At first glance, the $43.76 billion Q2 loss posted by Berkshire (BRK.A) might seem unnerving but a little digging indicates the well-oiled Berkshire machine continues to perform even in a difficult macro backdrop.

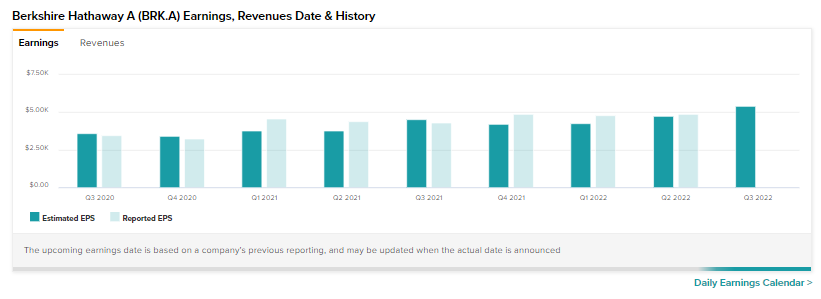

The insurance and energy to apparel and watches conglomerate reported an EPS of $4,860 versus the Street expectations of $4,740. Additionally, revenue grew 10.2% year-over-year to $76.18 billion. Importantly, operating earnings jumped 38.7% to $9.28 billion. This is a significant jump at a time when companies are reeling from cost pressures and inflation.

Berkshire is a holding company and keeps putting its cash pile to use by investing in names that the Oracle of Omaha favors. This means as the markets plummeted this year, many of these investments including Apple (AAPL) and American Express (AXP) (GB:0R3C) fell in value and impacted the paper profits of the company.

But indices have made a fair bit of recovery since then and needless to say, many of the paper losses have already been recouped. Additionally, Mr. Buffett’s buying spree of Occidental Petroleum (OXY) (GB:0KAK) stock came at a time when the company is churning out robust cashflows (Berkshire’s OXY stake is inching towards 20% now).

While investing gains can gyrate depending on market swings, Mr. Buffett favors operating earnings as a better yardstick for Berkshire. Geico, the company’s insurance unit saw an underwriting loss of almost half a billion dollars but growth in Berkshire’s other units more than offset this bump in Q2.

How Much Cash Does Berkshire Have in 2022?

Earlier this year, Mr. Buffett noted that good opportunities were getting difficult to spot, but since then, the company has put a sizable chunk of its cash pile to use in OXY stock, Alleghany, Chevron (CVX) (GB:0R2Q), and HP (HPQ). Despite these big-ticket splurges, Berkshire still had $105 billion in cash at the end of the second quarter.

Analyst’s Take

Wall Street, in the meantime, has a Hold consensus rating on the stock alongside a price target of $535,000. This implies a 21.72% potential upside in the stock on top of the 7% price gain over the past month.

Hedge Funds Remain Positive

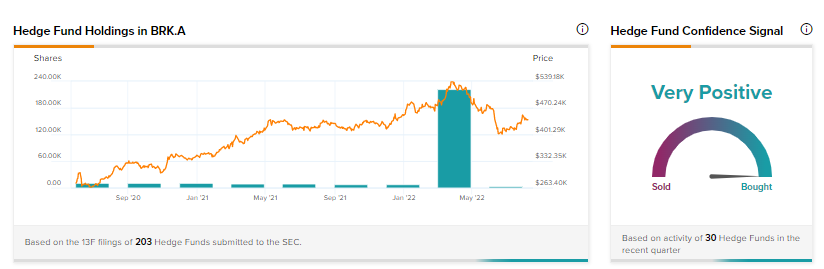

Furthermore, our data dive at Tipranks reveals hedge funds are very positive about Berkshire and have scooped up 214,400 shares over the last quarter. Additionally, Ulambayar Bayansan’s Gobi Capital is betting big on the stock with a 100% increase in its Berkshire holdings.

Closing Note

Berkshire, a veteran of multiple market cycles, continues to deliver outperformance. Despite being one of the most expensive stocks globally by price, a price-to-earnings ratio of 7.9, a price-to-sales ratio of 1.04, and a price-to-free cash flow ratio of 40.40 make the stock attractive. Additionally, a TipRanks smart score of 8 means investors need to keep Berkshire on their radar for the long haul.

Read full Disclosure