When billionaire financier Ken Griffin makes a move, Wall Street pays attention. Griffin has a thirty-year history of market successes, which have built up his reputation as a champion stock picker and fund manager – and made him one of the world’s wealthiest men, with a fortune of approximately $20 billion. He started stock trading from his Harvard dorm room, and founded the Citadel fund in 1990. Today, Citadel has over $43 billion in assets under management.

A look at the last couple of years shows that Griffin has been able to buck downward trends for profit. During this past January’s market swoon, when the S&P fell 5.3%, Citadel gained 4.7%.

Bearing this in mind, our focus shifted to Citadel’s most recent 13F filing, which discloses the stocks the fund snapped up in the fourth quarter. Locking in on three tickers in particular, TipRanks’ database revealed that each has earned a “Strong Buy” analyst consensus and boasts significant upside potential. Let’s take a closer look.

ImmunoGen (IMGN)

We’ll start with ImmunoGen, a Massachusetts-based biotech company focused on the development of antibody-drug conjugates (ADCs) as novel therapeutic agents for cancer treatment. The company’s approach is based on linking an anti-cancer toxin to a specific antibody, creating a directed agent that targets cancer cells. The R&D process is a long one, even by biotech standards, as it involves balancing four separate units: targets, antibodies, toxic payloads, and linkers.

ImmunoGen’s clinical pipeline target is currently targeting three cancers: ovarian cancer, acute myeloid leukemia (AML), and Blastic plasmacytoid dendritic cell neoplasm (BPDCN). The largest part of the pipeline, with five clinical trials ongoing for one drug candidate, focuses on ovarian cancer.

That leading candidate, mirvetuximab soravtansine, is the subject of the Phase 3 SORAYA pivotal trial, which just released positive top-line data in patients with folate receptor alpha (FRα)-high platinum-resistant ovarian cancer who had previously been treated with Avastin. Full data from the SORAYA study will be presented at the Society of Gynecologic Oncology (SGO) Annual Meeting in March.

In addition to the SORAYA study, mirvetuximab soravtansine is the subject of the MIRASOL Phase 3 trial, in which patient enrollment is continuing, and the Phase 3 GLORIOSA trial, for which ImmunoGen has recently aligned with the FDA on a design for a randomized study in combination with bevacizumab maintenance in FRα-high platinum-sensitive ovarian cancer patients.

The pipeline isn’t the only source of good news for ImmunoGen, however. The company also has an active partnership program, from which it derives a usable revenue stream, and on February 15 it announced a global, multi-target license agreement with Eli Lilly for the further development of ImmunoGen’s camptothecin platform. ImmunoGen will receive an up front payment of $13 million, and will be eligible for another $32.5 million on additional development targets. Overall, the licensing agreement is worth up to $1.7 billion.

So this is a biotech firm on the brink of breaking out. It has multiple Phase 3 studies, in late stages, on a high-potential drug candidate, and profitable licensing agreements with larger drug companies. Given ImmunoGen’s situation, it’s no wonder that Griffin is interested. His firm bought up 1,135,151 shares in the drug developer, staking out a position worth $6.23 million at current prices.

Griffin isn’t the only bull here. BMO’s 5-star analyst Etzer Darout rates IMGN an Outperform (i.e. Buy), with an $18 price target to suggest a robust upside potential of ~228% for the coming year. (To watch Darout’s track record, click here)

Backing his stance, Darout writes: “ImmunoGen trades at a significant discount to oncology peers despite (1) several upside drivers in 2022 for its lead program, including potential for a first-in-class US accelerated approval in ovarian cancer in 2H22; (2) a discovery platform that has been commercially validated through the company’s out-licensed technology; and (3) pipeline optionality from clinical updates for two additional assets in the clinic, which are not reflected in the stock.”

Turning to the Lilly deal, Darout adds, “The Eli Lilly deal for rights to IMGN’s antibody-drug conjugate camptothecin platform is supportive of our view of IMGN’s platform, and we reiterate the stock as our top 2022 top pick.”

Wall Street’s analysts are in broad agreement on the quality of IMGN’s stock, as shown by the 8 Buy reviews overbalancing the 2 Holds. This gives the stock its Strong Buy analyst consensus rating. Shares are priced at $5.49, and their $11.81 average price target suggests they have ~115% growth ahead. (See IMGN stock forecast on TipRanks)

GlobalFoundries (GFS)

The next stock we’re looking at is GlobalFoundries, a semiconductor contract manufacturer. The company has a 7% market share of the $86 billion global semiconductor chip manufacturing sector, making it the world’s fourth largest chip foundry. GlobalFoundries have 14 operational locations on 3 continents, serving more than 200 enterprise customers.

GlobalFoundries was privately owned by the UAE’s sovereign wealth fund until last fall, when it went public through an IPO. The GFS ticker debuted on the NASDAQ on October 28, with an initial price of $47. Despite closing lower on its first day, the stock quickly surged to a high just above $70. The shares remain volatile, although they are up 21% from their opening, and GFS has a $30 billion market cap.

Since going public, GlobalFoundries has reported rising revenues and earnings. For the most recent quarter, 4Q21, the company showed $1.85 billion at its top line, up from $1.7 billion in Q3. Earnings came in at 18 cents per share, well above the 11-cent forecast. For the full year 2021, the company reported $6.6 billion in total revenue, a gain of 36% year-over-year.

