Shares of Bed Bath & Beyond (BBBY) tanked by 23.6% on Wednesday, 29 June, plunging to its lowest price since April of last year. The share price sunk soon after the company published its first-quarter reports that came in weaker-than-expected. The transition towards e-commerce has become permanent, with customers spending less time physically buying goods from home goods retailers. This is a burning issue for the company, but it isn’t the only issue that needs attention. Bed Bath & Beyond experienced a shakedown in the top management, and it struggles to maintain an acceptable level of free cash flows. All in all, it seems wise to leave BBBY on the shelf, at least until there are clear signs of recovery.

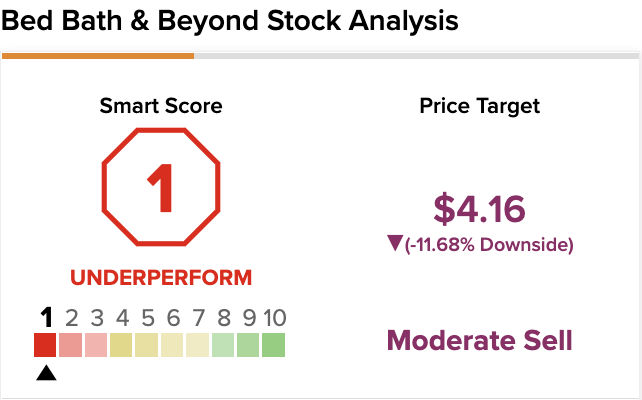

On TipRanks, BBBY scores a 1 out of 10 on the Smart Score spectrum. This indicates a high potential for the stock to underperform the broader market.

A Lackluster First Quarter

On Wednesday, June 29, Bed Bath & Beyond reported net sales of around $1.46 billion, slumping 25% year-over-year. Bearish sentiment was boosted as the company’s gross profit margin of 23.9% came in significantly below the 32.4% it reported in the same quarter last year. The fall in revenue and gross profit margin led to a net loss of $358 million, amounting to a loss per share of around $4.5.

Bed Bath & Beyond’s income statement is a nightmare for investors, but its balance sheet is no different. The company is burning cash at a startling rate. This resulted in a negative cash flow from operations of $400 million. This news leaves Bed Bath & Beyond in a dangerous financial position since it only has $107 million in cash and cash equivalents. Given the company’s burn rate, it can only survive three quarters using its cash on hand.

Jason Haas, an analyst at Bank of America (BAC), stated that the company’s liquidity is a significant concern. The analyst also mentioned that Bed Bath & Beyond is in a risky position financially, since its vendors might tighten credit terms due to the mounting fear of not receiving payments for merchandise.

Trouble at the Top

Along with the gloomy results, Bed Bath & Beyond announced several changes to its leadership on Wednesday. One of the changes that took the stock by a surprise, was the removal of Mark Tritton as CEO of the company.

Bed Bath & Beyond poached Tritton from Target (TGT) in 2019. He tried replicating his strategies at Bed Bath & Beyond, but he struggled to attract customers and determine what people want to buy. Hence, on Wednesday June 29, Sue Gove took charge as an interim CEO.

After her appointment as the interim CEO, Gove said that she would focus on supply chain reliability, secure balance sheet, reduce costs, and add strength to digital capabilities.

In addition to the removal of Tritton, Bed Bath & Beyond added three new directors to the board in March after activist Ryan Cohen pushed the company to improve revenue. Whether this decision will prove beneficial for the company remains to be seen, but its management seems more animated than ever about improving top-line results.

The Macro-economy Could be BBBY’s Biggest Enemy

Considering the failing economic conditions, it is difficult to believe that Bed Bath & Beyond will bounce back. The rifling inflation is eating into consumer spending ability. Moreover, the Fed is on a spree to raise interest rates, adding more fuel to the fire.

The country’s gross domestic product fell by 1.4% during the first quarter, against economist expectations of a 1% increase. This is likely to affect the business substantially as these factors are beyond Cohen and the entire team.

According to the analysts of Bank of America, Bed Bath & Beyond has cut labor hours, canceled remodeling projects, dropped reward programs, and reduced utility usage. Moreover, the resignation of two financial executives, John Barresi and Heather Plutino, signals that the company is shifting.

Wall Street’s Take

Turning to Wall Street, BBBY stock maintains a Moderate Sell consensus rating. Out of 12 total analyst ratings, four Holds, and eight Sell ratings were assigned over the past three months.

The average BBBY price target is $4.16, implying 11.68% downside potential. Analyst price targets range from a low of $1 per share, to a high of $14 per share.

The Bottom line – Is BBBY Stock a Buy?

Bed Bath & Beyond’s financial outlook is far from attractive. The company expects revenue to increase in the upcoming months, but this might be a drag considering the host of challenges it is facing. Moreover, according to Anthony Chukumba of Loop Capital, the company is in a major spot of bother since its first-quarter results were remarkably weak. Hence, it might be wise to let go of BBBY stock and employ a wait-and-see approach.

Read full Disclosure