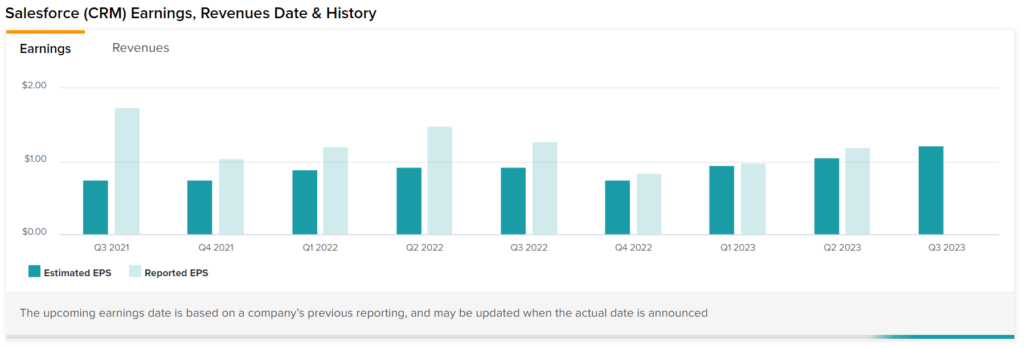

Despite bleak market forecasts, Salesforce (NYSE:CRM) was able to churn out another quarter of double-digit top-line growth. However, despite its consistent performances over the past several quarters and impeccable track record of earnings beats, its performance in the equity market has been abysmal. Nevertheless, it’s probably the right time to follow Warren Buffet’s lead and be greedy when others are fearful. Hence, we are bullish on CRM stock.

The odds still do not justify investors acting bearish. Though the headwinds are taking a toll on recurring revenue streams, it continues to post strong top-line gains. Being a pioneer of multiple customer relationship management products (CRM), the company remains far ahead in data analytics, integrated data systems, and complex task automation.

Estimates suggest it commanded a market share of around 19% of the global CRM market in 2019. That number is likely to have grown with the acquisitions of Slate and Tableau, which also contributed to the multi-industrial expansion of the company. Moreover, the CRM initiatives in the healthcare sector and the adoption of industry 4.0 applications have created an incredible image of the company in the tech space.

The latest developments suggest that the company addresses data security issues by adopting Blockchain technology. Salesforce is stepping up its game in this department to command a healthy market share in data encryption technologies.

Salesforce’s 360 Vertical Penetration Strategy

Salesforce’s 360 penetration strategy is paying a lot of dividends for the business. It has helped resolve data integration issues and allows companies to expand across public and private organizations.

While looking at the large industrial consumers, Salesforce Inc’s services have deeply penetrated the automotive, communications, petroleum, financial services, and healthcare industries. Its strong base of customers includes Amazon Web Services, The Hershey Company, New York Post, and others. Moreover, the firm has collaborated with local and regional governments to provide the services.

Presently, the decline in the company’s services, marketing, and data income shown in Q2 earnings is due to circumspect buying behavior. However, these headwinds are likely to pass as consumer markets show renewed strength in the upcoming quarters.

Catalysts Ahead for CRM Stock

Several developments related to big tech and distanced working are catalyzing the expansion of the virtual world throughout the globe. It was in 2015 when Salesforce launched a Health cloud product with limited customers. However, its portfolio in the niche now caters to healthcare insurance firms, public health departments, life sciences companies, and digital health services. The COVID-19-induced lockdowns also compelled organizations to integrate customer-focused CRM systems.

A recent report by the PWC experience center showed that more than half of the organizations are likely to adopt digital transformation owing to an enhanced customer experience.

Similarly, organizations leveraging data analytics through the Internet of Things, Big Data, and process optimizations have witnessed plenty of success in embracing technological changes. All these developments fit the array of solutions offered by Salesforce.

Blockchain-Based Data Encryption: A Win-Win Bet for CRM Stock

The rise in data theft and privacy breaches has compelled firms to re-evaluate their plans to adopt cloud-based CRM systems. Salesforce recognizes the encryption-related challenges and invests heavily in data encryption via blockchain technology. Recently, Salesforce announced a local platform enabling organizations to share authentic, scattered third-party data sets from different networks. The blockchain-supported data encryption also coincides with consumer concerns for data protection.

Technology is maybe doubly important for the healthcare industry. Research indicates that healthcare consumers often go awry when accessing digital health services. It is because health data security is at the core of their privacy. Thus, blockchain data encryption will likely aggrandize its CRM solutions’ credibility.

Will CRM Stock Go Up?

Turning to Wall Street, CRM stock maintains a Strong Buy consensus rating. Out of 33 total analyst ratings, 29 Buys, four Holds, and zero Sell ratings were assigned over the past three months. The average CRM price target is $225.19, implying a 48.3% upside potential. Analyst price targets range from a low of $150 per share to a high of $320 per share.

Sell-Off in CRM Stock Not Justified

CRM stock’s sell-off is not justified, as the company continues to post strong numbers across its top and bottom lines. Additionally, CRM remains in an excellent position to capitalize on the growing trend toward digitization. The impact of tech cannot be denied, and it will continue to dominate our lives. Salesforce offers solutions for firms to handle big data in real-time effectively.

Its software solutions are being used by some of the leading companies across the globe. Furthermore, CRM and many of its peers are currently trading at beaten-down prices. The broad-based sell-off in the tech sector has created multiple opportunities to invest in stocks for the long term. Hence, it’s perhaps an excellent time to invest in a stock such as CRM.