction. The agency has 60 days to approve the filing, following which (if approved), the application will be reviewed. Biogen hopes the drug will be granted priority status due to the disease’s unmet medical need. This means the review could be completed within 6 months instead of the 10 months it normally takes.

J.P. Morgan analyst Cory Kasimov is not entirely convinced the treatment will make it through the whole regulatory process. The approval prospects for aducanumab, he notes, are “little better than a coin flip,” and he estimates the possibility of success at 55%.

After conducting a poll among 30 US Alzheimer’s physicians, Kasimov argues aducanumab remains a controversial subject among industry professionals.

“In short,” said the 5-star analyst, ”The results suggest that the majority of docs don’t believe that aducanumab should be approved… but plan to prescribe the drug to a substantial number of early Alzheimer’s patients if it reaches the market. With safety not being a major sticking point for most of these respondents, we suspect the regulatory debate is likely to come down to whether perceived tolerability + the unmet need win out over a questionable efficacy data + trial conduct/analysis.”

All in all, Kasimov reiterated a Hold rating on BIIB shares along with a $293 price target, which implies a modest 5% upside. (To watch Kasimov’s track record, click here)

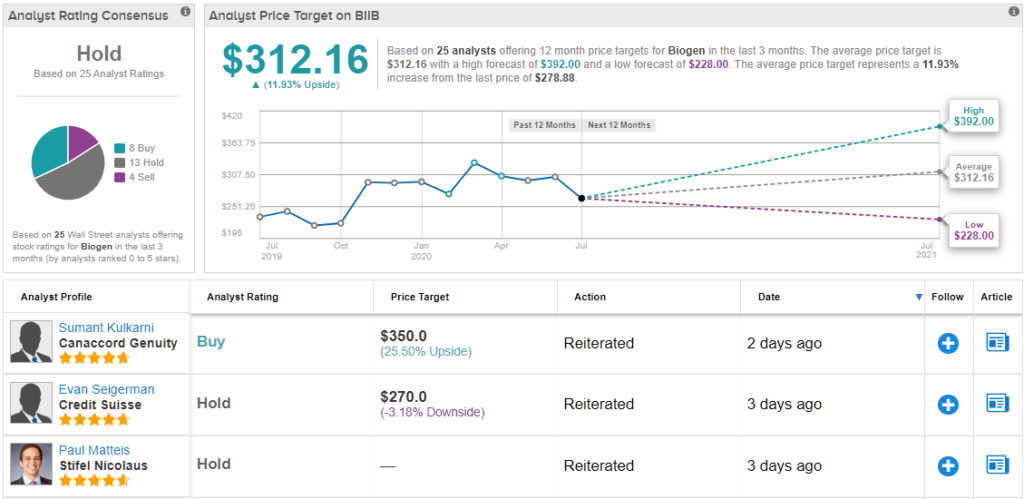

Overall, based on Biogen’s Hold consensus rating, the rest of the Street agrees. The breakdown consists of 8 Buys, 13 Holds and 4 Sells, and is accompanied by a $312.16 price target. There’s upside of 11%, should the figure be met over the following months. (See Biogen stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.