Dividend stocks. They’re the very picture of the reliable standby, the sound defensive play that investors make when markets turn south. Div stocks tend not to show as extreme shifts as the broader markets, and they offer a steady income stream no matter where the markets go. And it’s not just retail investors who move into dividend stocks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Recent regulatory filings show that billionaire Steve Cohen has bought big into high-yield dividend stocks.

Cohen has built a reputation for success, and his firm, Point72 Asset Management, is true giant of the hedge industry, with over $26 billion in assets under management and 150 investing teams serving customers around the world. Cohen leadership at Point72 has affirmed his status as one of the best investors active today.

Using TipRanks database, we’ve pulled up the details on two of Cohen’s recent stock moves, both new positions for him, and both Buy-rated equities with dividend yields exceeding 6%. We can turn to the Wall Street analysts to find out what else might have brought these stocks to Cohen’s attention.

EOG Resources (EOG)

We’ll start in the oil and gas industry, where EOG Resources is one of North America’s largest hydrocarbon exploration and production firm. EOG boasts an $82 billion market cap and operations in rich oil and gas production fields, such as Eagle Ford in Texas, Anadarko in Oklahoma, and the Williston Basin of North Dakota-Montana, among others. Offshore, EOG has operations near the Caribbean island of Trinidad.

For EOG, this is big business. The company reported $7.6 billion at the top line for 3Q22, a total that was up an impressive 58% year-over-year. The company’s adjusted net income rose to $2.2 billion, up 69% y/y, and adjusted EPS, at $3.71, was up 71% from the year-ago quarter. Free cash flow was reported at $2.3 billion. These numbers reflected a combination of increasing demand in 2022 post-pandemic, high prices for oil and natural gas, and increased production.

On the dividend front, EOG declared both a regular payment and a special payment in Q3. The regular common stock dividend was set at 82.5 cents per share, or $3.30 annualized, and yields 2.3%, about average. The supplement, however, was $1.50 per common share, and made the total dividend payment $.2.32; at that rate, the annualized payment of $9.30 yields 6.6%, more than triple the market’s average dividend payment.

This hydrocarbon firm was clearly attractive to Steve Cohen, who bought 1,174,838 shares in Q3. This is a new position for his firm, and a substantial one. At current share prices, this holding is worth over $165 million.

Cohen is not the only bull running for EOG. BMO analyst Phillip Jungwirth notes this company’s solid divided – and especially the increased special payment, noting: “The special dividend exceeded our expectation, and EOG is well positioned to continue to exceed its +60% FCF capital return framework given its net cash position.”

Jungwirth goes on to discusses EOG’s path forward, saying, “While the shale industry has faced challenges this year, EOG has consistently delivered differentiated performance owing to its multi-basin, core acreage footprint, innovative culture, operational expertise, and advantaged marketing position. Exploration success has further extended the company’s runway of double premium inventory, with the recently announced Ohio Utica play, along with Dorado, poised to support overall production growth and returns in future years.”

Following from his upbeat stance on this major oil and gas company, Jungwirth rats EOG shares an Outperform (i.e. Buy), and sets a price target of $160 to imply a one-year potential gain of 14%. Based on the current dividend yield and the expected price appreciation, the stock has ~20% potential total return profile. (To watch Jungwirth’s track record, click here)

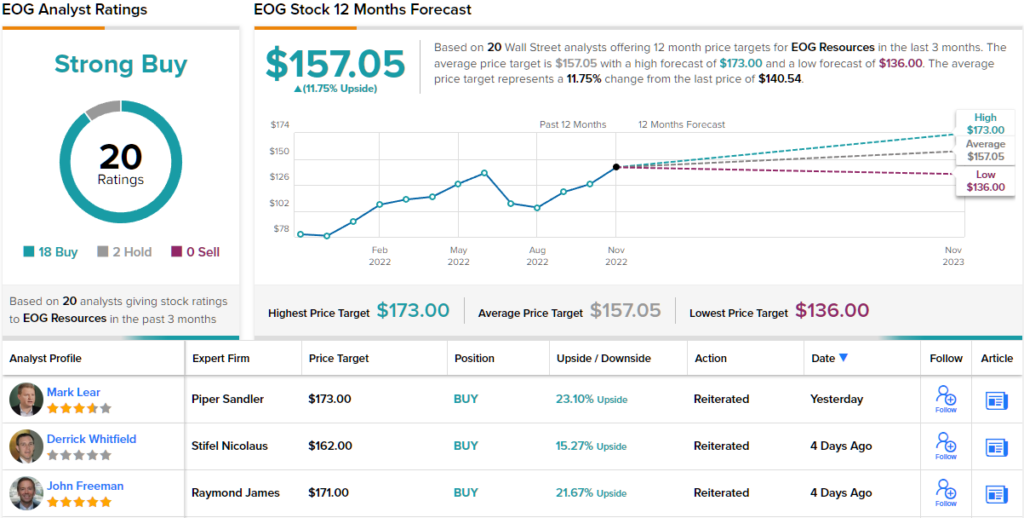

Big money hydrocarbon explorers don’t have to go begging for Wall Street’s analysts to check them out – and EOG has 20 analyst reviews on record. These include 18 Buys against just 2 Holds, for a Strong Buy consensus rating on the stock. (See EOG stock forecast on TipRanks)

Healthcare Realty Trust (HR)

Next up is a real estate investment trust, a REIT. These companies, which buy, own, operate, and lease a wide range of real properties and mortgage assets, are well-known as perennial dividend champions. Healthcare Realty Trust, which specializes in medical office space, is a solid representative of the niche. The company completed a major merger action, with Healthcare Trust of America on July 20.

Including assets gained in the merger, the company boasts a portfolio made up of 728 properties totaling well over 44 million square feet of leasable space. Of this total space, 82% is set up as multi-tenant leasing. The company operates in 35 states. Healthcare realty also provides leasing and property management services for more than 39 million square feet of medical space nationwide.

Looking at financial results, HR reported a net income of $28.3 million in 3Q22. This came to an EPS of 8 cents per share, well above the 1-cent expected. For the third quarter, the company realized a normalized funds from operations (FFO) of $129.4 million, or 39 cents per diluted share. That was below consensus estimates of $0.43.

The FFO is important to dividend investors, as this is the metric that funds the payment. HR declared a dividend of 31 cents per common share with its 3Q22 results, and paid it out on November 30. At the current payment, the dividend annualizes to $1.24 and gives a yield of 6.1%.

Steve Cohen has showed that he’s impressed by the attributes of HR, and he’s done so with a large buy. His firm picked up 800,200 shares of HR, setting up an initial position that’s now worth $16.24 million.

Stephen Manaker, 5-star analyst from Stifel, takes a balanced view of this REIT, weighing the positives and negatives before coming down firmly on the bullish side – giving his belief that the company’s growth potential is real and that the downside is more a slower pace to that growth rather than a pullback.

“We have concerns about how long it will take HR to integrate the HTA portfolio, and then capitalize on the combined portfolio’s leasing opportunities. At this point, it remains a ‘prove it’ story on the earning side. However, we remain Buy rated because we believe the current valuations are very attractive on our 2023 estimate, which we believe represent a ‘realistic scenario’,” Manaker opined.

Quantifying his stance, Manaker rates Healthcare Realty a Buy and puts a $25 price target, implying a 23% upside for the coming year. (To watch Manaker’s track record, click here)

Looking at the consensus breakdown, 2 Buys and 1 Hold add up to a Moderate Buy analyst consensus. Shares in HR are trading for $20.30, and the average price target of $25 suggests a 23% upside from that level by the end of next year. (See HR stock forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.