New stocks with strong growth curves are sure to attract Griffin’s attention. His firm picked up 297,233 shares of GFS. This new position for Citadel, and is currently worth $16.95 million.

Wall Street, like Griffin, sees plenty to appreciate here. 5-star analyst Rajvindra Gill, of Needham, notes GlobalFoundries’ ‘second beat and raise quarter out of the gate,’ and writes: “The company is in a pole position as demand for pervasive semis (e.g. RF SOI, SiGe/SiPho, BCD, NFC) is accelerating at an unprecedented level… CY22 will also be marked by capacity expansion… as the company ramps Singapore, Dresden and Malta facilities. Despite the capacity expansion, GFS noted that supply will continue to chase demand for several years, while price increases will offset capacity additions, setting up a positive backdrop for differentiated specialized foundries…”

Gill’s comments support his Buy rating on the stock, while his $87 price target indicates confidence in ~53% upside for the year ahead. (To watch Gill’s track record, click here)

Overall, there have been 10 recent analyst reviews of GlobalFoundries and they break down 9 to 1 in favor of Buys over Hold, for a Strong Buy consensus view. The stock is selling for $57.03 and has an average target of $83.90, suggesting a one-year upside potential of ~47%. (See GFS stock forecast on TipRanks)

Datto Holding (MSP)

The last of Griffin’s new positions is Datto Holding, a software company serving IT products to the managed service provider sector. Managed service providers, or MSPs, are third-party operators who take over the time consuming day-to-day details of back office work – in short, they’re outsource workers for other companies. Datto creates the software packages MSPs need to give efficient service to their own customers. These packages include cloud products for network management, remote monitoring, and professional services automation. Basic workplace functions like file back, protection, and syncing are also included. Datto’s customer base is composed mainly of small- to mid-sized MSP firms.

Datto went public in October of 2020, and since then has seen consistent modest sequential gains in revenues for every reported quarter. In its last quarterly report, for 4Q21 released last week, the company posted $164.25 million in sales, up 18% year-over-year. Non-GAAP earnings, at 14 cents per share, were just above the forecast of 13 cents, but down 12% from the 16 cents per share reported in the year-ago quarter.

Those were the gross numbers. Drilling down into some of the supporting statistics, we find that as of the end of 2021, Datto had over 18,500 MSP customers, and its revenue total included 93% recurring subscription revenue. Annual recurring revenue, ARR, a key metric for software subscription companies, was reported at $658.4 million.

That’s a solid foundation for a SaaS company, so it’s no wonder that Griffin was interested. His firm opened a position with 142,459 shares of Datto. This holding is now valued at $3.32 million.

Nehal Chokshi, 5-star analyst covering Datto for Northland Securities, notes three key points driving the company’s success: “(1) Datto saves MSPs time relative to other software vendors, such that comparing SKU price is not the only input on an MSP’s decision matrix; (2) Datto will not allow end customers to go around the MSP, which then gives the MSP much better margin protection; and (3) Datto’s security-first mindset has played a key role in ensuring Datto products have not been compromised providing peace of mind to MSP partners.”

Chokshi uses these points to support his ‘top pick’ status for Datto. That comes with an Outperform (i.e. Buy) rating and a $42 price target, implying one-year growth of ~80%. (To watch Chokshi’s track record, click here)

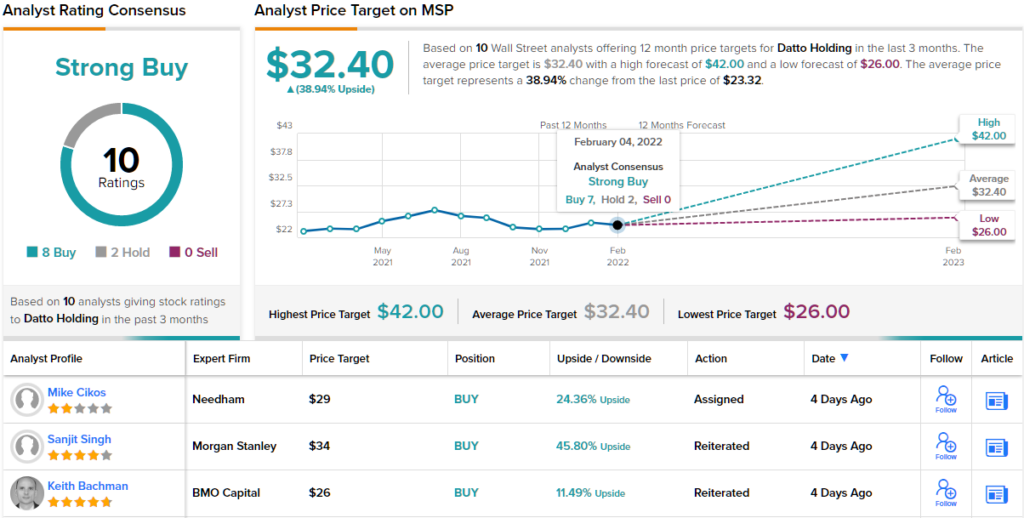

All in all, the 10 analyst reviews on file for Datto include 8 Buys over 2 Holds, for a Strong Buy analyst consensus. The average price target of $32.67 indicates ~39% upside to the shares, from their current trading price of $23.32. (See Datto stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.